European exchanges report €270 billion market volume in Q1 2019 while UK tranche products continue to perform.

Europe’s financial markets experienced a general decline in exchange-based turnover in investment and leverage products at the end of the first quarter of 2019.

The market volume of investment and leverage products recognised as securities stood at €269.6 billion – an 8% increase from the previous quarter and a larger 13% rise year-on-year, according to the European Structured Investment Products Association (Eusipa).

At the end of the first quarter of 2019, the market volume of investment products stood at €261.5 billion – an increase of 7% quarter on quarter and 14% year on year. Turnover fell 7% to €25.7 billion from the fourth quarter of 2018, a drop of 21% year-on-year.

First quarter turnover in investment products recorded on exchanges across Europe amounted to €12.3m, 47.9% of the total. Although turnover was up 23% on the previous quarter, it was down 8% on the same quarter of the previous year. Turnover in leverage products including warrants, knockout warrants, factor certificates etc) stood at €13.4 billion, 52.1% of the total.

Exchange-based turnover decreased 25% from the fourth quarter of 2018 and was down 30% year-on-year but the aggregate listed products offering rose 4% from the previous quarter and 10% year-on-year. At the end of March, there were 572,501 investment products and 1,340,687 leverage products available for trading in European exchanges.

Banks issued 1,242,592 new investment and leverage products in the first quarter of 2019, a 14% ddecrease from the fourth quarter of 2018. However, this still meant a year-on-year increase of 8%. In total, 176,206 new investment products were launched, accounting for 14.2% of new issuance; the 1,066,386 new leverage products represented 85.8% of the total.

The outstanding volume of leverage products totalled €8.1 billion at the end of March, a 24% rise from the fourth quarter of 2018, but a drop of 3% year-on-year.

UK market

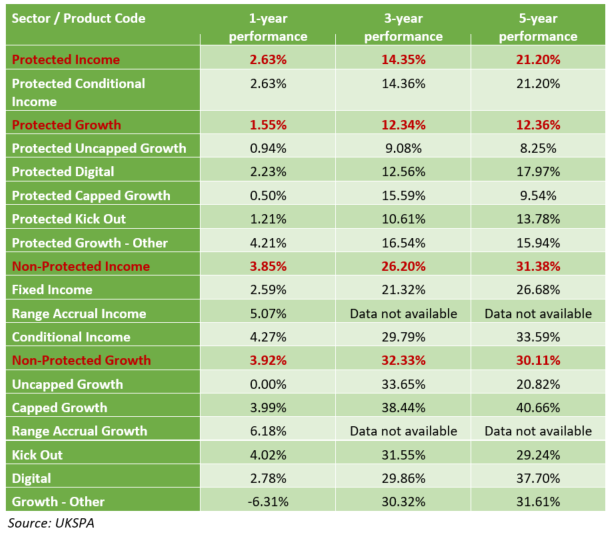

Additionally, the UK Structured Products Association (UK SPA) has released its monthly performance summary covering tranche products. The report shows that products offering non-protected income delivered an average of 31.38% after five years followed by non-protected growth (31.3%), protected income (21.2%) and protected growth (12.3%).

‘Another quiet month for the markets in credit default swaps (CDS) with most of the European banks seeing a small increase in their rates but nothing noteworthy,’ said David Stevenson (pictured) in his monthly UKSPA update. ‘The big French banks, notably SG and BNP, did see the price of their swaps fall significantly (between 7 and 9%) while...Deutsche experienced another steady increase in the price of its swaps. Rates for 5-year swaps are now around 160 basis points.’

Stevenson notes that stock markets have strongly rallied in the first quarter, but he argues that this bullish reaction to last years travails is built on weak foundations.

‘If we look at fund flows, a distinct pattern has emerged - outflows from equities, inflows into bonds,’ he said. ‘Sure, stock market indices have ticked up aggressively, but this hasn't prompted any big switch into risky assets.’

Overall, the best performing individual structures in the UK market were range accrual growth products (average 6.1% after one year), followed by range accrual income (5.07%), non-protected conditional income strategies (4.27%) and protected growth strategies (4.21%). The worst performing products during this period were protected capped growth structures (0.5%), followed by protected uncapped growth structures (0.94%), protected kick-out structures (1.21%), protected digital structures (2.23%) and non-protected fixed income strategies (2.59%).