The US investment bank reports net income of US$9.7 billion in the second quarter while retaining its position as one of the top structured product providers in US.

JP Morgan has reported net revenues of US$29.6 billion for the second quarter of 2019, up four percent from the same quarter last year. Net income was up 16% to US$9.7 billion, which included income tax benefits of US$768m related to the resolution of certain tax audits.

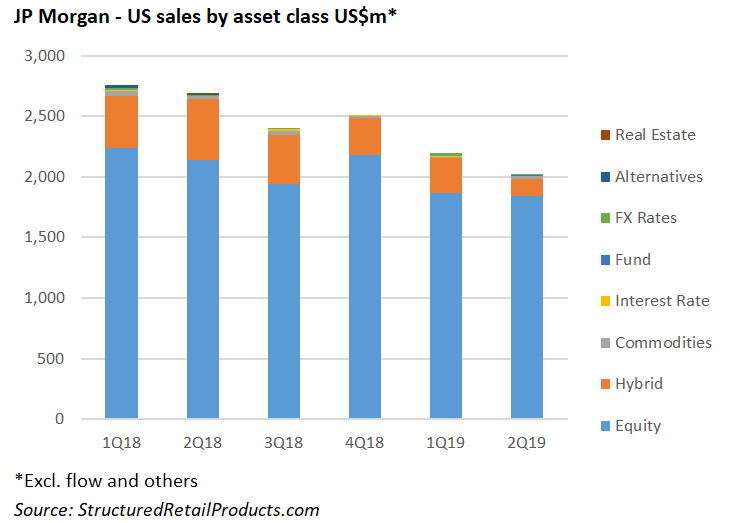

Equity markets revenue, at US$1.7 billion, was down 12% year-on-year, primarily driven by lower client activity in derivatives, compared to a strong prior year while securities services revenue was US$1 billion, down five percent, according to the bank.

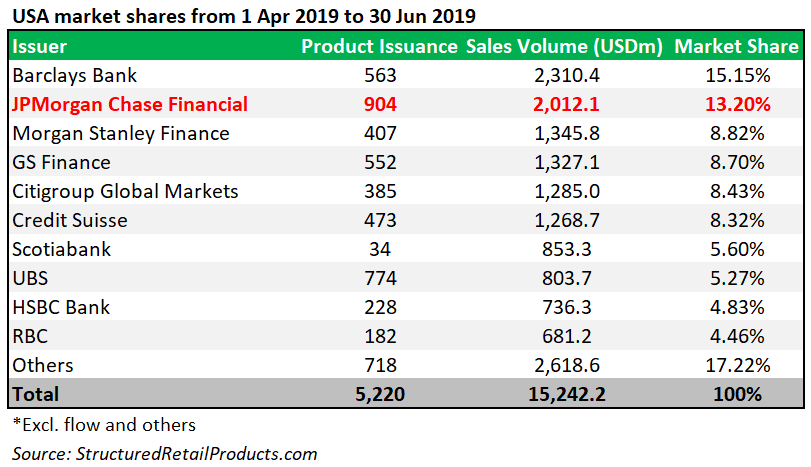

JP Morgan was the number two issuer in the US with a 13.2% share of the market in 2Q19, behind Barclays (15.2%), but ahead of Morgan Stanley (8.8%), Goldman Sachs (8.7%) and Citigroup (8.4%), according to SRP data. The bank sold 905 structured products worth US$2 billion between April 1 and June 30, including 668 structured notes (US$1.6 billion) and 237 certificates of deposit (US$0.4 billion).

The performance leveraged upside securities linked to the Eurostoxx 50 index, which were distributed via Morgan Stanley Smith and Barney (Morgan Stanley Wealth Management) was the bank’s bestselling structured note in the quarter, with sales of US$40.5m. The highest selling certificate of deposit came in the shape of a barrier absolute return market CD linked to the DJ Industrial Average Index, a shark fin issued in collaboration with UBS Financial Services and sold US$11.4m.

Almost US$900m, 45% of the total sales, was accumulated by 348 products linked to a single equity index, including, among others, the S&P 500 (US$266m from 90 products), S&P Economic Cycle Factor Rotating Index (US$144m from 78 products), Eurostoxx 50 (US$113m from 35 products), and Russell 2000 (US$74.3m from 15 products).

A further US$684m was collected from 340 products linked to a basket of indices while there were also products linked to a hybrid basket (US$137.8m from 95 products); single share (US$121m from 84 products); basket of shares (US$50m from 25 products); and commodities (US$24m from seven products).

In asset & wealth management, revenue of US$3.6 billion was relatively flat year-on-year. Assets under management of US$2.2 trillion, and client assets of US$3 trillion, were both up seven percent, driven by net inflows and the impact of higher market levels. There were net inflows of US$36 billion into long-term products and US$4 billion into liquidity products, according to the bank.

‘In the Corporate & Investment Bank, Markets performance was relatively steady on slightly lower client volume, probably due to slightly higher global macroeconomic and geopolitical uncertainties,’ said chairman and CEO Jamie Dimon (pictured) commenting on the financial results.

Click the link to view the JP Morgan second quarter 2019 results and the presentation.