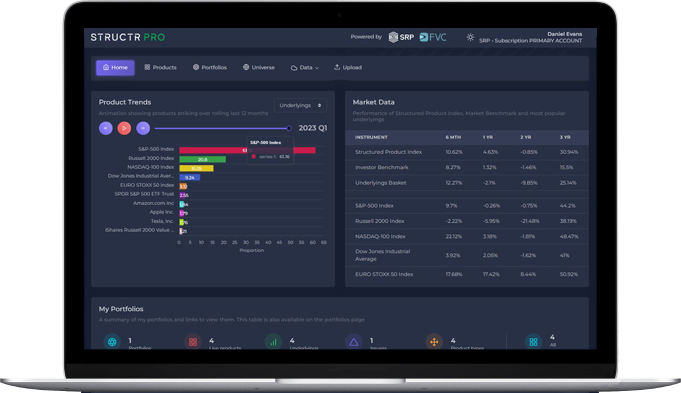

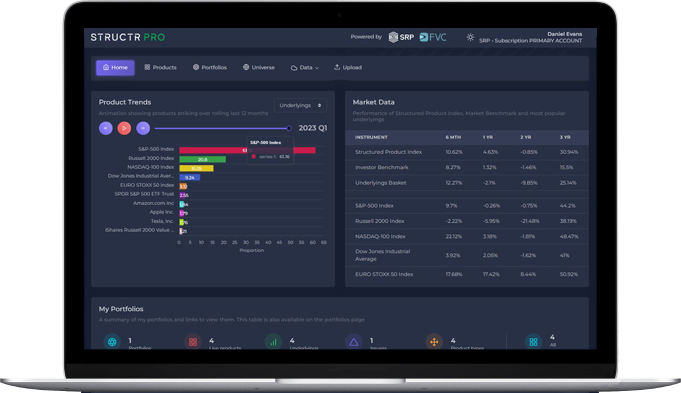

A fully featured structured product lifecycle management tool. StructrPro was developed using SRP’s extensive structured products database and FVC’s analytics and valuation expertise.

Request a demo

A fully featured structured product lifecycle management tool. StructrPro was developed using SRP’s extensive structured products database and FVC’s analytics and valuation expertise.

Request a demoIssuers and distributors can gain valuable market intelligence on trends and market activity.

Asset managers, advisers and brokers can use it to enhance their product selection and management processes across entire portfolios.

Extract insight through an intuitive and easy to navigate interface.

StructrPro combines database with analytics. It is powered by the world’s most comprehensive structured products database, built by SRP over the last twenty years enhanced with detailed sophisticated analytics from FVC that have a long track record.

These two capabilities have been tightly integrated to provide in-depth weekly analysis on all live products in the US market with the ability to drill down into individual products and see aggregate statistics for portfolios or market segments. to drill down into individual products and see aggregate statistics for portfolios or market segments.

Trusted by the world’s biggest financial institutions – here’s just a selection