Products linked to share baskets dominated the Polish market in the first nine months of 2021.

Seventy-nine structured products worth PLN2.8 billion (US$670m) had strike dates in Poland during the first nine months of 2021 – down from the 110 products with combined sales of PLN4.3 billion that struck in the prior year period, according to SRP data.

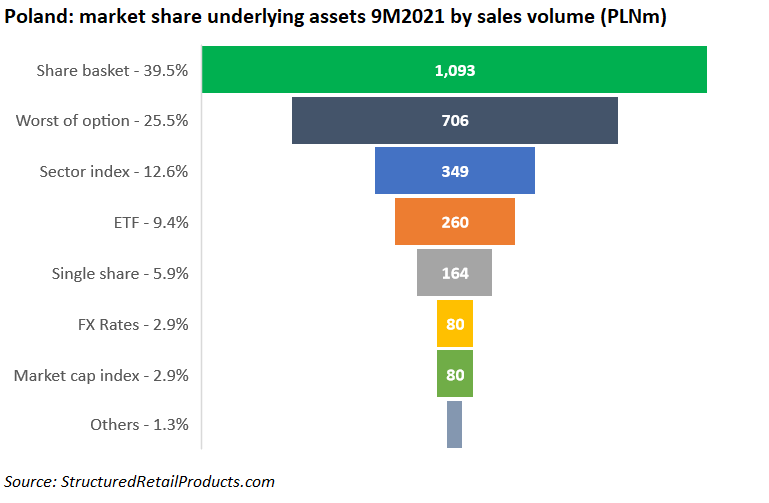

Equally weighted share baskets attracted sales of PLN1.1 billion, equivalent to a 39.5% share of the market. These were mainly autocalls and digitals. Products with a worst-of option feature sold PLN706m (25.5% market share) and included Świat Online, the best-selling product of 9M2021 with sales of PLN135m. It was distributed via BNP Paribas Bank Polska and linked to the shares of Deutsche Telekom, Netflix, and Tencent Holdings.

The share of Amazon, seen in eight products, was the most often used in a (worst of) basket, followed by Volkswagen and Netflix (seven products each).

Sector indices held a market share of 12.6% and included products tied to the Eurostoxx Banks, Eurostoxx Technology and Stoxx Europe 600 Automobiles & Parts.

Bank Millennium was the sole provider of products linked to ETFs, which had a 9.4% share of the market. The three structures were based on the performance of iShares Silver Trust ETF, which reflects the price of silver.

Single shares and FX-rates were tied to eight products each, while there was also a small selection of products linked to market cap, decrement and ESG indices.

Check out the below chart for the preferred underlying assets of the Polish investor.