The Asia-Pacific region has grown significantly in 2018, with issuance up 23% to almost 80,000 products and total sales volume of over US$189 billion, SRP data shows.

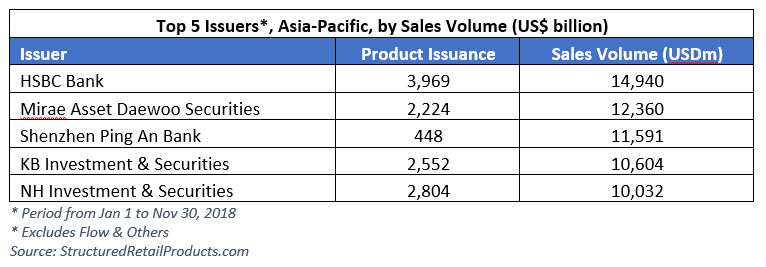

Looking at the non-flow market in the region, HSBC is the clear leader in the region with total sales volume at US$14.4 billion for the 11 months to the end of November 2018. The British bank doubled issuance of core structured products in Q32018 globally with investment distribution revenues in wealth management up 8% year-on-year. The bank will remain ‘committed to growing profits, generating value for shareholders and improving the service we offer our customers around the world,’ said John Flint, group chief executive.

Korean investment bank Mirae Asset Daewoo comes in second in the issuer rankings, on the back of strong performance and steady sales despite structured products sales drop in H2 on a faltering ang Seng China Enterprises Index (HSCEI). Equity-linked securities (ELS) linked to HSCEI recorded an increase in sales in the first half of the year when overall issuance volume of the ELS was also on the rise. The increased sales came on the back of the recovery momentum of the benchmark coupled with regulatory restrictions that ended late last year.

Coming in third in the issuer ranking is Shenzhen Ping An Bank, which reported very fast growth for structured products in China in H1. SRP data shows that Ping An is among the most active issuers of structured products in China with 522 products worth US$8.8 billion. The bank is planning to focus on developing new types of products within the new regulatory requirement earlier this year as part of broader efforts by China’s financial regulators to contain the risk in the financial system.

KB Investment & Securities came in fourth, gathering a total volume of US$10.6 billion from 2,552 products to the end of November 2018. While this is only 6% higher on an annual basis, mainly driven by equity-linked bonds (ELB) sales as well as ELS ones. Despite issuance slow down, the bank believes that ‘the market will be able to brush off any HSCEI-related fears,’ according to Joong Ho Lee, head of derivatives research at KB Securities.

The top five ranking is completed with NH Investment & Securities which has registered sales of US$10.03 in the APAC in 2018, almost no change on an annual basis. Contrary to KB Securities, Nonghyup registered a drop of 55% in the sales volumes of ELB product on the back of 45% increase in sales volumes of derivative-linked securities (DLS) to US$2.03 billion to the end of November 2018.

Including flow

2018 comes to an end with products linked to interest rates still in focus for the next year in the region as turbulence in the equity markets continues. Growing investor fears around trade tension, slowing economic growth and subsequent weak corporate earnings across the globe, has given momentum to products tracking interest rates with principal protection feature.

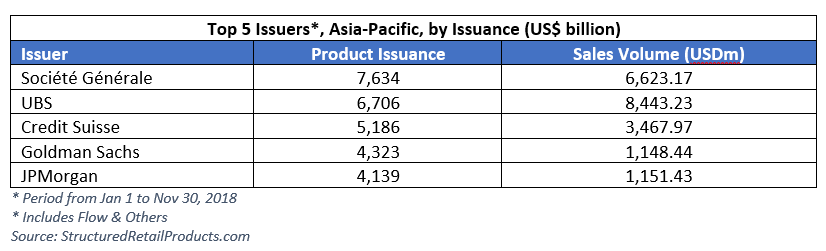

UBS is the leading issuer in the region in terms of issuance mainly driven by its warrants and callable bull/bear contracts (CBBC) in Hong Kong as well as its business in Australia and Taiwan. The Swiss bank has seen volumes increase over 100% to US$8.4 billion compared to last year, allowing it to continue its dominance in the flow market, which has seen an overall peak in issuance.

Coming in second is Societe Generale, which has seen its sales volume jump by over 90% to US$6.6 billion worth of structured products. While lagging in terms of volume behind UBS, the French giant saw issuance up by almost 150% to over 7,500 products also driven mainly by its warrants and CBBCs business in Hong Kong.

Credit Suisse takes the third spot with a total of around 5,100 products issued this year with sales of over US$3.4 billion. The group’s net revenues of the global markets unit were almost 30% down in the third quarter this year from the second quarter, according to its third quarter 2018 results, which were released on November 1st. The bank attributed the decrease to reduced trading volumes and lower levels of volatility. Net revenues for the group’s Asia-Pacific arm also went down by more than 10% on the quarter in the third quarter of this year due to lower revenues in its markets business, according to the bank.

Goldman Sachs comes in fourth with sales standing at US$1.15 billion worth of around 4,300 products. Although Goldman’s sales were also driven by its flow business in Hong Kong, overall sales were lower compared to JP Morgan, which attracted slightly higher volume despite lower issuance.

All of these leading issuers’ sales were driven by their Hong Kong subsidiaries, as the aggregate transaction amount for investment products sold during the year ended March 31st, 2018, was US$508 billion. This is 34% higher than the figure reported in the 2016 survey, which covered the sale of investment products from April 2015 to March 2016, according to the latest survey on the sale of non-exchange traded investment products released by the country’s Securities and Futures Commission.