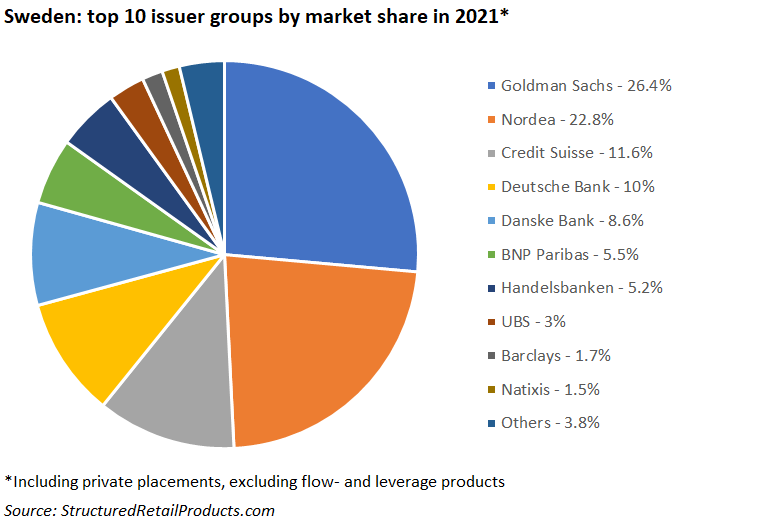

Goldman reached the number one spot in Sweden for the first time.

Some 461 structured products worth an estimated SEK7.6 billion (US$892m) had strike dates in Sweden between 1 January and 31 December 2021 – down 10% in sales volumes compared to the previous year (FY2020: SEK8.4 billion from 526 products).

Sixteen issuer groups, a mixture of Nordic financial institutions and European/US investment banks, were active during the year.

Of these, Goldman Sachs, which saw its sales volumes increase by almost 70% year-on-year, was the number one provider. The US investment bank topped the charts for the first time since the launch of the SRP Sweden database in April 2007, collecting SEK2 billion from 121 products – the equivalent of a 26.4% market share (FY2020: SEK1.2 billion from 95 products).

In second place, Nordea, with a 22.8% share of the market, registered an even bigger increase in sales volumes (+140% YoY) on the back of a much better performance of its autocalls.

Third placed was Credit Suisse, which held a 11.6% share of the market. Deutsche Bank (10%) and Danske Bank (8.6%) completed the top five.

The top-seller of the year was 2449 Fondobligation VAL Nordic Corporate Bond Kupong, a six-year certificate that offers 140% participation in a strategy on the Pareto Nordic Corporate Bond Fund. It is issued on the paper of Deutsche Bank and distributed via Strivo (formerly known as Strukturinvest).

Goldman was behind the best-performing product of the year, which came in the shape of Autocall Nordiska bolag Kvartalsvis Smart Bonus 2 år nr 4200. The certificate, which was linked to a basket comprising the stocks of EQT, Getinge B, Nokia, and Veoneer, knocked out after 2.5-months returning 110% of the nominal invested. It was distributed via Garantum, which saw no fewer than 283 of its products autocall/mature during 2021, returning on average an annualised coupon of 6.27%.

Check out the below piechart to view the top 10 issuer groups in the Swedish market.