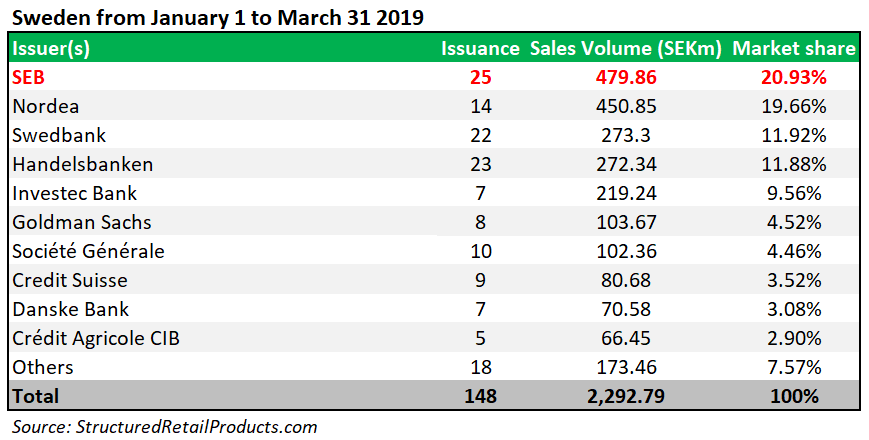

The bank has a 21% share of the Swedish structured products market in the first quarter of 2019 and in line with the strategic initiative to further develop financial solutions with positive climate impact, it arranged the first blue bond.

SEB has reported an operating profit of SEK5.8 billion (US$607m) for the first quarter of 2019. During the period, the effect from structured products offered to the public was approximately SEK420m (Q4 2018: -SEK770m) in equity-related derivatives and a corresponding effect in debt-related derivatives of -SEK280m (Q4 2018: SEK940m), according to the bank.

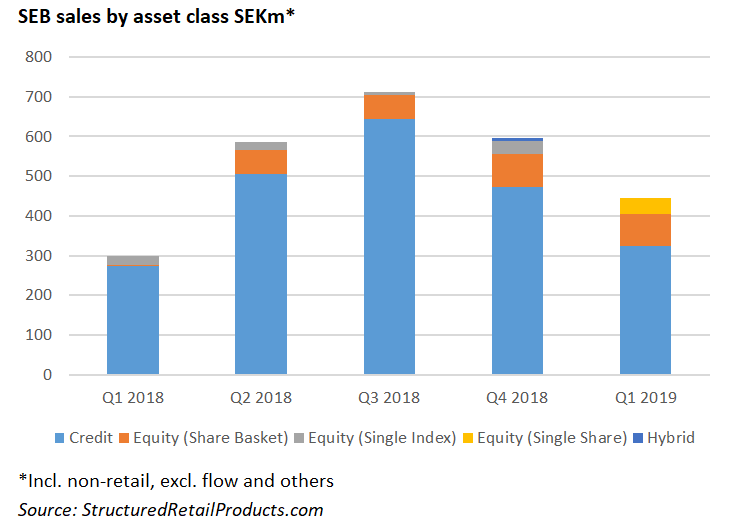

SEB was the main issuer of structured products in the first quarter of 2019 with a 21% share of the market, according to SRP data. The bank manufactured 25 structured products worth SEK480m in Q1 2019, considerably up from the 10 products with a combined volume of SEK297m that struck in the same period in 2018. However, quarter-on-quarter, there was a decrease both in issuance and sales, from the 26 structures worth SEK597m that were sold in Q4 2018.

Thirteen of the banks products were credit-linked notes (CLNs) with a further 10 products tied to a basket of shares and two products linked to a single stock. The majority of the structures were distributed via Garantum Fondkommission (15 products), followed by Strukturinvest (eight) and Nord Fondkommission (one).

The bank’s bestselling product during the quarter came in the shape of Kreditobligation High Yield USA Kvartalsvis nr 3541, a five-year CLN which was distributed via Garantum and collected sales of SEK64m during the subscription period. Forty-two products matured between January 1 and March 31. Of these, Kreditindexbevis High Yield SEBK1414 achieved the highest annual performance at 6.21% pa.

The positive market development in the first quarter led to an increase in asset values and SEB labelled mutual funds managed by the division amounted to SEK688 billion. The mixed fund asset class increased the most. Assets under management that fulfil SEB’s sustainability criteria increased to approximately SEK207 billion with the bank reporting a ‘high demand’ from customers for sustainable investment products.

SEB collaborated with the Nordic Investment Bank when they issued their inaugural Nordic-Baltic Blue Bond, the proceeds of which will target projects aiming to reduce water pollution and protect the marine environment in the Baltic Sea. The bank also enhanced its investment offering by launching a sustainable credit fund, focusing on Nordic floating rate notes.

The global green bond market experienced another quarter of record-levels of issuance, according to Johan Torgeby (pictured), SEB president and chief executive officer. ‘During the first quarter alone, SEB arranged US$1.2 billion in green bond issuance.’

Short-term funding, in the form of commercial paper and certificates of deposit, increased by SEK100 billion in the first quarter of 2019 while SEK30 billion of long-term funding matured during the quarter (of which SEK6 billion covered bonds and SEK23 billion senior debt). New issuance during the quarter amounted to SEK36 billion (of which SEK29 billion was covered bonds and SEK8 billion senior preferred debt).

Click the link to read the full SEB interim report and the fact book January – March 2019.

Related stories: 75020; 74836; 74949