SRP provides an overview of the structured products landscape in Poland in 2021.

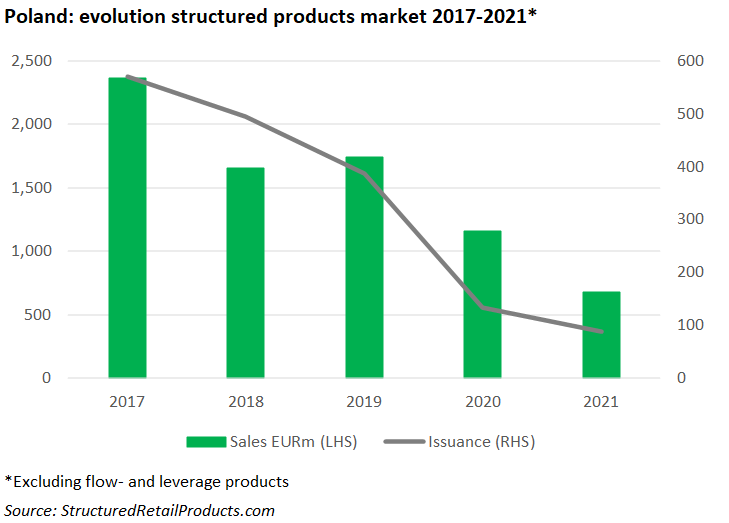

Looking at the evolution of the Polish structured products market in recent years, it really is a tale of two stories.

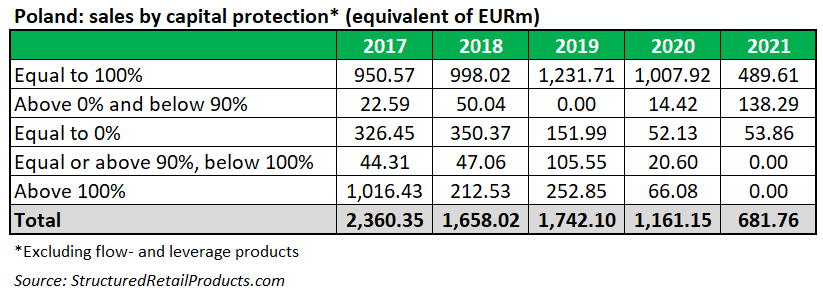

On the one hand, there is the market for traditional, mainly capital-protected products, which, hampered by the low interest rates, have seen sales volumes decline by more than 70% in the past five years.

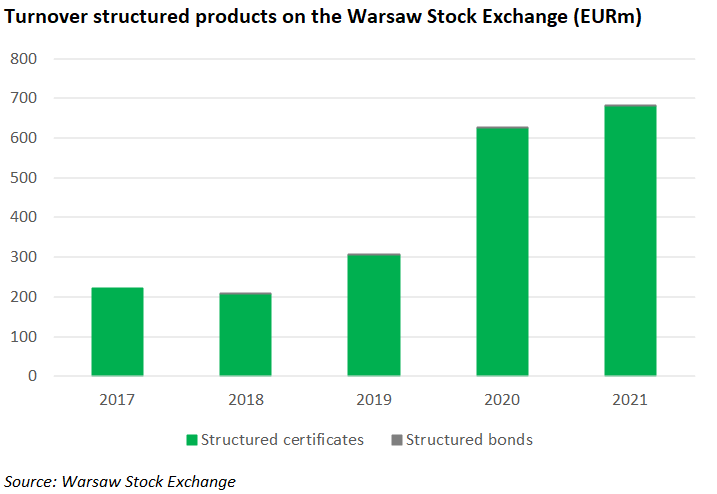

On the other end of the spectrum, the listed structured products on the Warsaw Stock Exchange (WSE), and especially the turbo certificates, have gone from strength to strength, registering a turnover of €680m (PLN3.1 billion) in 2021 – an increase of more than 200% since 2017.

Numerous educational activities are undertaken in the scope of investing in structured products - Antonina Karwasińska, PRPS

In this feature article, SRP spoke to market participants and although the general consensus is that there will be challenges ahead, the overall outlook is positive, with a bright future predicted for both capital-protected products and listed certificates.

Ninety structured products had strike dates in Poland during 2021. The total volume for the year, at an estimated €682m, included €628m that was gathered by (partially) capital-protected products – down from €1.1 billion that was collected in 2020, according to SRP data.

The largest decrease in volumes of structured deposits and capital-protected notes on the Polish market was observed in 2020, according to Monika Pawlak (right), structured product manager, Santander Polska.

The direct cause was a sharp drop in interest rates in the first quarter of 2020, from approximately two percent per annum to 0.5% per annum for five-year tenors and close to zero percent for short term deposits.

“It had a significant impact on the attractiveness of the capital-protected solutions,” said Pawlak.

“In case of the short-term structured deposits it even led to the suspension of their offering by some banks. At that time the highest capital inflows were recorded by bond funds. This trend continued in the second half of 2021. Then long-term bond yields began to rise and as a result there was an outflow of capital from bond funds, mainly into foreign equity funds.”

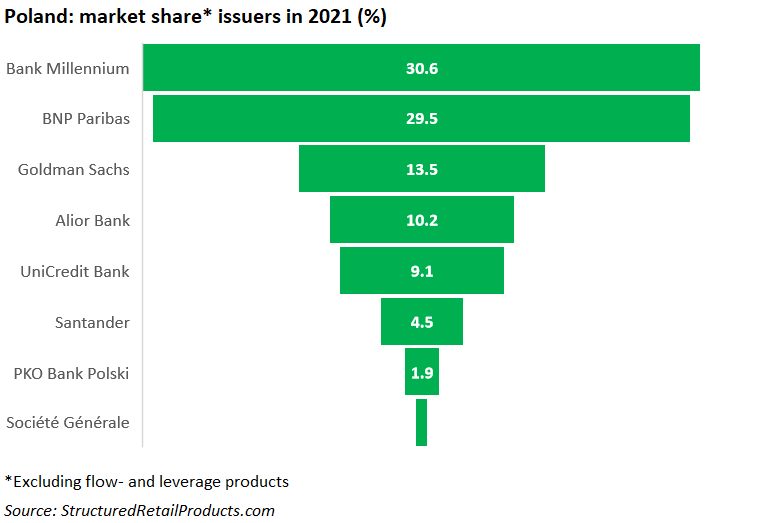

Marcin Serafin, director treasury department at Bank Millennium, which issued 11 structured deposits in 2021, agreed: “Last year was difficult because of low interest rates environment, but we did not stop offering capital protection products,” Serafin said.

“Recent rates hikes support this business in 2022, which means we can offer better products for the customers – more vanilla options embedded and fewer barriers.”

The low interest rates in Poland meant that just 70 (partially) capital-protected products were issued on the primary market in 2021, a decrease from 102 such products the previous year (and 275 in 2019).

At the same time, manufacturers found it hard to come up with suitable alternatives.

“Issuers issued less capital-protected products, but the alternative they offered, such as express certificates, weren’t so easy to understand for clients, and they didn’t offer attractive returns, even when combined with pure shares or ETFs,” said Bartosz Sańpruch, senior product manager at ING Bank.

Not everyone suffered from the ultra-low interest rates climate though.

UniCredit had a very productive year in terms of its own structured products with sales volumes increasing by 140% year-on-year (YoY). The bank issued 14 products in 2021 worth approximately €60m, including three 100% capital-protected certificates that achieved combined sales of €37.5m

“We remained agile around client demand – finding the right solutions to match investors’ needs and the right products for a low interest rate market environment,” said Daria Stuhlmann (right), vice president, private investor products, CEE sales, at UniCredit.

“One of the main reasons for our standout performance is that we are in constant contact with our distributors and partners in Poland, listening to what they are saying and acting accordingly.

“This year’s performance can also be attributed to our personalised approach. We seek to provide value-add services along the entire product lifecycle, not only before and after launching, through targeted training sessions for our distribution networks,” Stuhlmann said.

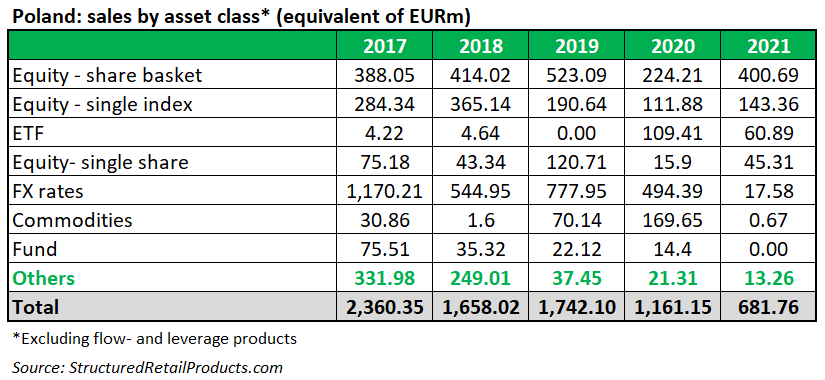

The bulk of sales volumes in 2021, at €400m, came from the 53 products that were linked to a basket of shares. They were issued, among others, via BNP Paribas (20 products), Goldman Sachs (12), Alior Bank (11), and Santander (six).

UniCredit used share baskets specifically for its capital-protected products last year, although it does provide a wide range of underlyings – indices, funds, single stocks and baskets.

“One important angle is that baskets of stocks, particularly in Poland, are usually preferred if the distributors or counterparties have a particular view,” said Tom Coufal (right), director, head of private investor products, CEE, at UniCredit.

“They may have their own research and are requesting tailored products for their network,” Coufal said.

The 13 products that were linked to single indices accumulated sales of €143m, but with this type of structure, there often is a catch, according to Coufal.

“When it comes to indices, index providers have increased their costs and so this has naturally become an important factor in pricing. That's why you’re seeing more stock baskets,” he said.

Despite UniCredit having its own proprietary indices, such as the UC Next Generation Energy Index, which was used as the underlying for HVB PLN Express Plus Certificate in September last year, Coufal believes there is often a hint of reservation from the market with this type, because the provider of the structured product and the index is the same entity, or they are connected.

“It is not usually very easy to get approval for this from the distribution network, so you need to look for other index providers and this can be a cumbersome process. An easy workaround in this context is to use share baskets,” he said.

Another 11 products (€45m), including offerings from Bank Millennium, Goldman, and UniCredit, were tied to single stocks.

“The products linked to single stocks are usually tailor-made and this is the approach that we take. We are client focused on everything we do as we seek to deliver best-in-class solutions to our distributing partners and investors alike,” said Coufal.

Listed products

Away, from structured deposits and capital-protected notes, certificates listed on the secondary market experienced an excellent year, with turnover and number of trades at record levels.

Turnover of structured products on the WSE stood at €680m in 2021, an increase of approximately nine percent YoY (FY2020: €624m), while the number of trades, at 424,254 was up by two percent YoY (FY2020: 416,844).

“The year 2021 brought significant volatility on the Warsaw Stock Exchange, which had a positive impact on the market of structured products,” said Antonina Karwasińska, chair of the supervisory board, Polish Council for Structured Products (Polska Rada Produktów Strukturyzowanych, or PRPS).

“Interest rates, which in Poland remained relatively low until October 2021, were also an important factor that led investors to seek alternative ways of investing,” she added.

Karwasińska’s views were echoed by ING’s Sańpruch (right), with the Dutch bank experiencing a record year for its turbos in 2021, as turnover exceeded PLN2 billion (€435m) on the WSE.

“The volatility in the financial markets during 2020 and 2021 allowed clients to use turbos in shorter terms, which boosted turnover,” said Sańpruch.

Currently, almost 2,500 structured certificates are listed on the WSE. Of these, turbo certificates enjoyed the greatest interest of investors (more than 1,305 listed products at the end of 2021), which resulted in a total turnover of €446.9m in 2021. The second place was taken by factor certificates (940 listed products at the end of 2021 and turnover of €127.3m).

Structured certificates with capital protection enjoyed less interest than turbos and factor certificates. At the end of 2021 there were less than 80 such products listed with a turnover of €47m.

Despite the lack of demand for capital-protected certificates on the exchange, Sańpruch doesn’t believe many investors moved from structured deposits/capital protected products to turbos.

“Turbos are aimed at a different type of client […] they have a completely different risk, and offered return,” said Sańpruch.

Outlook

According to Stuhlmann, there are two things that will influence the Polish market in 2022.

“Firstly, I think we will see a rate hike again in Poland, most likely in the first half of the year,” she said. “This might create opportunities for more vanilla investment products, like saving deposits, as they could become more attractive to local investors.”

The environment will be challenging but with an increasing demand for structured and capital-protected products the market is expected to grow further.

“We’re also expecting high volatility in equity markets. Again, this can represent a good opportunity to enter via structured products. Products with conditional capital protection are interesting in this context, as they offer an optimal risk/return profile and alternative to investing directly in equities,” Stuhlmann said.

Santander’s Pawlak is also expecting a rebound of the structured products market on the back of a hike in interest rates in 2022.

“We believe that capital-protected solutions will be the main beneficiaries of interest rate increases.

“The rates of around three to four percent per annum allow us to build an interesting offer of capital protected products for customers, both in the segment of short-term deposits as well as for three- to five-year bonds,” Pawlak said.

Karwasińska (right) agreed with both Stuhlmann and Pawlak, as she too expects the upward trend of the structured products market to continue in 2022.

“Although the structured certificates are complex products, retail investors seem to choose them more and more often due to the relatively high profit perspectives, wide range of underlying instruments as well as possibility to choose various risk indicators,” she said.

In addition, the Polish system of voluntary individual pension scheme account allows the possibility to invest in structured products, which also positively influences the demand.

“Moreover, numerous educational activities are undertaken in the scope of investing in structured products, including the initiative undertaken by Polish Council for Structured Products in cooperation with WSE to develop educational materials for retail investors,” Karwasińska said.