Mitsubishi UFJ Financial Group (MUFG) has reported a rise in profits attributable to owners of its parent in the fiscal first quarter. The results come as the bank tops Japan’s distributor list for 11 straight quarters during the April to June period.

MUFG, based in Tokyo, reported profits attributable to owners of its parent of JPY391 billion (US$3.7 billlion) for the first quarter of fiscal year ending in March 2020, up 24% from a year ago.

The bank attributed the rise to ‘improvement in net periodic cost of retirement benefits,’ and gains from equity sales in a subsidiary of Bank of Ayudhya, a Thai bank in which MUFG is the major shareholder.

Gross profits also edged up in the first quarter from a year ago to almost JPY960 billion due to a rise in net gains on debt securities that were offset by a drop in net interest income, reflecting a decline in interest rates.

By business segment, global markets sector drove the overall net operating profits of MUFG as it added JPY18.8 billion more compared to the previous year.

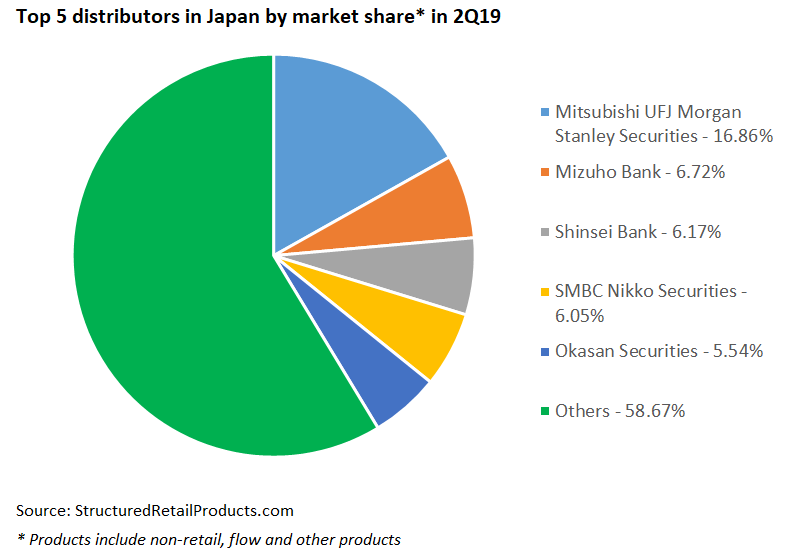

The increase in profit comes as MUFG secured the top spot in Japan’s structured product distributor list, in terms of sales volume, for 11 straight quarters. In the April to June period this year, Mitsubishi UFJ Morgan Stanley Securities was the distributor of 18 products that raised a sales volume of JPY92.6 billion, accounting for a market share of over 15%, according to SRP data. The sales volume far outpaces that of the second-largest distributor, Mizuho Bank, of around JPY37 billion.

The majority of the products distributed by Mitsubishi UFJ Morgan Stanley Securities during the period are tracking the Nikkei 225 either as a single index or one of the indices of an index basket. Most of them are reverse convertibles with a knock out feature.

MUFG had an average quarterly market share of over 20% since the fourth quarter of 2016 and the number peaked at almost 40% in the fourth quarter of 2017. Before the bank stood out as the largest distributor, ANZ Bank took the spot with a market share of over 40%.

You can find the financial highlights for MUFG’s first quarter of fiscal year ending in March 2020 here and the summary report here.