The French bank has more than doubled its traded notional of 3(a)(2) structured notes in the US in the past quarter year-over-year.

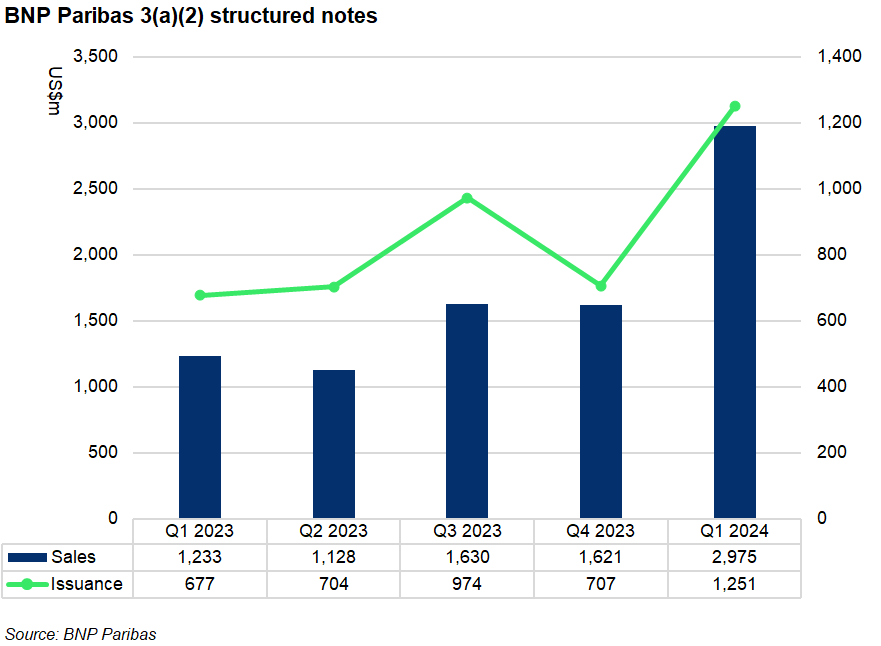

BNP Paribas collected a total of US$3 billion in principal amount from 1,251 structured notes in the US in the first quarter of the year, 141.4% higher than the prior-year period.

This also represented over half of its combined volume in 2023 when the French bank issued 3,062 structured notes worth US$5.6 billion for the full year.

These products are offered under the Section 3(a)(2) of the Securities Act of 1933, which is exempt from registration with the U.S. Securities and Exchange Commission (SEC) and enables BNP Paribas to access the US onshore structured note segment.

Behind the growth lies a wider adoption of “price efficient indices”, according to Gabriel Nguyen (pictured), managing director, head of cross asset distribution sales, Americas at BNP Paribas.

Price efficient indices are a set of indices derived from benchmark broad indices designed specifically for use in structured products - Gabriel Nguyen

“Price efficient indices are a set of indices derived from benchmark broad indices designed specifically for use in structured products,” Nguyen told SRP, pointing at the S&P 500 Futures 35% Defined Volatility Index (SPXFV35E) and S&P 500 Futures 35% Defined Volatility 5% Decrement Index (SPXFD35E) as two of the indices that drove increased activity in 2023.

The S&P Defined Volatility Indices measure the performance of leveraged strategies applied to the S&P 500 futures (3-Day Roll) Index which seek to target specified levels of volatility. The indices reset leverage every week to the ratio of target volatility to weekly implied volatility on the S&P 500.

“The indices allow US investors to reach their desired risk-return profile when designing their structured notes and be less dependent on the volatility regime at time of pricing,” said Nguyen.

BNP Paribas has increased its structured notes issuance linked to the two defined volatility indices as well as their underlying index as one of the first issuers bringing them to the market, according to Nguyen.

In Q1 2024, its traded notional linked to the S&P 500 Futures Index reached US$54m compared to US$95m seen in 2023. Meanwhile, the French bank raised US$5.5m and US$3m issuance amount linked to the S&P 500 Futures 35% Defined Volatility Index and S&P 500 Futures 35% Defined Volatility 5% Decrement Index, respectively.

Launched on 24 June 2022, the defined volatility index suite also targets volatility at 25% or 30% with an optional decrement feature.

“Decrement overlay started in Europe and is picking up in the US as investors become more educated with this feature,” said Nguyen.

In the US structured note space, the MerQube Vol Advantage Indices developed in partnership with J.P. Morgan stand out for its combination of volatility control and decrement overlays, as SRP reported.

BNP Paribas last year also traded 3(a)(2) structured notes on the S&P 500 Sector Rotator Daily RC2 5% Index ER, which went live in October 2018. Outside of the US, the index with a decrement overlay was traded through structured certificates in Italy and Czech Republic by the bank.

Beyond 3(a)(2) notes, BNP Paribas utilises Regulation S to offer and sell structured notes outside of the US, which is exempt from the registration of Section 5 of the Securities Act of 1933.

In Latin America, the French bank recorded a double-digit growth in its traded notional in 2023 driven by credit-linked notes (CLNs), which accounted for 10% of the total in the Americas, a rise from two percent in 2021.

“Private clients in Latam see credit as an alternative to equities in structured products,” said Nguyen. “A higher rate environment and appetite for longer durations [have] propelled the asset class.”

Nguyen and his team have also observed a demand from clients to better manage their overall portfolio allocation, which is also reflected at the Structured Derivatives Forum held by BNP Paribas in California last month where over 30 wealth managers attended across the Americas.

In response, the bank ramped up its alpha warrant program last year following its debut in 2022 to complement its traditional structured notes program. “The programme allows investors to optimize their capital allocation and asset diversification,” said Nguyen.

Do you have a confidential story, tip, or comment you’d like to share? Write to summer.wang@derivia.com