European sales volumes in 2023 were boosted by strong performance of products linked to equity baskets.

Structured products saw particularly strong inflows in 2023, with products in Europe pulling in €171 billion (US$187 billion) in new issuances throughout the year, up 30% compared to the previous year (2022: €130.4 billion).

Equities, as an asset class, continued to grow in terms of sales during 2023

The increase was largely supported by the re-appearance of capital protection products linked to rates or equities. For the below analysis, we are looking into the latter category, as the trend seen so far looks set to continue in 2024.

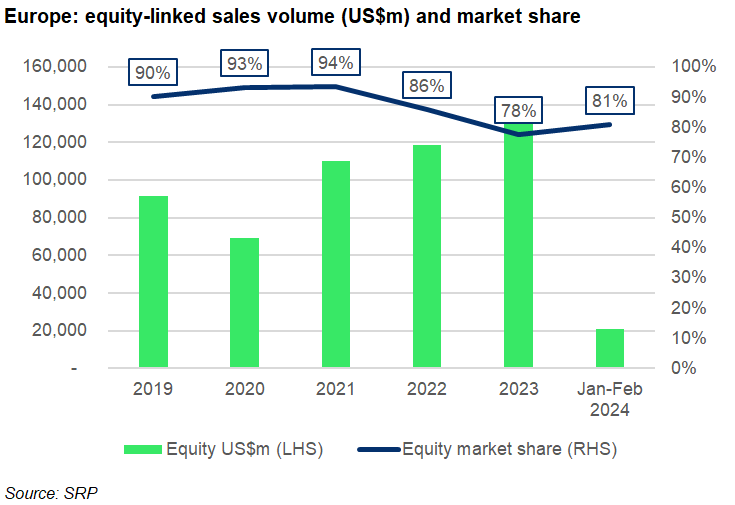

Despite losing some of its market share to rates-linked products, equities, as an asset class, continued to grow in terms of sales during 2023. The traded notional reached an estimated €143.8 billion in 2023, up 21% year-on-year (YoY), and up 57% since 2019, with an average growth rate of 16% pa. Meanwhile, the European market added 82%, with an average growth rate of 20.7% pa for the last four years.

Peaking at 94% of the total issuance in 2021, market share of equity-linked products shrunk by eight percent in each of the following years, reaching 78% of the overall offering in the end of 2023.

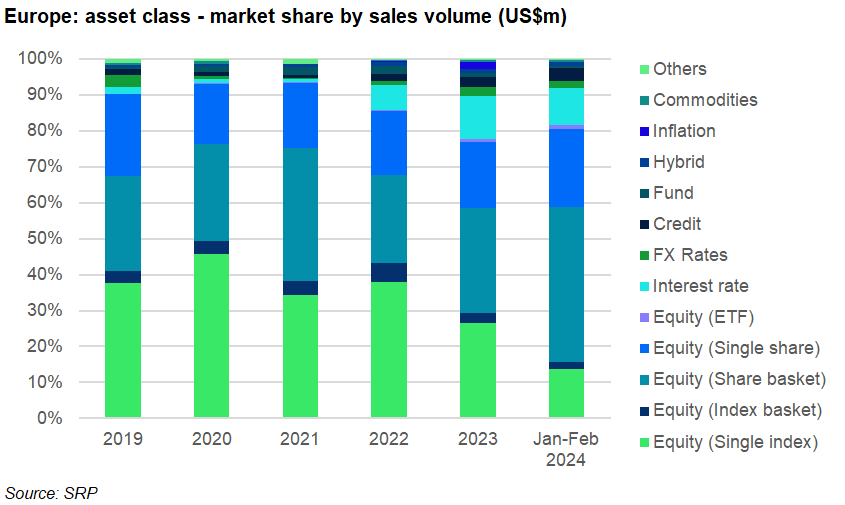

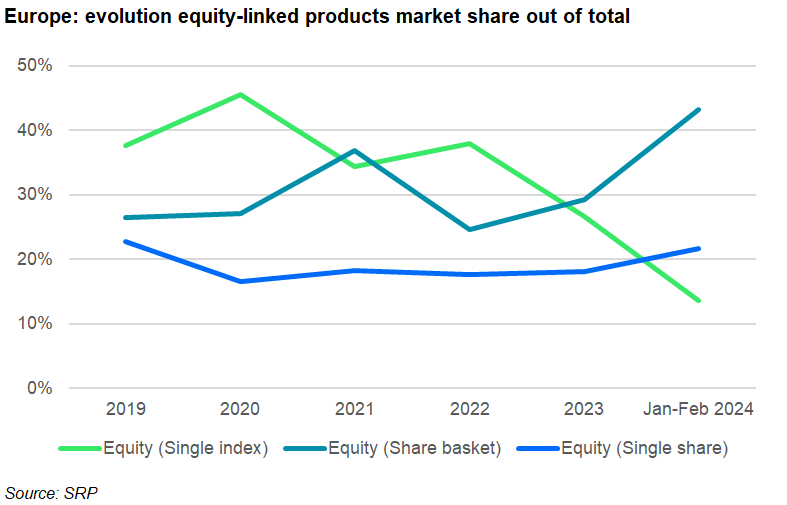

Our analysis further shows a decrease in the use of equity indices since 2023 and a shift towards stocks-linked products.

In a three-article series, we are going to review the developments within each multi-stock, single stock and index-linked products to provide more colour and focus on each sub-group.

As shown in the two charts above, products linked to baskets of stocks have grown in popularity, representing 30% of the notional in 2023, while single stock-linked products stayed flat and consistently accounted for just below 20% of the offer.

One reason for the change, are financial market’s current levels – arguably near peaks – which are waiting for the slightest opportunity to correct. This is why investors have been turning to stocks of quality rather than indices, which are less concentrated.

Another angle to look at the increased use of stock baskets could be supported by certain adoption of strategies for recycling volatility and correlation of stocks via dispersion trading based on a basket.

When it comes down to this type of correlation exposure, looking for ways to offset their risk banks have been looking for the right combination of issuing a structured product and doing risk recycling trade on something manageable.

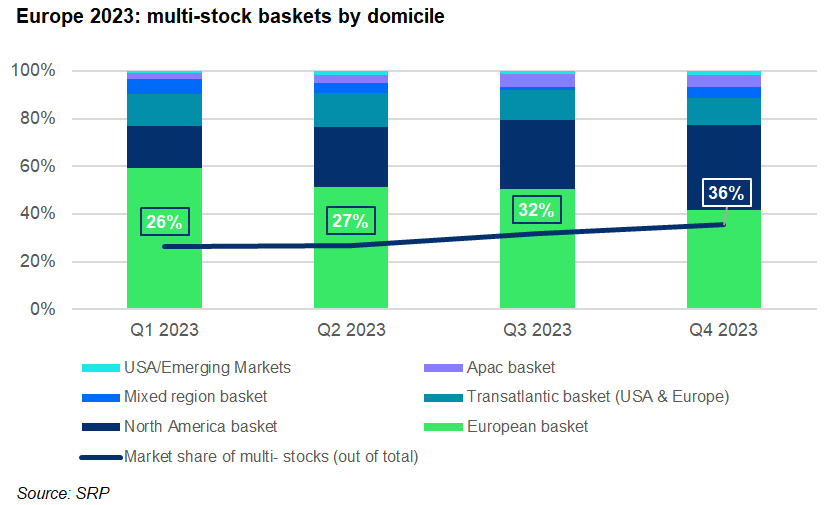

The chart above shows that the notional linked to stock baskets (worst-of or weighted baskets) grew by 60% YoY and ended 2023 at almost a third of the whole offer. Volumes in worst-of baskets increased by 58% while volumes for weighted baskets increased by 75% YoY.

By jurisdiction, 68% of the stock basket-linked products in 2023 were traded in Switzerland, of which 99% were worst-of baskets. Notably, the weight of the Swiss market in this segment has come down from the 73% share it represented in 2022. This is a sign that multi-stock underlyings have been increasingly adopted in Europe beyond Switzerland.

Italy, the second most important market for this type of underlying, accounted for 14% of the total multi-stock-linked notional. The €6.9 billion traded in worst-of structures was the result of 98% YoY growth and represents 20% of the Italian total new issuance volume in 2023.

Six percent of the multi-stock-linked notional in Europe 2023 was traded in France. The amount, equally distributed between worst-of and weighted baskets, grew by 34% YoY, and represents seven percent of the total new issuance volume in France for 2023.

Belgium (+275%), Poland (+10%), Germany (+28%) and Ireland (+106%) have also seen YoY increase, while Sweden (-7%) and Finland (-47%) experienced a negative growth related to this type of underlying.

In terms of domiciliation of the baskets, our analysis shows an increase in the exposure to North American stocks over the year. The most popular North American baskets have been based on the ‘magnificent seven group’, with the combination of Amazon and Apple representing 4.1% of the North America-based baskets used in Europe, followed by a basket of Nvidia and Tesla (2.1%) and Alphabet, Amazon, and Microsoft (two percent).

The most popular ‘Transatlantic’ baskets, which combine North American and European stocks, were a combination of Bayer, Intel, Walt Disney and ASML, Advanced Micro Devices, Nvidia.

The most popular basket overall remained the combination of Nestle, Novartis, Roche which collected US$737m, or 1.4% of the total notional collected from basket-linked products.

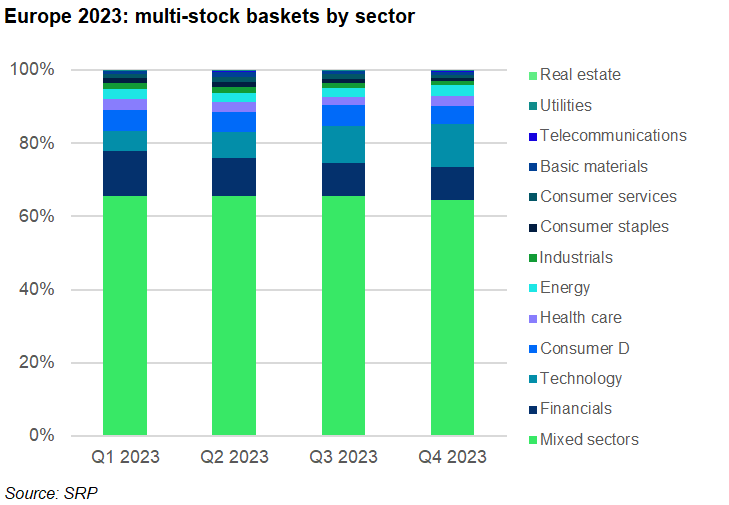

Looking at the thematic of the baskets, 65% of the estimated notional was contributed by baskets combining different sectors. Their market share was 84% in France, 62% in Switzerland and 57% in Italy. The group of mixed sector baskets was most heavily weighted towards technology stocks (featured in 17% of the notional), financials (15%) and healthcare stocks (10%).

Baskets of financial stocks account for 10% of the multi-stock universe. However, their market share slightly decreased in Q3 and Q4 with technology baskets (nine percent) the main beneficiary. Financial stock baskets were the most popular sectorial basket in Italy (19%) and the second one in Switzerland (10%), after technology baskets.

Consumer discretionary stocks baskets and baskets of healthcare stocks with five- and three percent market share respectively, were also popular, with energy stocks baskets catching up healthcare in Q4 2023.

Image: Ivan/Adobe Stock

Do you have a confidential story, tip, or comment you’d like to share? Write to info@derivia.com.