The US market represents almost 25% of all structured products outstanding globally in 2023.

It is a mature and developed market with a wide range of product types on offer linked to many different underlying assets. Here we will focus on those US products linked to non-US assets using data and analysis from StructrPro.com.

For the purpose of this article, we consider non-US assets to be those assets either listed on exchanges outside the US or in the case of indices or ETFs those made up of foreign stocks or designed to track a non-US underlying.

StructrPro is a tool that can be used to analyse a single product or portfolio of products from the US structured product market. This analysis includes both live and matured products from the SRP database using analytics powered by FVC. It includes a universe of over 80,000 CUSIPs featuring both live and matured trades.

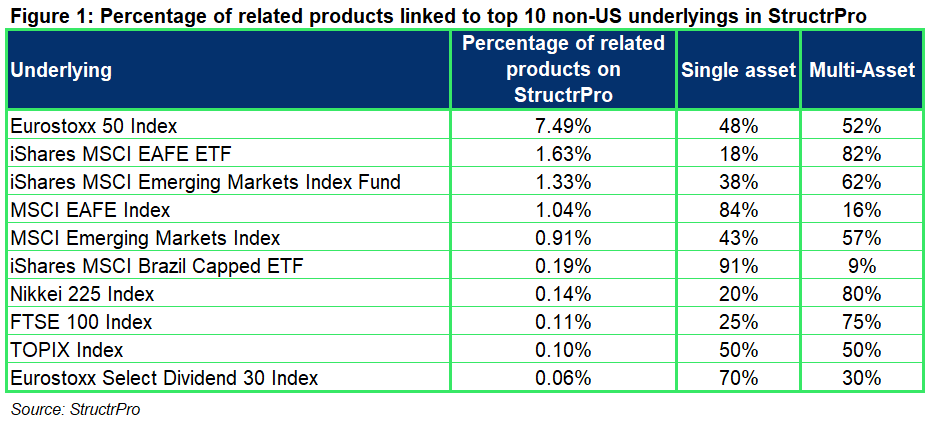

Figure 1 shows the top ten non-US underlying assets in the StructrPro universe. Of the top ten there are seven indices and three iShares ETFs. Two of the ETFs are designed to track indices that also appear in the top ten, the MSCI EAFE Index and MSCI Emerging markets Index. Of the remaining five indices there are four regional benchmark indices representing Europe, Japan and the UK. The final index is the Eurostoxx Select Dividend 30 Index which tracks high dividend stocks in Europe.

The table shows the percentage of products that include the relevant underlying, this could be as a single asset or part of a basket of underlyings. The table also shows a breakdown by underlying of single asset vs multi asset products.

The Eurostoxx 50 Index is the most commonly seen non-US underlying and features in approximately 7.5% of products on the service, this is more than the rest of the top ten non-US underlyings put together. The iShares MSCI Brazil Capped ETF, MSCI EAFE Index and the Eurostoxx Select Dividend 30 Index stand out as being underlyings that have a high proportion of products linked solely to them. This suggest that there is specific interest in exposure to these underlyings rather than as part as a basket. Conversely, the FTSE 100 Index, Nikkei 225 Index and iShares MSCI EAFE ETF are used as part of a basket much more frequently than as the sole underlying. The highest ranked non-US individual stock was BP followed by Barclays, these are both listed on the London Stock Exchange.

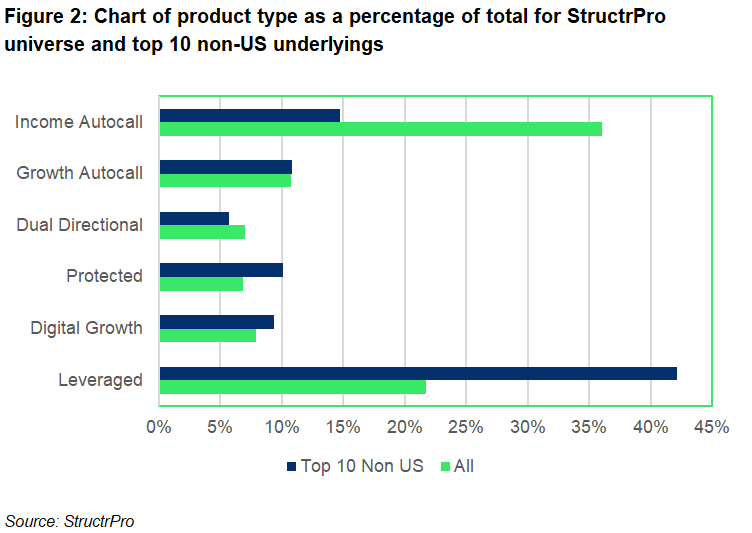

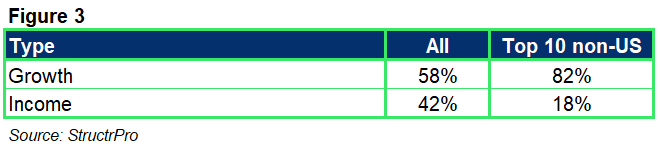

Figure 2 shows a breakdown by product type for all products and the sample set of the most popular non-US underlyings. For the market universe the most popular product type is the Income Autocall with approximately 36% of all products falling into this category.

For the non-US products the proportion of Income Autocalls is much smaller and instead it is the Leveraged category that has the most products with a 42% share. This is also reflected in Figure 3 which shows a breakdown by simple investment aims of Growth or Income. The non-US products have a much higher percentage share in the growth category than the whole universe.

Structured products provide a good way for investors to gain access to international markets. The “Quanto” mechanism that in employed by most structured products linked to underlyings denominated in a different currency means that investors are not exposed to currency risk since all products are denominated in USD. They only need to consider the growth prospects of the underlying in question.

Interest in exposure to alternative regions could be one of the reasons that growth products seem to be more popular for non-US underlyings. Leveraged products allow the investor to make returns based on the growth of the underlying and may offer some protection to downside losses. This important niche area alongside US benchmark offerings shows the variety that the structured product market can provide.

Image: ArtBackground/Adobe Stock.