By estimated sales in 2023, autocallable yield enhancement products reached more than half of the market share in Asia Pacific.

This is a two-part series of Spotlight featuring Asia Pacific product trends in 2023. The first one on Asia Pacific equity underlying sector trends can be found here.

Yield enhancement structured products maintained robust growth in the Asia Pacific region (Apac), which comprises Hong Kong SAR, Japan, South Korea, Taiwan, and Thailand, in 2023. According to SRP data, these products' estimated sales volume rose 26% year-on-year (YoY)to US$147 billion.

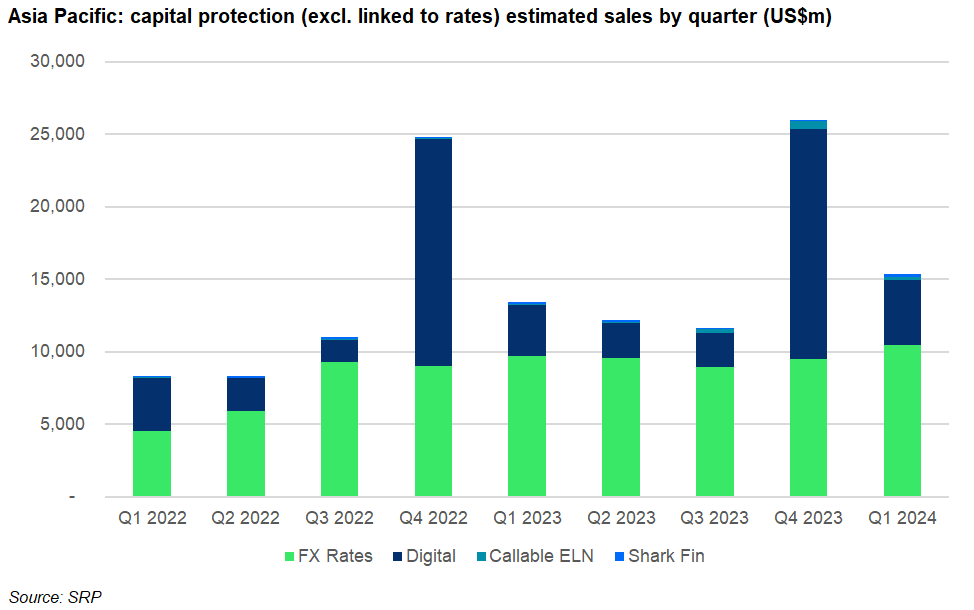

The growth in yield enhancement products surprisingly surpassed that in capital protection products, which tended to be favoured by the high-interest rate environment. The latter saw an estimated US$76 billion in sales last year, up 15% year over year.

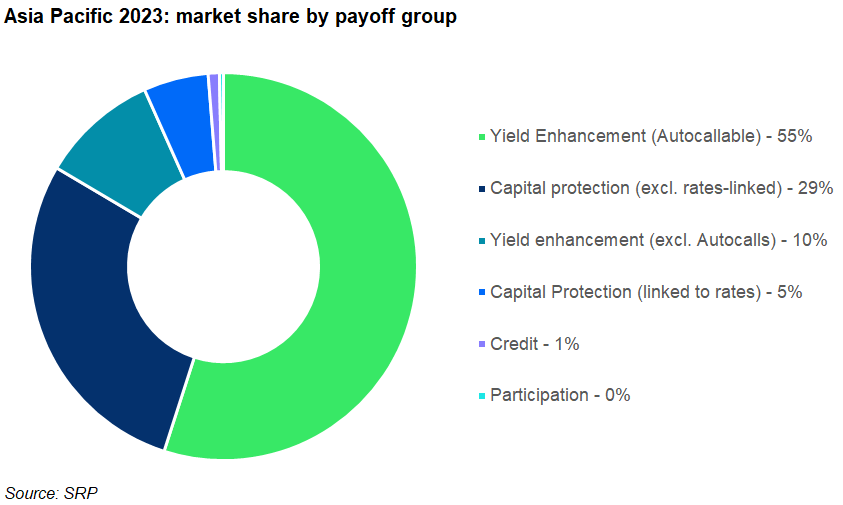

Among all structured product payoff types, autocallable-focused yield enhancement products made up around 55% of the Apac market share by estimated sales last year as the payoff type was well received by investors from South Korean and Taiwan markets.

Capital protection (excluding linked-to rates) products had 29% of the market share last year, followed by non-autocallable yield enhancement products at 10%, and capital protection (linked to rates) at five percent. Meanwhile, credit and participation products recorded some minor presence.

Autocallables led in Q1 2024

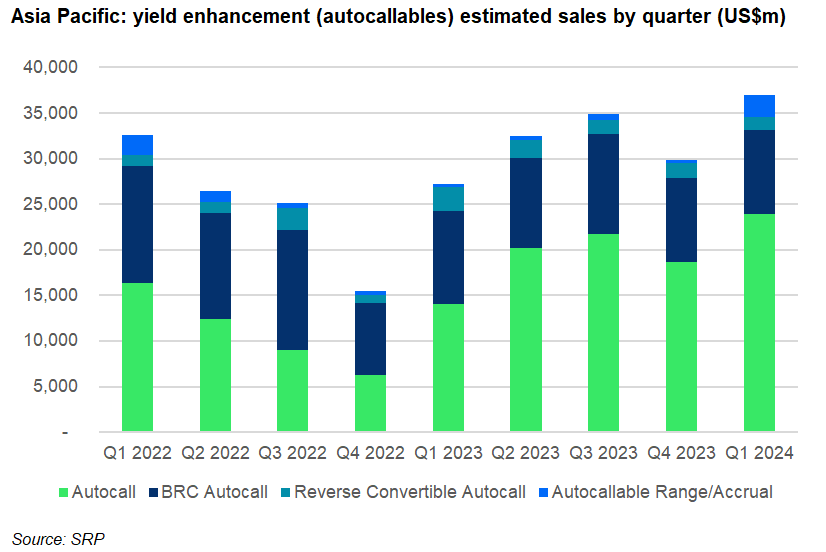

In the first quarter of 2024, the autocallables reached almost US$37 billion in estimated sales, up 35% from the prior year’s quarter.

Out of US37 billion in sales, around US$23.9 billion of which stemmed from the traditional autocall structure, followed by barrier reverse convertible autocall (US$9.2 billion), autocallable range accrual (US$2.4 billion) and convertible autocall (US$1.5 billion).

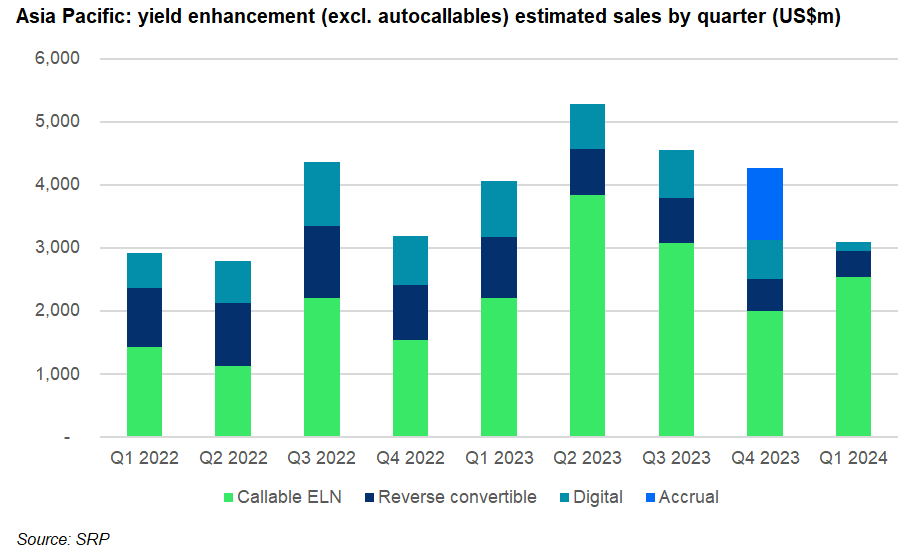

When excluding auocallables, callable equity-linked notes (ELN) were the most sold yield enhancement products in Q1 20224, with estimated sales edging up 15% YoY to US$2.5 billion in estimated sales.

However, sales in the reverse convertible-focused products shrank by 56% YoY to US$419m in the January through March quarter.

Digital is in focus among rate-linked capital protection products

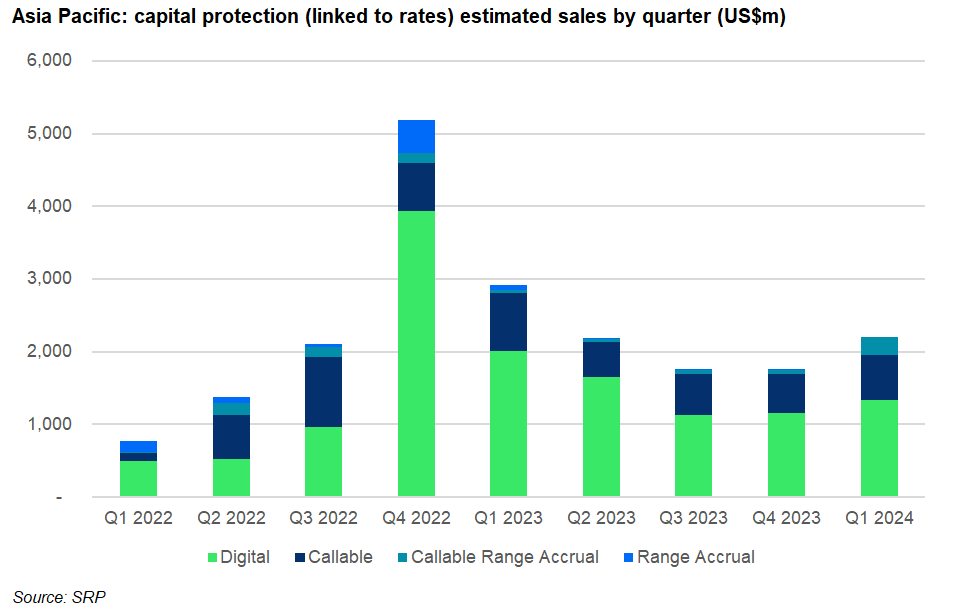

For rates-linked capital protection products, the digital payoff structure recorded the largest estimated sales amount in Q1 2024, US$1.34 billion. The latest figure saw a drop of one-third compared to Q1 2023, which gathered US2 billion in estimated sales.

Callable capital protection products’ estimated sales also headed south by 23% YoY to US$615m in the quarter ended 31 March.

For capital protection products excluding those linked to rates, FX rates-linked products remained popular, with estimated sales increasing seven percent YoY to US$10.4 billion in the first quarter of the year.

Meanwhile, digital-focused capital protection products, which saw the most volume flock in during the fourth quarter in the past two years, reached an estimated sales volume of US$4.5 billion in Q1 2024.

Image: Zhu Difeng/Adobe Stock

Do you have a confidential story, tip, or comment you’d like to share? Write to info@structuredretailproducts.com