The French bank sold more than 80 structured products in 1Q2019 including its first ever structures in Spain. Sales volumes, however, are down 35% year-on-year.

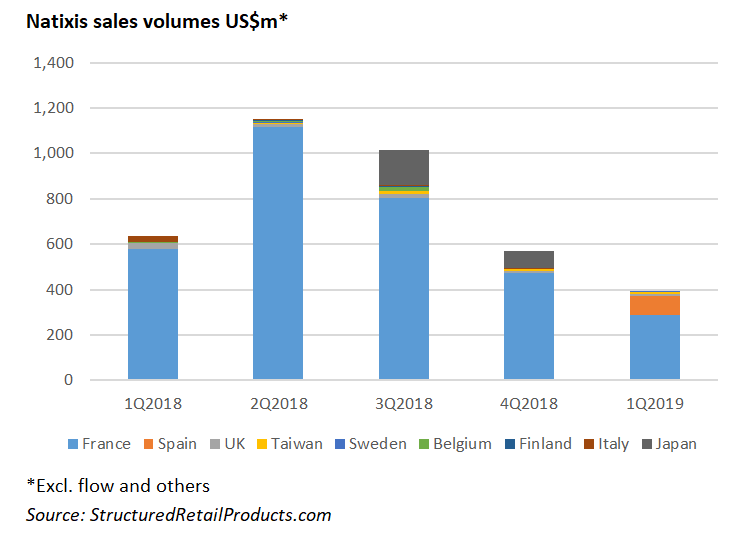

Natixis sold 85 structured products worth an estimated US$450m across five global markets in the first quarter of 2019, down from 90 products with sales of US$700m during the same quarter in 2018, according to SRP data.

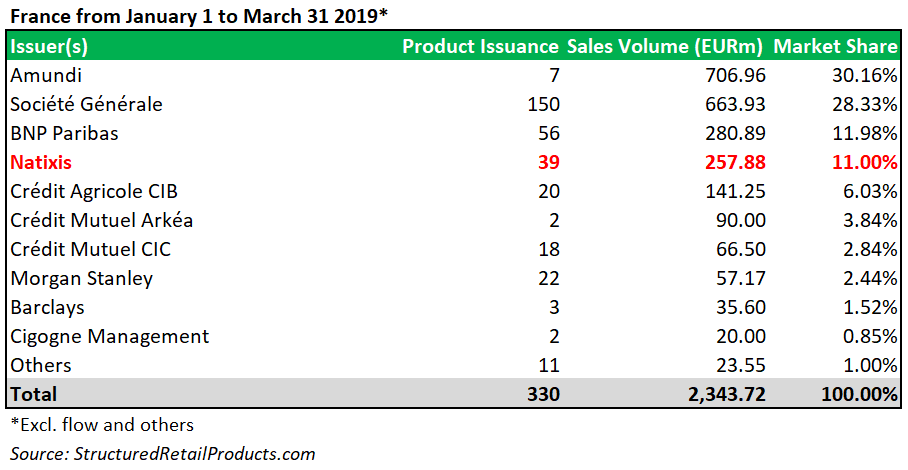

In France, where Natixis had a 11% share of the market in 1Q2019 – fourth behind Amundi, Société Générale and BNP Paribas – the bank collected €260m from 39 products which were distributed via 16 different providers, including, among other, Action Patrimoine Conseil, Equitim, Exclusive Partners, Marigny Capital and Oddie & Cie – compared to €515m, from 41 products in 1Q2018.

The bank made its first ever appearance on the SRP Spain database during the quarter as the manufacturing company behind two structured notes worth a combined €75m which were distributed via Deutsche Bank, while it was also active in the UK (three products), Taiwan (two) and Sweden (one).

Another 38 securities with sales of approximately US$70m were added to the SRP Institutional database. These products included seven structures linked to the proprietary NXS Ultimate Fund Allocator ER Index, a dynamic strategy index which offers exposure to a basket of global multi-asset funds. Institutional clients also had access to a number of Solactive indices via Natixis structures during the quarter including the Solactive Electric Car Makers 8.5% VT Index, Solactive Growth Prospects Basket 12% VT Index, and the Solactive Semiconductor Equity Basket VT 10 NTR Index

Natixis has reported net income, at €764m (US$858m), in the first quarter of 2019 was up 194% compared to the same period last year, as the bank moves towards the targets set in its 'New Dimension' strategic plan which is based in three initiatives around model transformation, flexibility and a shareholder friendly dividend policy.

Underlying return on tangible equity was 10.2% in 1Q2019 and 13.2% over New Dimension, as at March 31 2019, adjusting for the non-recurring impact on 4Q2018 revenues from Asian equity derivatives, according to the bank.

At the end of 2018, Natixis had to set aside €160m to hedge autocallables in South Korea after the model used for hedging the products was not sufficient enough to cover losses from managing ‘specific products traded with clients in Asia’ under the then market conditions.

Assets under management in life insurance reached €63 billion at end-March 2019, up 5% quarter-on-quarter, of which 24% in the form of unit-linked products. Debt securities in issue stood at €45.7 billion at March 31, up from €35 billion at end-December 2018.

‘The first quarter of 2019 was marked by a number of important developments in the implementation of our New Dimension strategic plan,’ said François Riahi, chief executive officer. ‘In a challenging environment, especially for market activities during the first two months of the year, and despite a high basis for comparison due to our very strong first quarter in 2018, the diversification and the uniqueness of our business model enabled us to further strengthen our capital position.’

Click the link to view the full Natixis 1Q19 results and presentation.