An unrivalled world of insights across the global structured products industry.

Request Demo Get Started

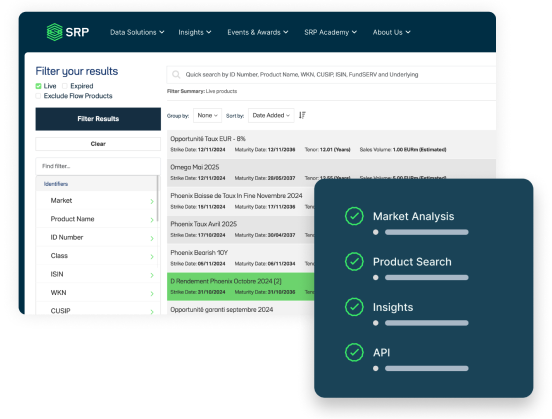

We draw on deep expertise from across the structured products industry to deliver a cutting-edge blend of data solutions and insights.

Our comprehensive database and analysis capabilities drive smarter decision making and help businesses stay ahead of the rest of the market.

Cutting-edge insights help you stay informed of the shifting dynamics creating change in the global structured product space.

Learn, network and celebrate excellence at events held around the world.

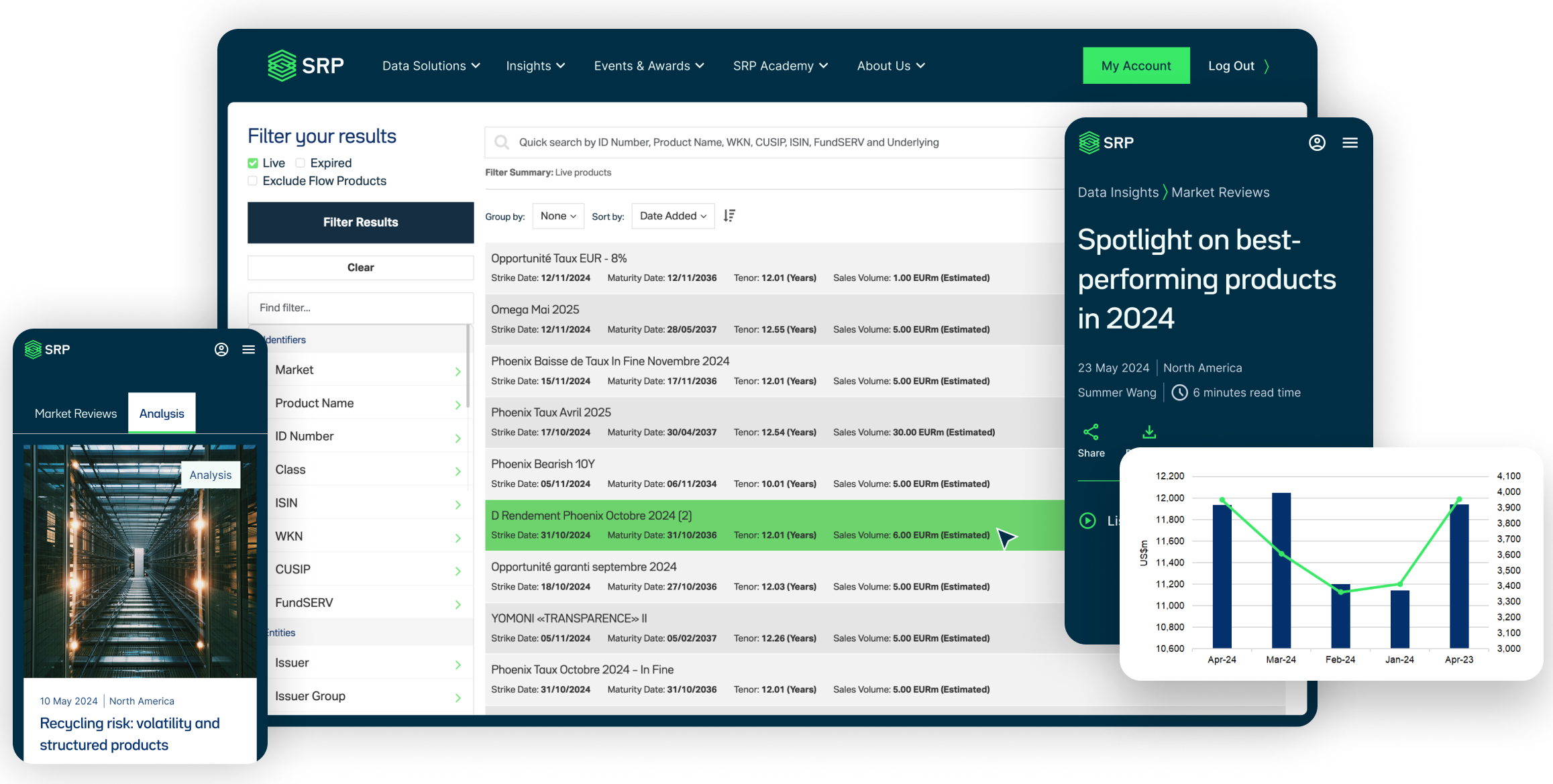

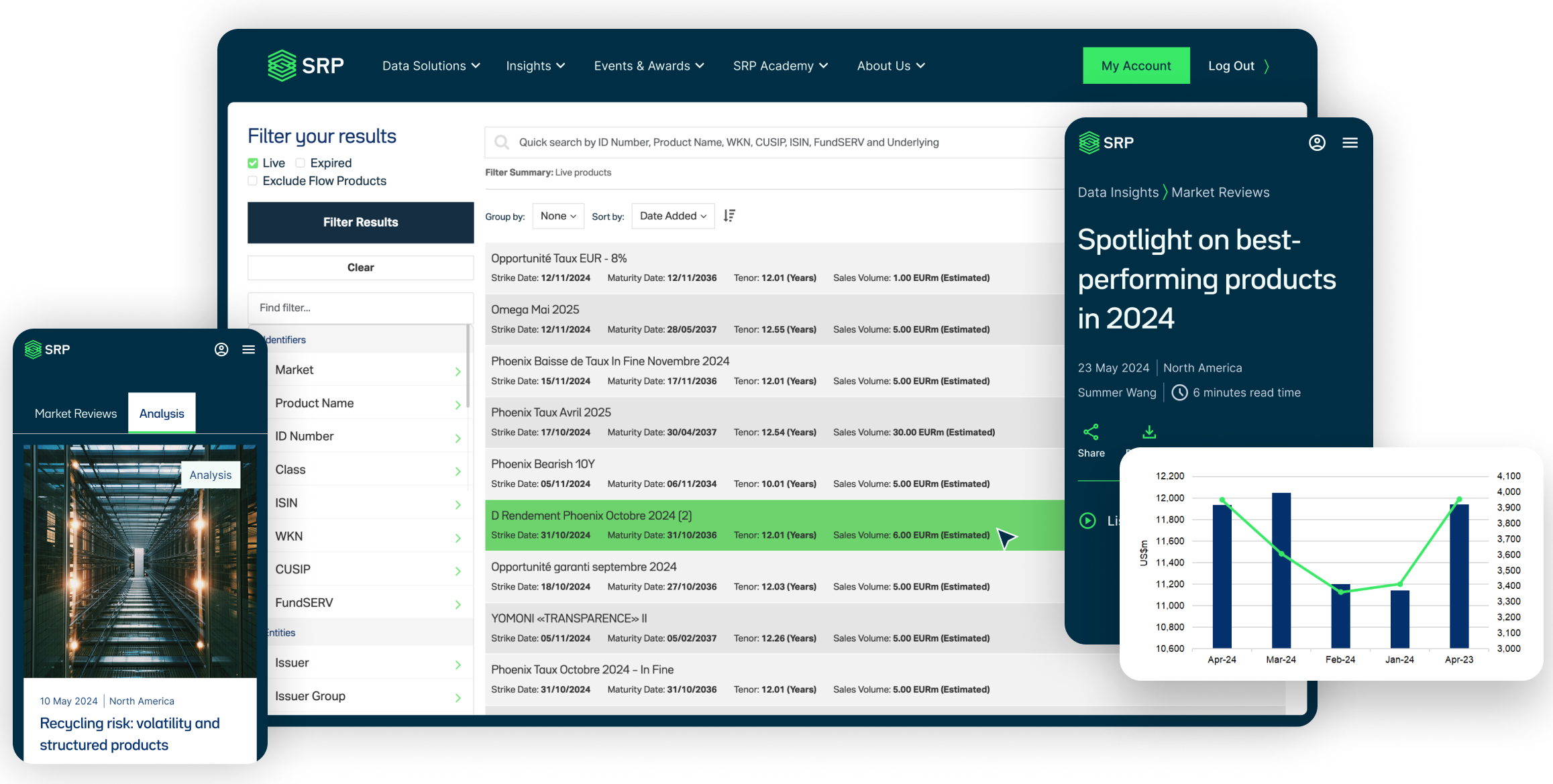

Our comprehensive database of structured product data matches granular product information with historical trends, putting a world of strategic insights at your fingertips.

Request Demo Get Started

Read the latest stories, insights and analysis of the major trends shaping structured products markets.

The issuance marks the first structured note created natively on Euroclear’s D-FMI distributed ledger platform and signals growing momentum for digital issuance in the wealth management market.

The UK boutique is building out its structured products business, navigating UK fund plumbing and exploring Ucits, AMCs and scalable systematic strategies.

The AMC market is slowly taking hold in Asia, combining traditional assets and crypto-linked strategies as investors look for flexible, cost-efficient investment structures.

The most comprehensive, trusted source of structured product data and market intelligence.

22+ years

of building the industry’s leading database

57+ million

structured products covered worldwide

600+

leaders convene across 5 global conferences every year

5 global

offices in London, New York, Hong Kong, Sofia and Chennai

10

We work with the top 10 investment banks globally