Zeno Staub (pictured), chief executive officer, Vontobel, said the bank’s financial products were affected by the ‘general mood of caution among investors’ as well as the trend towards lower margin products, especially compared to the strong first half of 2018.

Vontobel has reported the volume of structured products and debt instruments outstanding (excluding leverage products) in the first half of 2019 increased by 30% to CHF10.3 billion (US$10.4 billion) compared to the end of 2018. The rise was due to money market products that were issued in larger volumes for the first time during this half-year period, according to the bank.

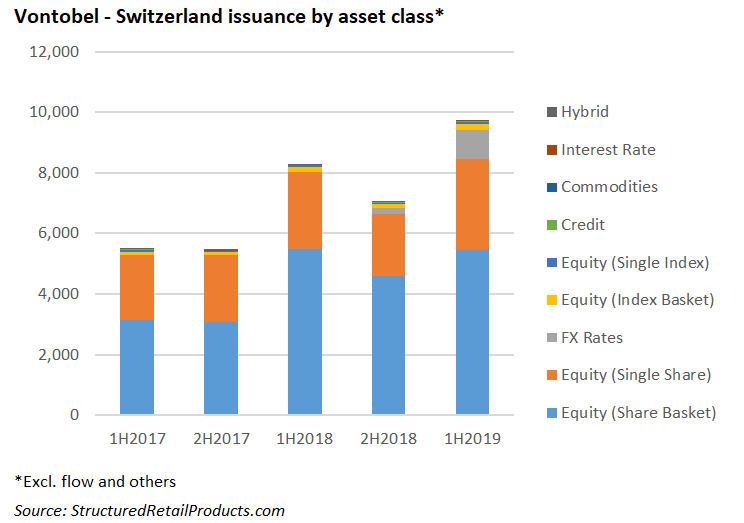

The bank issued 9,702 structured products in its domestic market Switzerland between January 1 and June 30 2019, up 33% from the 7,037 products issued the previous semester and a 17% increase from the 8,270 products issued in the same period last year, according to SRP data. The vast majority of Swiss products were linked to a basket of shares (5,457), followed by almost 3,000 products linked to a single stock, 950 linked to FX rates and 200 tied to a basket of indices.

In its home market, the Vontobel deritrade platform enabled more than 75 banks and more than 550 asset managers to independently compare, create, purchase and manage structured products from different issuers for their clients. In the period under review, a total of CHF4.1 billion of products was purchased on the platform – an increase of 28% compared to the first half of 2018, despite a decline in stock market volumes.

In Germany, Vontobel launched more than 25,000 flow products, predominately (capped) bonus and discount certificates, while a further 12,500 leverage products were admitted to trading on the exchanges of Frankfurt and Stuttgart.

Vontobel registered a market share for investment and leverage products of over 11.5% in Europe and 29% in Switzerland, measured in terms of exchange-traded volumes in the target segment.

In January 2019, the bank debuted a range of leverage products in the Danish market and in Hong Kong – the world’s largest derivatives market – it achieved a market share of 1.3% in 1H2019 from 441 structured warrants.

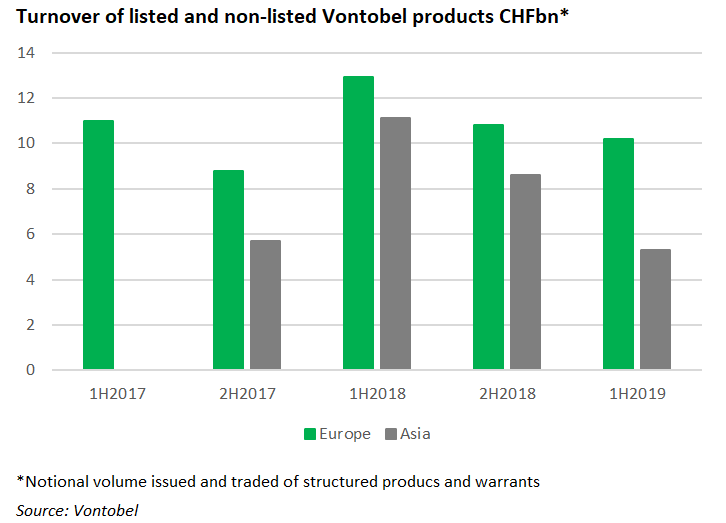

In the first half of 2019, clients around the world traded a total of CHF15.5 billion of Vontobel products, of which CHF10.2 billion was traded in Europe, down 20% year-on-year, in line with the market (1H2018: CHF12.9 billion). Turnover of listed and non-listed structured products and warrants in Asia stood at CHF5.3billion, down from CHF11.1 billion in the same period in 2018, due to overall market development as well the bank’s increased focus on its margin after establishing a present in the market in 2018.

In the first half of 2019, Vontobel Investment Banking introduced an ESG label for structured products that designates sustainable underlyings that have been evaluated according to environmental, social and governance (ESG) criteria. Vontobel Asset Management has been investing sustainably in accordance with ESG criteria since the 1990s. At the end of June 2019, a total of CHF28 billion of Vontobel client assets was already invested in ESG strategies.

The two percent decline in trading income – which mainly comprises income from the issuing, hedging and market making of structured products and warrants – to CHF162.4m was attributed by the bank to the ‘weak market environment for structured products and derivatives’.

In an environment characterised by continued low transaction volumes, Vontobel achieved good profitability in the first half of 2019, with a cost/income ratio of 75.8%. The return on equity was 14.3% (15.1%). The bank has set itself the target of generating a cost/income ratio of less than 72% and a return on equity of more than 14% by 2020.

Click the link to view the full Vontobel half-year report 2019 and the presentation.