The use of strategy and custom indices has had a long and rich history within retail structured products markets for many years.

Equity underlyings remain the most dominant choices globally and they divide into benchmark indices and baskets of individual stocks.

[Strategy & custom] indices have shown growth over the last decade or so and represent the structured product market’s main attempt to access various strategy plays - Tim Mortimer, FVC

However, an important niche area is occupied by strategy and custom indices. These span various different concepts but can be defined as algorithmic investments combining equities with other asset classes. As such they give some diversification away from pure equities and also from more passive benchmark indices that simply track their relevant market.

[Strategy & custom] indices have shown growth over the last decade or so and represent the structured product market’s main attempt to access various strategy plays. This is because it is generally impracticable to employ a discretionary approach as a fund would be able to do as product payoffs need to be ruled based. It would be possible as an alternative to use an ETF to access a more complex and innovative strategy, but this has seen surprisingly little take up. ETFs as underlyings are popular but this tends to be mainstream funds tracking major indices.

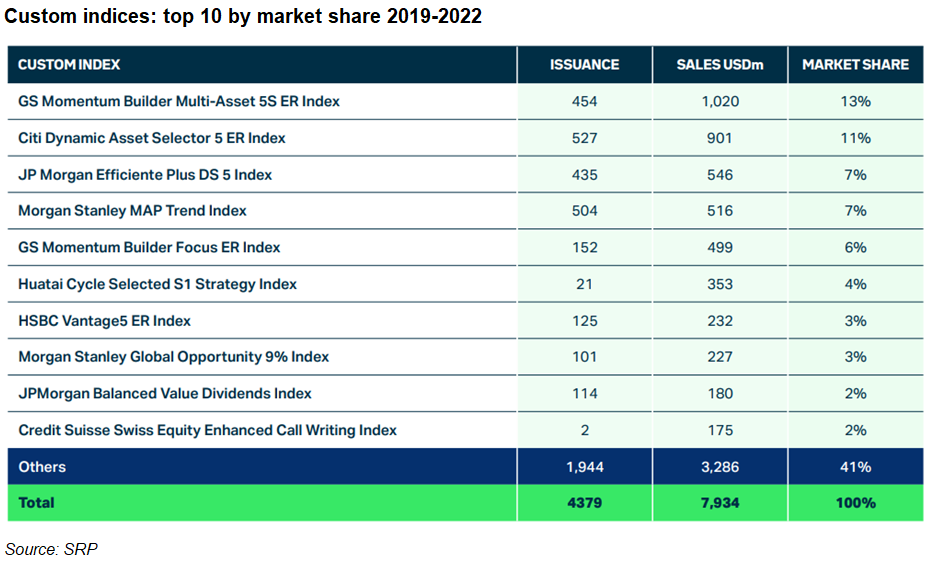

Custom indices are very varied and the table of the most popular in the period 2019-2022 for the US market is shown below:

Many of these indices have been popular in the US structured products market for some time, in particular the Goldman Sachs Momentum Builder (variants of which appear twice in this list) and the JP Morgan Efficiente Index. These two well-known index concepts take a similar approach and seek a multi asset class diversification across equities, bonds, cash and other asset classes. These indices define criteria to calculate the weighting to each asset class over the next investment period, typically by observing performance over the previous period.

They are both momentum-based strategies, an enduringly popular investment “factor” which has been shown to add value consistently. The rationale for using momentum is that observed trends will continue and therefore the index should seek to invest in assets with strong recent growth and reduce exposure or uninvest in those with poor growth over the period.

The JPMorgan ETF Efficiente 5 and the GS Momentum Builder Multi-Asset Class both give exposure to a range of asset classes through indices or ETFs using a momentum algorithm to determine asset allocation. In addition to momentum these indices seek to maximise portfolio performance by various diversification constraints and have volatility control measures with a target of 5% volatility.

The other indices in this list are generally newer entrants from other investment banks active in the market such as Citi, Morgan Stanley and HSBC.

These indices have proven successful for a number of reasons. Firstly, they give diversification away from the regular market capitalisation indices such as the S&P-500, Russell 2000, Nasdaq100 and international choices such as the Eurostoxx and Nikkei.

Although the indices are rules based and therefore fit well with investment bank technology and regulatory constraints, they have the flavour of actively managed academically sound fund concepts and therefore allow structured product providers to compete against similar concepts from the insurance sector.

Virtually all of these indices are also volatility controlled generally with target volatility of between 5% and 9% per annum. This addition is important as it allows pricing of capital protected solutions even in lower interest rate environments.

Many of these products are designed for the certificates of deposit market which require them to be fully capital protected. Since these investments compete against fixed rate CDs or heavily constrained alternatives with various caps and limits the low volatility methodology is not detrimental and indeed helps to show smoothed trajectories for the underlying index.

Data from Structured Retail Products shows that such indices are also popular in Europe. The same indices from Goldman Sachs, JP Morgan and Morgan Stanley from the US top ten also feature in this list along with indices from S&P Dow Jones such as the Economic Cycle Factor Rotator.

However, the two most invested indices are the Eurostoxx Select Dividend 30 (with 38% of market share) and the Stoxx Global Select Dividend 100.

Disclaimer: the views, information or opinions expressed herein are those of FVC, and do not necessarily reflect the views of SRP.

Image: Pixels Hunter/Adobe Stock.