Gold has always been an important underlying in the investment universe with its status as a safe haven in times of turmoil.

The price of gold has experienced a strong run in 2023 and it posted a return of 13% for the year. This followed two flat years after the stellar year of 2020 when its value jumped by 25% during the market and economic turmoil caused by the outbreak of Covid-19.

There are several triggers to cause gold to perform strongly from time to time with political uncertainty and renewed inflationary fears being top of the list - Tim Mortimer, FVC

Back in the high inflation times of the 1970s, gold was viewed as an extremely strategic asset by governments and investors alike. It lost much of its importance in later decades as inflation fears receded and equities went on their decades’ long bull run. Consequently, it lost its prestige and its price stagnated for long periods.

There are several triggers to cause gold to perform strongly from time to time with political uncertainty and renewed inflationary fears being top of the list. The war in Ukraine has had a strong bearing on gold prices since early 2022. Fears of political instability were raised further with events in Gaza in recent months.

Gold is still seen by some as a virtual currency and additionally it is a way to either hedge against the US dollar or to buy stable assets without the political sensitivity in being seen to support the US dollar by buying US Treasury bonds.

As a powerful economy with a particular eye on commodity prices China now has a significant interest in gold markets on a scale that did not exist during previous cycles. There is evidence of both government intervention and investor demand from China. In recent years this trend has also been matched by investors in India who have also supported the rise in gold with significant buying patterns. Shifts in balances of the world’s economies and regions can have profound long-term effects.

Protection against inflation is one of gold’s perceived properties and this was brought into focus when inflation jumped two years ago. Although inflationary fears remain the corresponding sharp interest rate rises have changed the picture again. Gold no longer had such an advantage as it became possible to lock in attractive interest rates at a time when inflation was expected to be relatively short lived and caused by temporary shocks and not for long term structural reasons.

Given the very strong run in US equities in particular (S&P 500 up 23% in 2023), gold now has the advantage of providing some growth potential and provides diversification away from equity markets which are starting to look expensive.

Another drawback for investing in gold it is does not have an income stream unlike cash, bonds and some equities. This is a problem for income seeking investors.

Strong fundamentals

The backdrop over the last two years provides positives and negatives to investing in gold. Since it is an asset that always has plenty of press interest it is natural that there is structured product activity particularly when the fundamentals are good. This year, there has been a significant increase in issuance to provide investors with an alternative way of investing in gold with the potential to provide income with structured products.

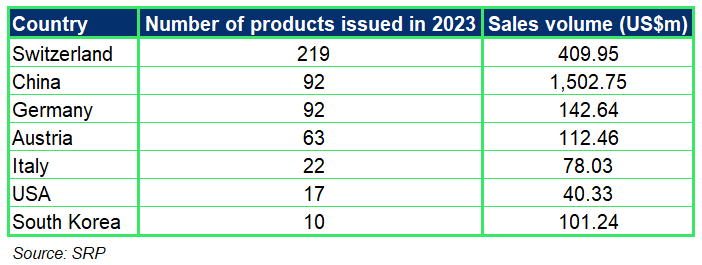

The table below shows structured product issuance in 2023 for the top seven countries by number of products, according to SRP data.

Switzerland, Germany and Austria occupy three of the top four entries and have very healthy sales volume totals. However, the Chinese market dwarfs all the others by sales volume indicating its very active position in gold-linked products, a position it has held since 2018.

Switzerland has seen over 200 products issued this year with typical profiles being Up and Out Calls such as this 18-month example in USD (SRP id 43132750) and Twin Win including this two-year maturity also in USD (SRP id 43130589). Maturities tend to be in the one- to three-year range, and the structures are consistent with an expectation of modest growth or range bound behaviour.

In China the most favoured products are those with shorter maturities with three-12 months being most common and the payoffs mostly digital in nature and either bullish or bearish in direction.

Other notable markets for gold issuance are Germany and Austria. These countries have active structured products markets therefore interest in gold was inevitable particularly given some commonality in investor preferences with Switzerland for whom gold has always been important with its banking industry.

In Germany, there are many examples of capital-protected gold products with a cap, including a three-year note issued by Deutsche Bank (SRP id 40026249). As is common in the structured products market as a whole, there are also products with gold and other underlyings combined such as a Credit Suisse income paying product linked to the worst of gold and the Eurostoxx 50 (SRP id 37142017).

As an underlying gold tends to go in and out of fashion more noticeably than other mainstream opportunities. This year it has been a popular asset, and the structured products market has provided choice and investment solutions.

Disclaimer: the views, information or opinions expressed herein are those of FVC, and do not necessarily reflect the views of SRP.

Image: Nomad_Soul/Adobe Stock.