The Italian bank reported a record net profit of €1.4 billion (US$1.6 billion) in Q1 2019 while both issuance and sales of structured products remained on par from the same period in 2018.

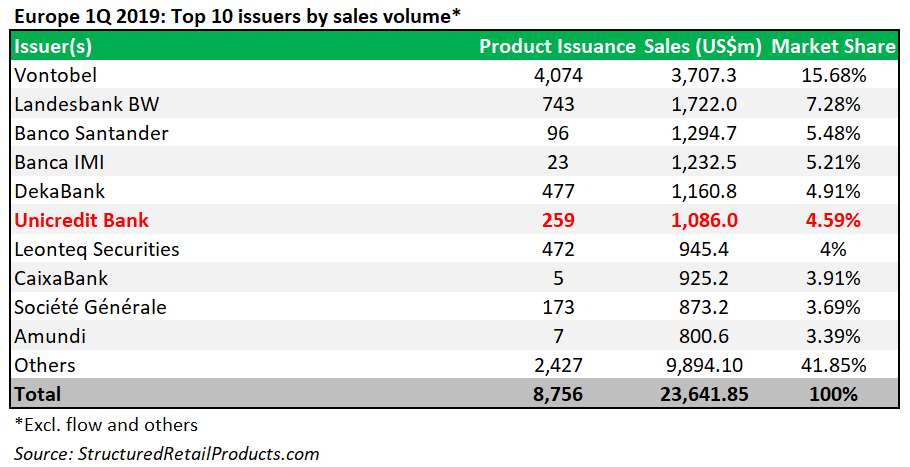

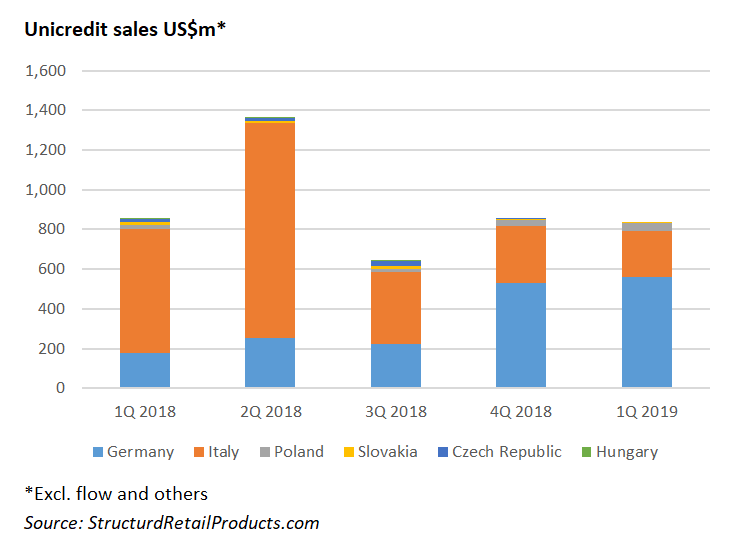

Unicredit had a share of 4.6% of the European structured products market (excluding flow and other products) in the first quarter of 2019, according to SRP data. The Italian global banking and financial services company sold 259 structures worth US$1.08 billion between January 1 and March 31 2019, very much on par with the US$1.14 billion that was collected from 230 products in the previous quarter and also similar to the 289 products worth US$1.09 billion issued by the bank in the same period last year.

Seventy-five percent of sales in Q1 2019, at US$815m, came from 240 products marketed at investors in Austria and Germany. Of these, 204 products were linked to a single share, of which Bayer and Basf were the most in demand, while a further 30 products were linked to a single index.

In its domestic market Italy, the bank sold 14 products worth a combined US$233m during the period, including to structures tied to the Stoxx Europe Sustainability Select 30 index. In Poland four express plus certificates (US$32m) were distributed while another two certificates (US$5.3m) were targeted at investors in Slovakia.

Unicredit also issued 13,250 leverage certificates and 16,692 flow certificates listed on the exchanges of Frankfurt and Stuttgart, and 222 reverse convertible certificates where listed on the multilateral trading facility EuroTLX.

Unicredit reported net profit of €1.4 billion in Q1 2019, up 24.7% year-on-year while revenues, at €5 billion, were down 3% y-o-y but up 2.1% quarter-on-quarter.

At the end of March 2019, the group funding plan was completed for €13.4 billion, around 42% of the 2019 plan. Assets under management increased to €223.1 billion in the first quarter, up €9.2 billion compared to the same quarter of 2018, as flat net sales were compensated by positive market performance in the quarter (+€8.9 billion).

During the quarter, Unicredit, via its subsidiary Structured Invest, and Axiom Alternative Investments announced the launch of the UC AXI Global CoCo Bonds Ucits ETF, the first global exchange-traded fund (ETF) to provide a market weighted exposure to the contingent convertible (CoCo) bond market.

The bank also issued callable tier 2 Notes targeted at institutional investors for a total amount of US$1.25 billion. The notes have a 15-year tenor and pay a fixed coupon of 7.296% pa. for the initial 10-years equivalent to 420bps over the euro 10-year mid swap rate. If not redeemed by the issuer, the coupon will be reset to the aggregate of the USD five-year mid swap rate plus 491.4bps.

‘This was the best first quarter results in a decade for the second time in a row, underpinning the success of our current strategic plan, and confirming we are well on track to achieve our Transform 2019 objectives by the end of this year,’ said Jean Pierre Mustier (pictured), chief executive officer, commenting on the results.

Click the link to view the full Q1 2019 results for Unicredit.