When I first started to become familiar with the South African market, one of my first questions was why so much investment in foreign currencies.

When I first started to become familiar with the South African market, one of my first questions was why so much investment in foreign currencies. As a Portuguese who grow in the Euro zone and lives in the UK, how could you understand the risks of investors living in an emerging market. I certainly couldn’t.

The truth is that currencies in developing market, like the South Africa Rand are more affected by pressures compared with those in developed markets. A rapid depreciation can result from several factors, from the US interest rates and debt environment, to the local economy behaviour or political events, but always with one result: diminished purchase power, as imports become more expensive.

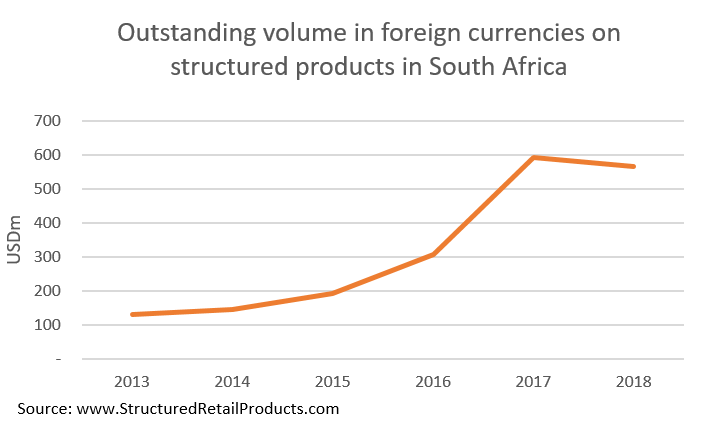

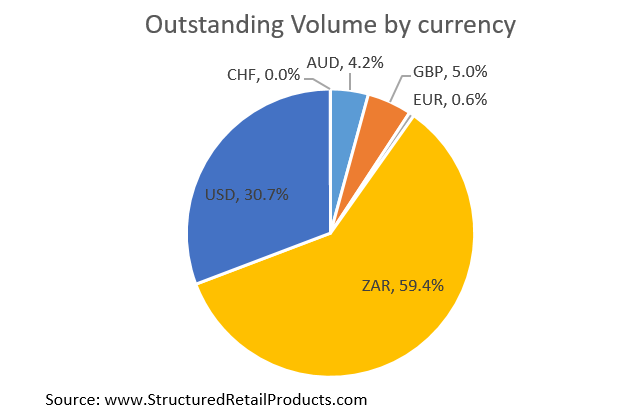

As such, the structured product market came up with an easy solution: issuing the products in foreign currencies. Since 2013, the market has seen a 200% growth in the total outstanding notional in foreign currencies structured products, alongside a depreciation of the South Africa Rand, which enabled investors to preserve their capital. Allied with capital preservation in foreign currencies, the average annualised return of 7.3% of all products matured since 2013, gave South African investors a fulfilment of capital preservation that they couldn’t on other investment products. When I first started to become familiar with the South African market, one of my first questions was why so much investment in foreign currencies. As a Portuguese who grow in the Euro zone and lives in the UK, how could you understand the risks of investors living in an emerging market. I certainly couldn’t.