Connected Intelligence

An unrivalled world of insight across the global structured products industry.

Request a Free Trial

An unrivalled world of insight across the global structured products industry.

Request a Free Trial

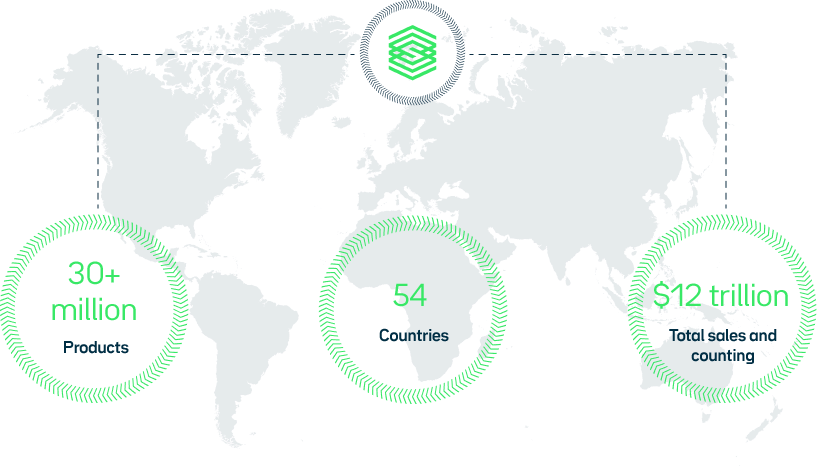

At the heart of the global investment community, we draw on deep expertise and broad coverage to deliver a rich mix of data solutions, market intelligence and events.

We are an industry-leading data and analysis hub on the pulse of the structured products industry. Our data solutions provide comprehensive intelligence on market structure, sales volumes, key trends and competitor activity.

Collected for over 20 years, our market intelligence powers your critical dividend risk and volatility analysis - all from a single source.

Access our data via the Product Search and Analysis portal or integrate with your own infrastructure using our API.

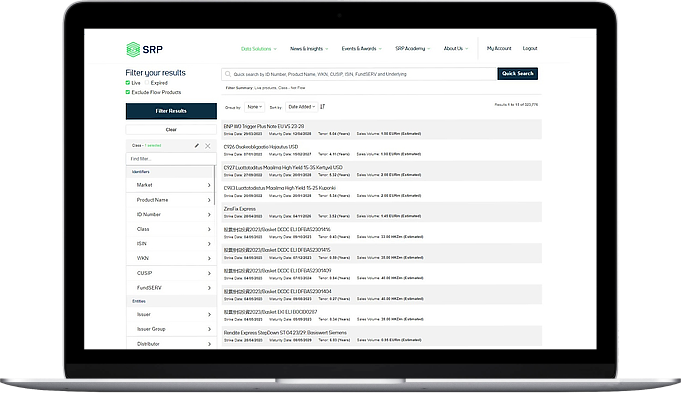

Filter and analyse information from over 30 million individual products by extracting key data points from standardised information cards for each product.

Gain the intelligence you need to make informed decisions by following market shares, trends, best-selling and performing products, asset classes and more.

Find specific products or create complex analysis. Save your results and share insights with your colleagues with ease.

Track market shares, trends, best-selling products, asset classes and many other datasets. Select a range of filters to see an overview of all the information available to you. Select region, market site, competitor info and sort the data by date, sales volume and more to make informed decisions at the click of a button.

With the SRP API, you can integrate and manipulate our comprehensive data within independent software vendor solutions and bespoke, in-house applications and analytics.

The web-based software application allows you to access, integrate and manipulate data from the world’s most comprehensive and trusted database of structured products directly in your in-house systems, applications and analytics.

StructrPro is a new structured product lifecycle management tool combining database with analytics.

It is powered by the world's most comprehensive structured product database, built by SRP over the last twenty years enhanced with detailed sophisticated analytics from FVC.

A new monthly e-magazine packed with news, features, interviews and data insights designed to showcase the most relevant coverage of our news service as well as to provide market insight and intelligence to our readers.

Explore the latest issues

Trusted by the world’s biggest financial institutions – here’s just a selection

The best way to see how our data can benefit your business is to experience it first-hand.

Request a Free Trial