The US insurance carrier has brought to the fixed index annuities (FIAs) a popular crediting strategy used in registered index-linked annuities (Rila).

The dual trigger account is now available with all FIA options issued by the Pennsylvania-based insurer tracking the S&P 500, including its flagship OptiBlend.

“We’re bringing a trigger portfolio to market by expanding our trigger option and leveraging this concept that the consumer has been familiar with from Lincoln Financial for a very long time - Kim Genovese

Like trigger account, the new dual trigger account will credit the trigger rate at the end of the one-year index term if the index doesn’t fall. However, the trigger rate for the dual trigger account additionally acts as a downside buffer, allowing the difference to be credited if the index decreases less than the reference rate. Investors are protected from loss with no interest credited if the index drops more than the rate.

The introduction of the dual trigger is a first for the FIA market in the US, according to Kim Genovese (pictured), vice president, annuity product management at Lincoln Financial.

“We’re bringing a trigger portfolio to market by expanding our trigger option and leveraging this concept that the consumer has been familiar with from Lincoln Financial for a very long time,” Genovese told SRP.

The trigger rate has become the most utilised index account option at Lincoln for its “simplicity” after the insurer pioneered the strategy over 20 years ago, according to Genovese.

Last August, Lincoln Financial rolled out dual performance trigger crediting strategy for its Level Advantage Rila products, which deploy a similar payoff to dual trigger FIAs but offers limited capital protection.

“Over the past 20 years, the S&P 500 has been within negative five percent or higher 85% of the time from a return perspective,” said Genovese. “That’s really giving the consumer more opportunity to lock in growth with this dual trigger option.”

In the Rila market valued at US$47 billion, the dual performance trigger strategy is also referred to as ‘dual direction’ after being first brought by Equitable in May 2020. The New York-based insurance company added a dual step-up option three years later, providing a fixed return whenever the index return exceeds the downside buffer.

“There is a lot of synergies between FIAs and Rilas, but it really depends on the consumer’s preference when it comes to value proposition,” said Genovese, citing additional crediting strategies - interest cap and participation rate - commonly seen in both product types.

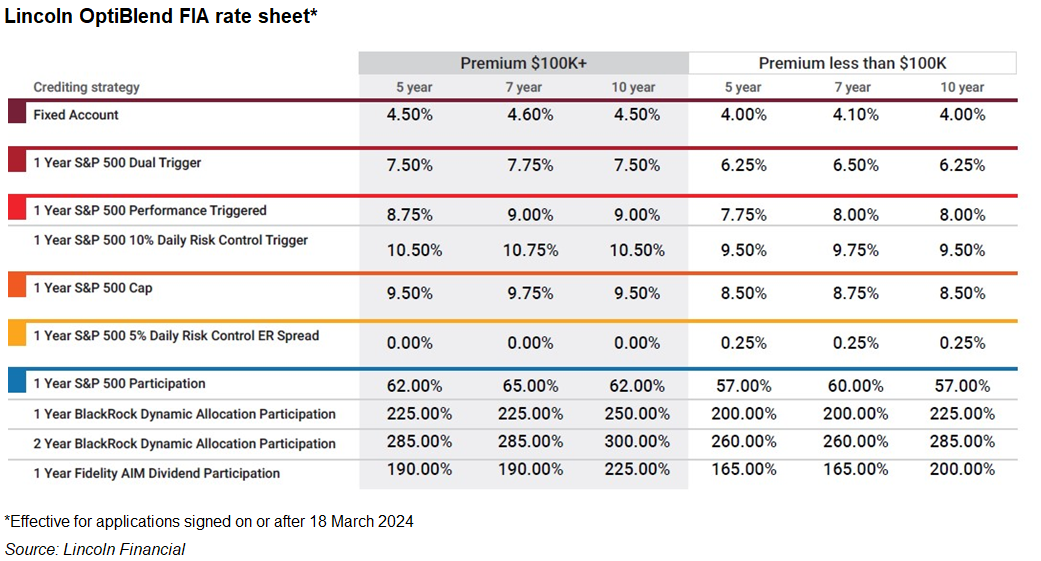

Besides the dual trigger, Lincoln Financial also launched the 1-Year S&P 500 10% Daily Risk Control Trigger for its OptiBlend FIA to offer opportunities for more growth potential in up or flat markets.

That adds up to a total of 10 account options for OptiBlend, which is designed to be distributed through independent marketing organizations (IMOs), in comparison with Liconln's CoveredChoice and FlexAdvantage series sold by direct channels including advisors, wirehouses, banks and independent planner firms.

Alongside the S&P 500 index, the suite also offers index accounts linked to the BlackRock Dynamic Allocation Index and the Fidelity AIM Dividend Index with a trigger strategy.

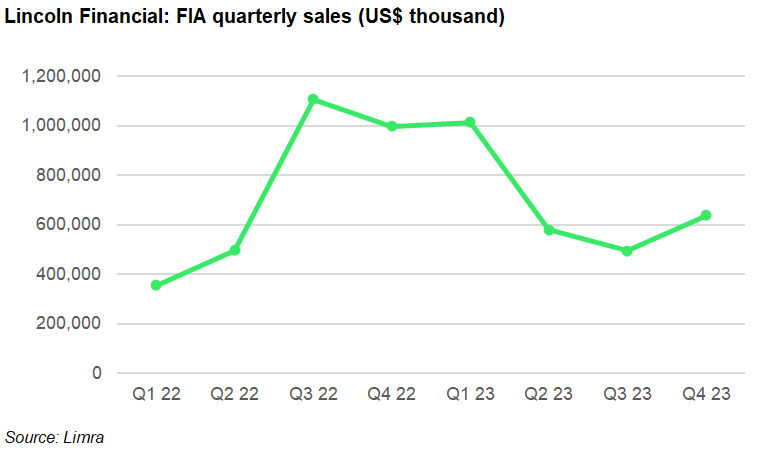

OptiBlend, which houses most of the index-linked accounts with surrender periods of five, seven and 10 years, made up two thirds of the total FIA sales volume at Lincoln Financial last year, according to Genovese.

In 2023, the insurer collected US$2.73 billion and US$4.33 billion from FIA and Rila sales, taking a respective market share of 2.8% and 9.1%. Within the company, the FIA sales volume dropped by 7.8% from US$2.96 billion year-over-year while the market delivered a 20.2% growth, the latest survey by Limra shows.

“The biggest trend we’ve seen that have helped the [entire] FIA sales grow is increasing utilisation of bonus products and income riders,” said Genovese, adding that these products are not offered at Lincoln Financial today.

A bonus FIA offers either an upfront premium bonus or a first-year interest rate bonus. Income riders, known as guaranteed lifetime withdrawal benefit (GLWB), are an annuity feature that provides enhanced lifetime income for an annual fee.

“It’s a market we continuously keep a pulse on, but not in the short term,” she said. “We want to focus in bringing new value propositions like the expansion of our trigger portfolio.”

Do you have a confidential story, tip, or comment you’d like to share? Write to Summer.Wang@derivia.com