SRP reviews the data and third quarter 2019 financial results of SEB and Swedbank, who confirmed their status as the main Swedish providers in a market increasingly infiltrated by foreign issuers.

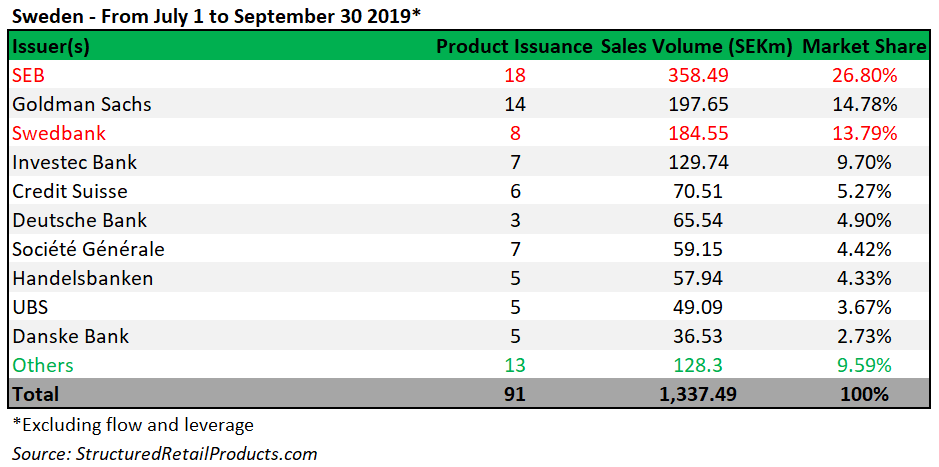

Ninety-one structured products worth SEK1.3 billion (US$138.6m) had strike dates in Sweden during the third quarter of 2019 (3Q2018: SEK2.4 billion from 120 products).

Seven out of the top 10 issuers in 3Q2019 were foreign investment banks, including Goldman Sachs, Investec, Credit Suisse, Deutsche Bank and Société Générale, with, apart from SEB and Swedbank, Handelsbanken the only other Swedish issuer.

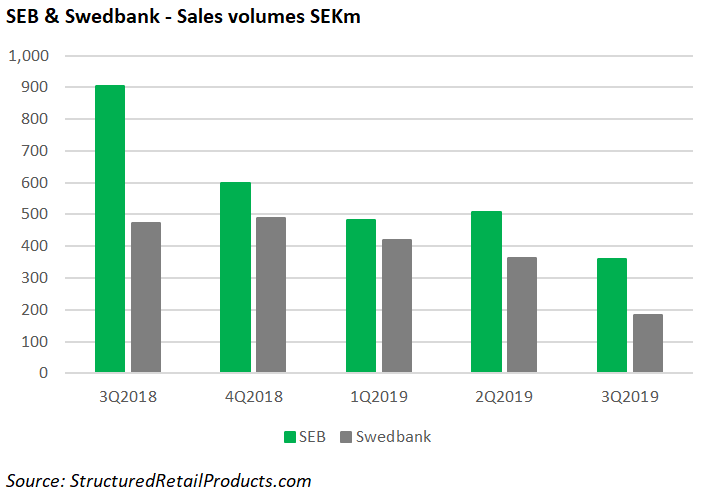

SEB dominated the structured products market in Sweden in 3Q2019 with a market share of 26.8%, despite a 60% drop in sales compared to the same quarter last year, according to SRP data. The bank sold 18 products worth SEK358m during the quarter (3Q2018: SEK902m from 26 products), which were distributed via Strukturinvest (eight products), Garantum (nine), and Consensus Asset Management (one), respectively.

The bulk of the volume was collected via seven credit-linked notes (CLNs) which sold SEK255m.

SEB reported an operating profit of SEK5.8 billion in 3Q2019, an improvement of five percent compared to the third quarter of 2018. The effect from structured bonds offered to the public for the third quarter was approximately SEK215m (2Q19: SEK220m) in equity-related derivatives and a corresponding effect in debt related derivatives of SEK65m (2Q19: -SEK10m).

Short-term funding, in the form of commercial paper and certificates of deposit, increased by SEK200 billion since year-end 2018, mainly due to the fulfilment of regulatory requirements on liquidity coverage in key currencies, according to the bank.

SEK98 billion of long-term funding matured during the first nine months of 2019 (of which SEK52 billion covered bonds and SEK46 billion senior debt). New issuance since year-end amounted to SEK 86 billion (of which SEK65 billion was covered bonds and SEK22 billion senior preferred debt).

‘Despite a seasonal slowdown and a softening macroeconomic environment, clients remained active in the third quarter,’ said Johan Torgeby (pictured), President and CEO, commenting on the bank’s results. ‘Our diversified business model remains favourable and the operating profit increased by five percent compared with last year while return on equity reached 13.2%.’

Swedbank had a 13.8% share of the Swedish market in the third quarter of 2019. The bank sold eight structured products worth SEK185m to retail investors during the period, a 61% decrease in sales volumes compared to the SEK472m (from 27 products) that was collected in the third quarter of 2018.

Six of the structures, which were distributed via the bank’s own branch network, were linked to a single index, including three products tied to the Solactive Sustainable Development Goals World Index – a reference for the performance of global companies identified as making a significant contribution to the United Nations’ Sustainable Development Goals.

Swedbank signed the UN Principles for Sustainable Banking during the quarter and posted an operating profit of SEK5.8 billion, down two percent from the previous quarter.

As of September 30 2019, the outstanding volume for structured retail bonds stood at SEK9.7 billion, a nine percent decrease from end-December (SEK10.7 billion) and down 20% compared to September last year (SEK12.2 billion). Total debt securities in issue at end-September stood at SEK951.8 billion, up 14% from December 31 (SEK838.5 billion) and level from September last year (SEK955.9 billion).

Long-term debt issuance amounted to SEK18 billion with the total issuance in the first nine months amounting to SEK120 billion. The bank said it expects the total issuance volume for the full-year 2019 to be ‘slightly higher’ compared with 2018. As of September 30, outstanding short-term funding, commercial paper, included in debt securities in issue amounted to SEK 164bn (SEK 185bn as of 30 June).

Click the link to view the third quarter 2019 results for SEB and Swedbank.