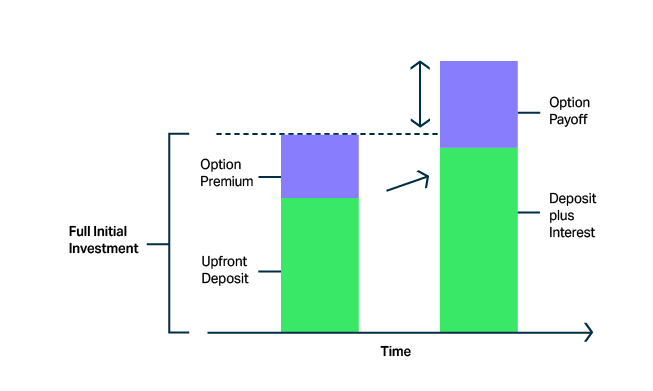

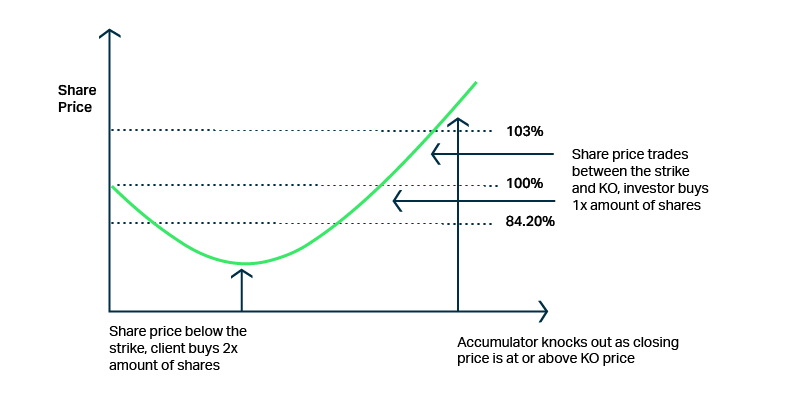

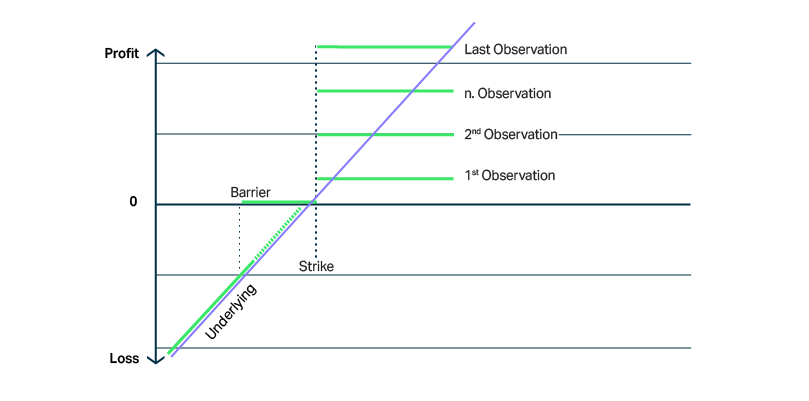

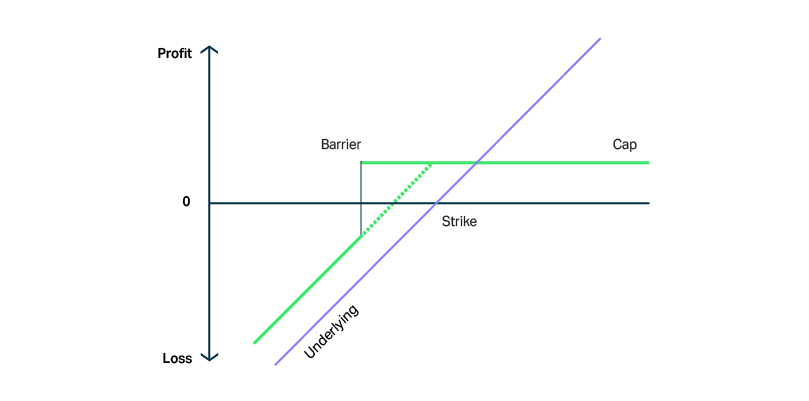

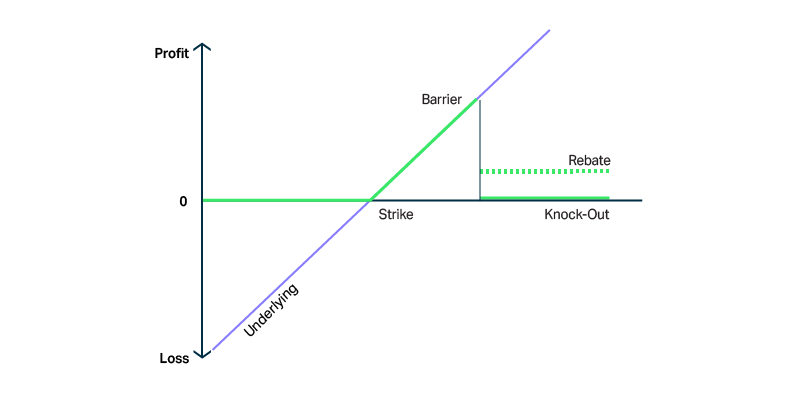

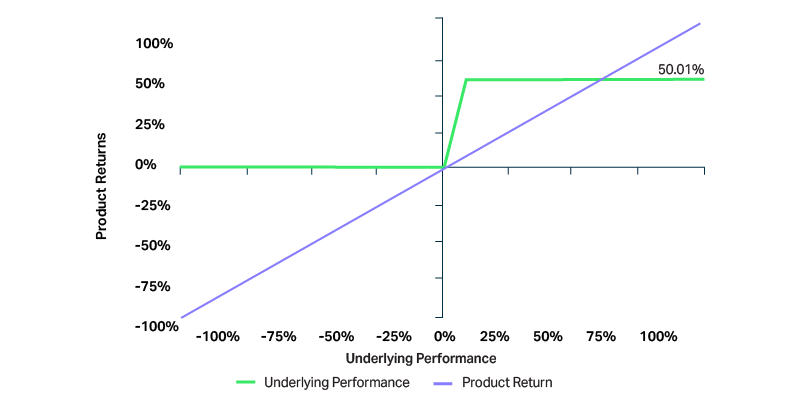

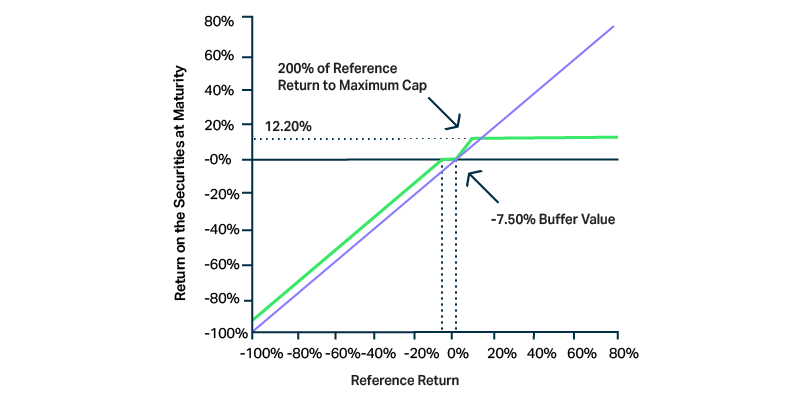

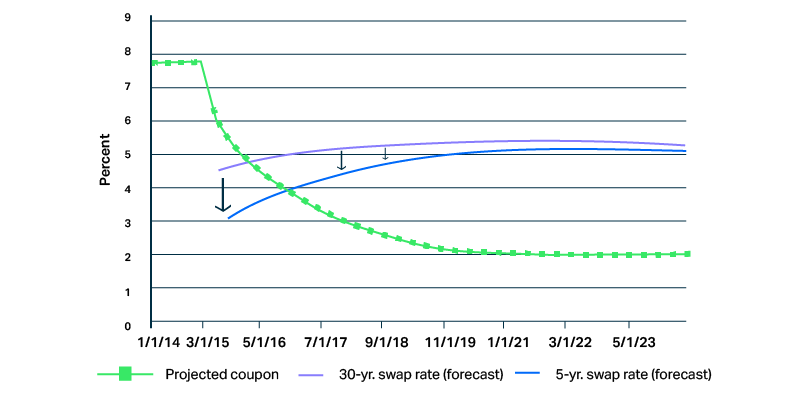

Structured products are investments which provide a return based on the performance of an asset.

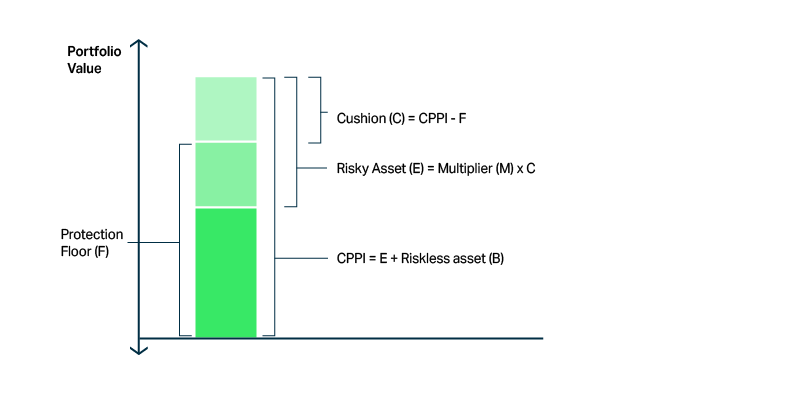

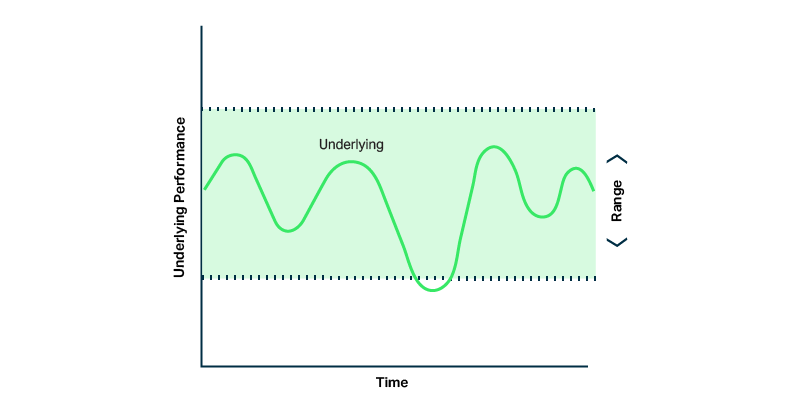

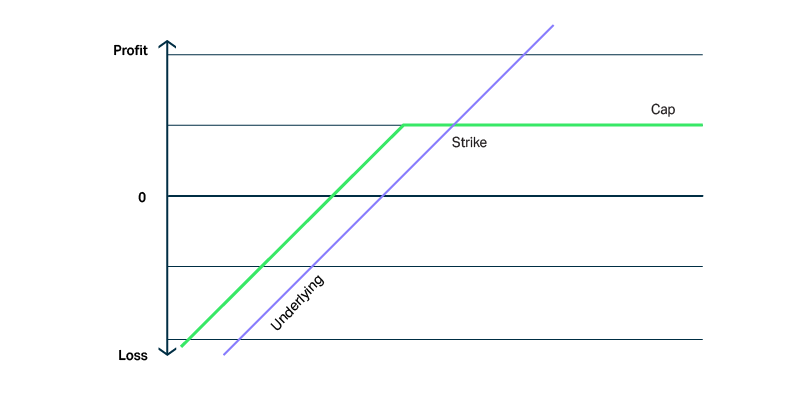

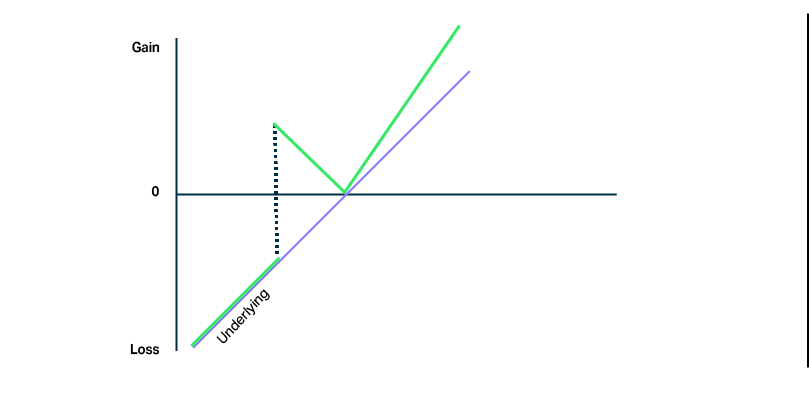

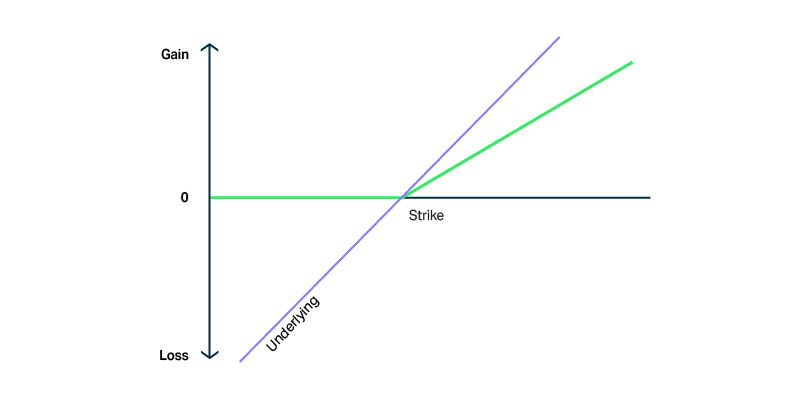

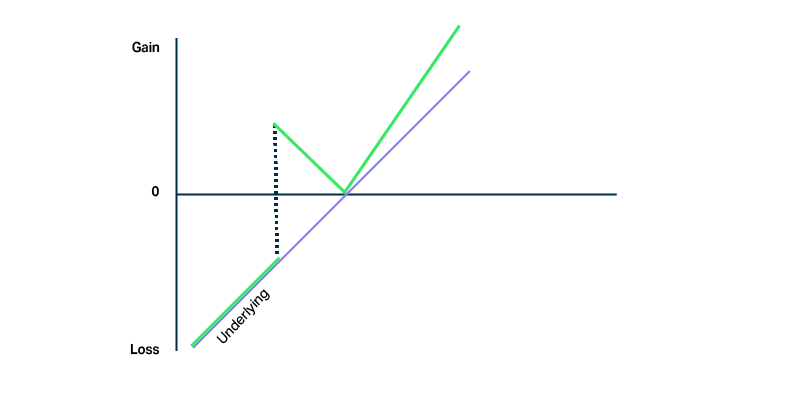

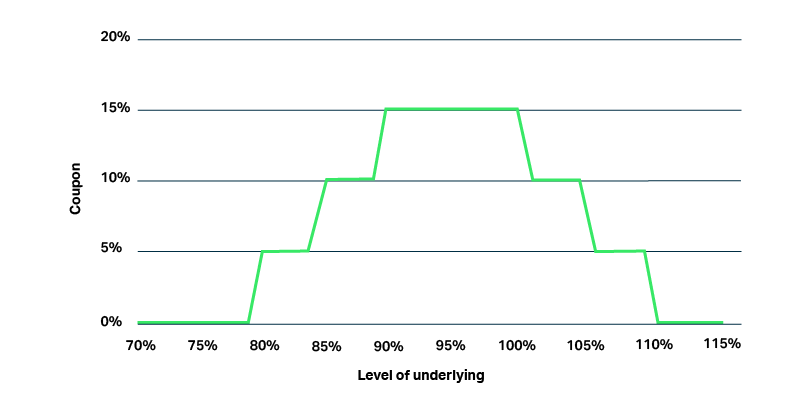

This asset can cover the equity, index, fund, interest rate, currency, commodity or property markets. The payoff and level of capital at risk can be pre-defined. Payoff profiles can be designed to take advantage of rising, falling or range bound markets, and delivered in a way that can be tailored to the needs of investors.

They are designed for investors who are prepared to invest for a fixed period, and who also want some degree of protection over their initial capital.