Dutch online broker sees revenues in turbos increase by €1.8m although AUM is down 11% on last year

Revenues from financial instruments increased by 47% to €5.7m in the first three quarters of 2018 (2017YTD: €3.9m), according to Binckbank. In addition to the increase in revenues on the Binck turbo, a positive result from hedge accounting is included in other income, the Dutch online broker stated in its quarterly results.

The result from financial instruments “can almost entirely be attributed to the Binck turbo,” a spokesperson for Binckbank said.

The third quarter 2018 result was ‘in line with expectations’, according to the broker which saw its assets under management (AUM) decrease with €12.4m on net basis to €1 billion, down 1% on the previous quarter, and down 11% year-on-year.

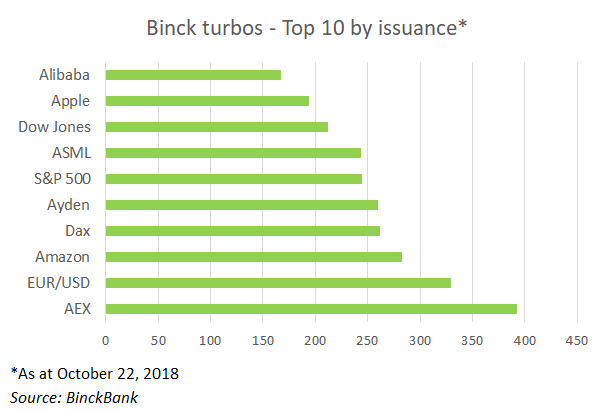

Binckbank has almost 14,000 turbos outstanding as of October 22, 2018, including 11,349 products linked to shares; 1,234 linked to indices, 953 linked to FX rates; and 413 linked to commodities. The local AEX-index is the most popular underying, seen in just under 400 products, followed by the EUR/USD currency pair (329 products) and the share of Amazon (282 products).

The Dutch broker introduced a number of new underlyings in the third quarter, often at the request of new clients, including turbos long and short on Momo, Shopify and turbos long on First Solar, Medtronic, NXP and Wirecard.

The number of transactions in the period January to September 2018, at 7.21 million, was 29% higher than in the same period last year while the net fee and commission income increased by 2.1% to €78.7m (2017YTD: €77m) despite the loss of revenue due to the sale of Think ETF Asset Management to Van Eck.

The new proposition ‘Laten beleggen’ (Invest for me), in which customers outsource their portfolio management to Binckbank, has €163m of AUM invested by the online brokers clients and assets under administration related to savings increased to an amount of €19.8m.

Total assets stood at €4.1 billion as of September 30, 2018, up from €3.9 billion at the end of December last year. Assets included derivatives (€44.6m) and financial assets at fair value through profit and loss (€18.5m). Liabilities registered at €3.8 billion (December 31, 2017: €3.5 billion) while total equity, at €395.5m, was more or less level from last year.

Binckbank was founded in 2000 and is part of the Amsterdam Smallcap Index (AScX). The brokers services – trading, investing and saving, are directed towards private individuals and independent asset managers. Binckbank has offices in the Netherlands, Belgium, France, Italy and Spain.

Click the link to read the Binckbank trading update third quarter 2018.