We are excited to announce improvements to the SRP website and data model, which will deliver a faster and more enhanced analysis experience for website users.

The changes are demonstrated in a video and detailed throughout this article. For a comprehensive view of SRP’s data model, download our data model guide.

Summary of updates

- Faster search capabilities with instant results

- Interactive product card with more product attributes

- Product model changes – more product properties, new payoff structure and new naming convention for some existing values

- Revised search page and revised filters: filter for ESG product, more granular details for underlying – e.g. Underlying provider

- Revised analysis & reports

- Standard report with individual component view – some standard reports will be accompanied with individual component views allowing more granular analysis

- New two-layer report for the payoff type report that uses payoff style features to narrow down results

- New product term report

- Professional Investor and Non-public market

- Professional Investor category with products from the non-retail sector by merging private banking, offshore and institutional products

- Non-public market for products for which the market is unknown

1. Faster search

The technology behind the SRP database has been upgraded to allow for a much faster search and overall website experience.

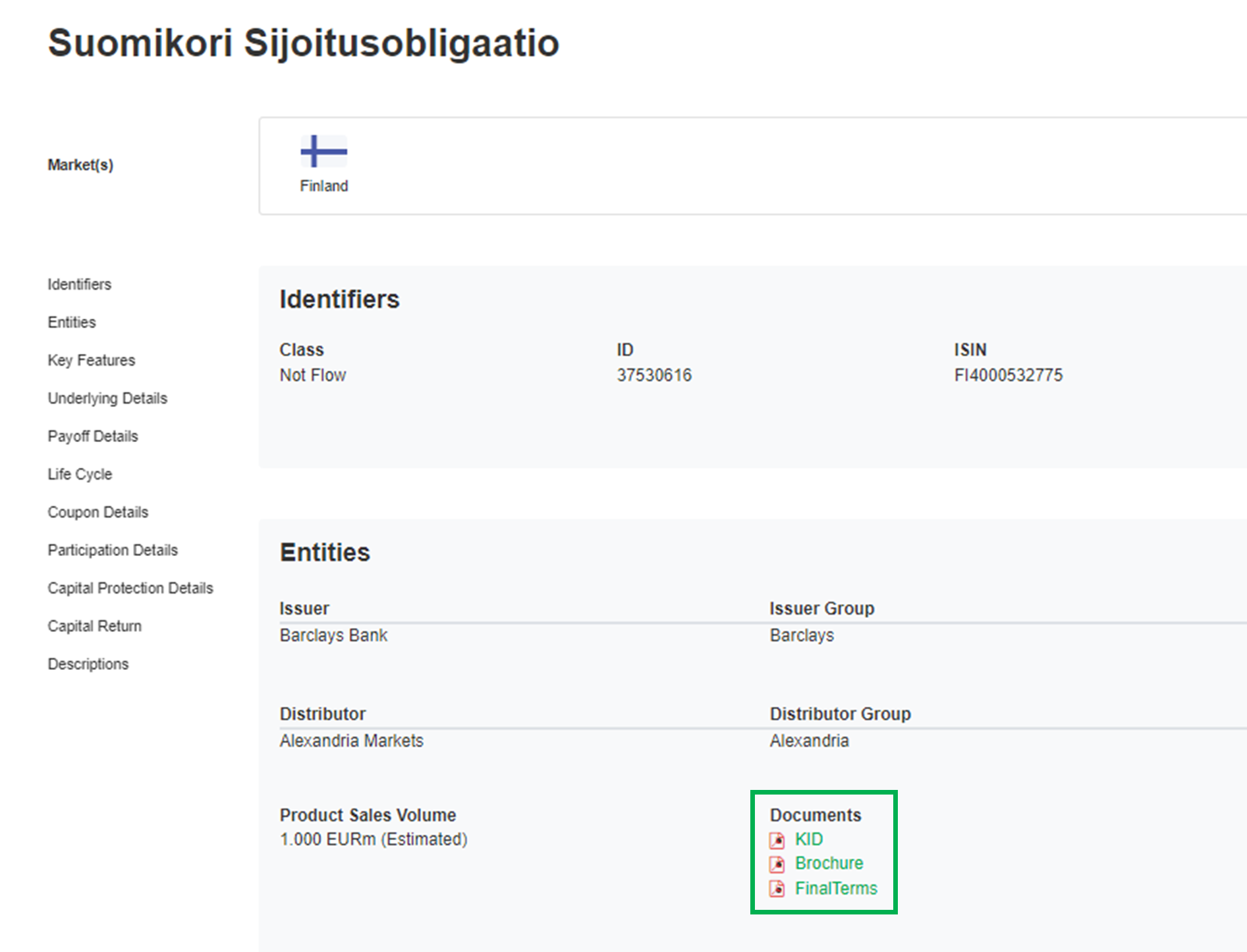

2. Product card: new design and more sub-properties

The product card has been redesigned and now includes a navigation bar. The new product card includes more granular product properties.

Example: Underlying Details

Example: Asian Option

3. Product model changes - Properties and values

3.1. More attributes describing the underlying

New product properties added: underlying provider, underlying instrument, underlying instrument group.

3.2. More properties for coupons (including observation frequency)

The new data model distinguishes between fixed, digital and range coupons, whereas they were previously recognised as income type with values fixed, variable or mixed coupon. The new website also provides data for the observation frequency.

Current view

New view

3.3. More properties for participations & asian options

The new model specifies the participation strike, with indication of the participation cap, if applicable.

The model also indicates the respective dates if any averaging is applied when calculating the initial fixing or final underlying level (asian option).

Current view

New view

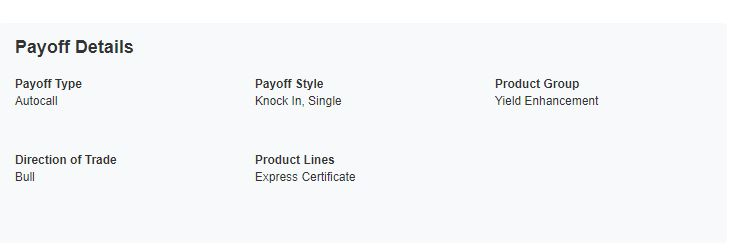

3.4. New payoff structure

Revised terminology and values for payoffs added: payoff type, payoff style, direction of trade, product group.

Example: as payoff “knock out, reverse convertible” is now referred to as payoff type “autocall” with additional values for payoff style, product group and direction of trade.

Current view

New view

3.5. Merged investment type (flow, leverage) into one class (flow)

Category flow products and all those products are now called 'flow'. They can be filtered by 'flow' and 'not flow'.

Both the new product search page and the new analysis page show not flow products by default. In order to visualise the full market, ‘flow products’ needs to be added to the selection.

Current view

New view

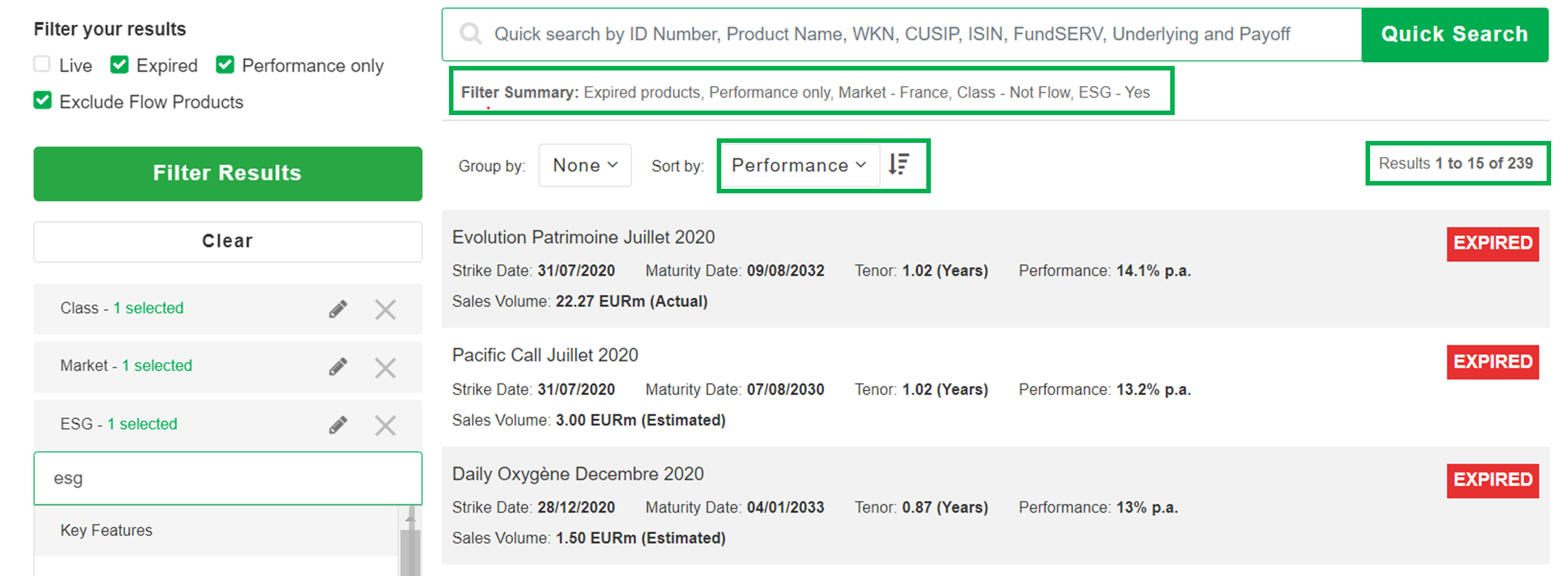

3.6. Embedded ESG flag

ESG products are now searchable via our new product search page.

The example below shows the result for expired ESG products in France with capital return sorted by performance.

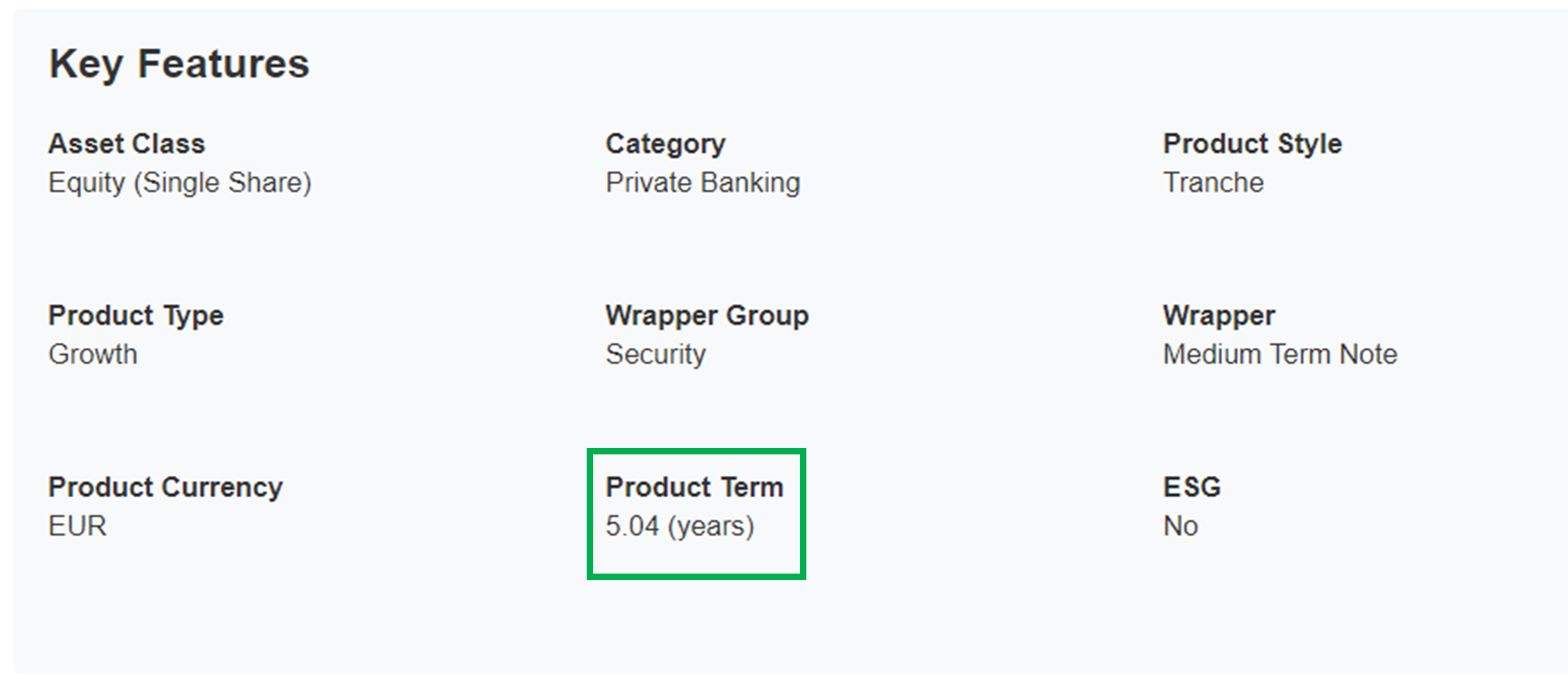

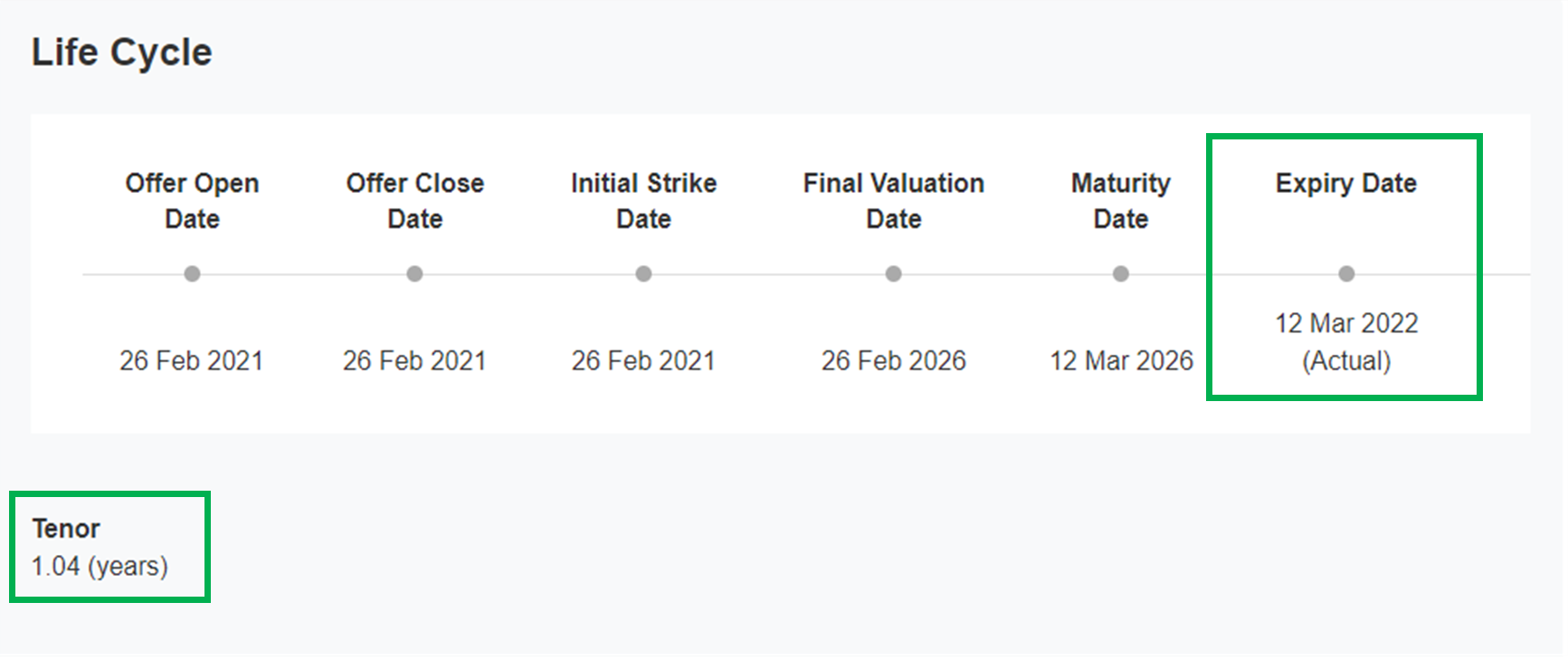

3.7. Product term

The new model features both contractual and actual maturity of the products. The former is referred to as ‘product term’ whereas the latter is referred to as ‘tenor’.

3.8. Naming conventions

Product document names, previously called PDF brochures, are translated from local language to English.

4. Revised search page

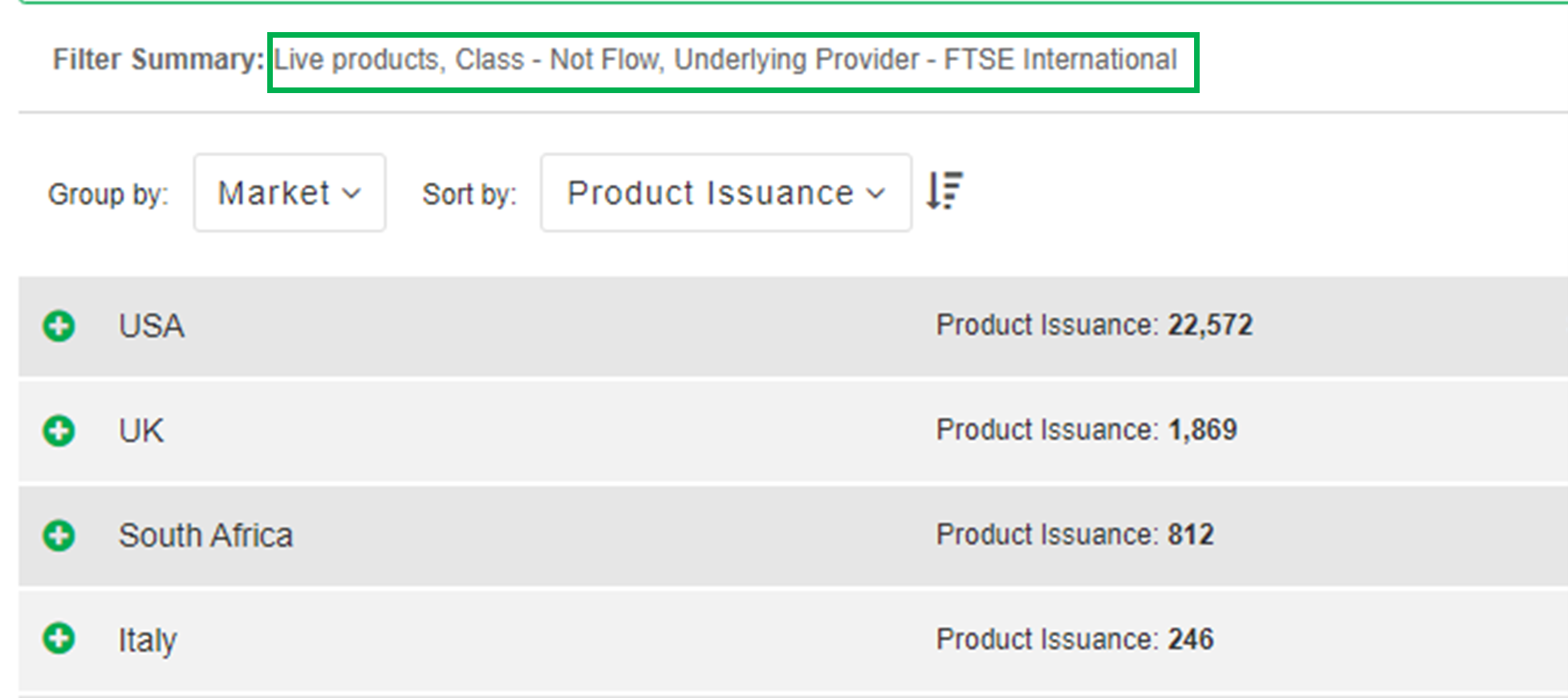

Product search has been updated to return faster results with additional properties.

The example below shows the result for the new property, FTSE International as the as the underlying provider, live products, not flow, in Europe, grouped by market.

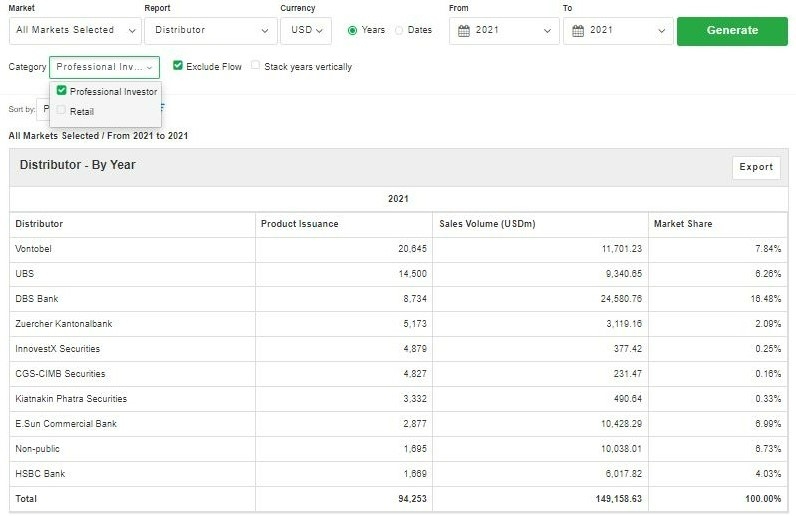

5. Enhanced analysis

The reports section now provides more valuable data. Its default view now includes core (not flow) products.

Payoff type report with additional filter by payoff style

This report aims to simplify the core payoff types, while transferring payoff features into a newly created category, ‘payoff style’. An additional filter is embedded in payoff types, allowing filtering by payoff styles which offers a more detailed overview of each selected payoff type.

5.1. Example: step 1

France, 2021: 23% of all products in France with coupon and payoff type ‘autocall, barrier reverse convertible’ raised EUR6 billion (23% of the market). No additional filtering is used here.

5.2. Example: step 2

When the payoff style filter is applied, more granular analysis can be achieved.

In the example below ‘snowball’ filter is selected. The result can be interpreted as products with payoff type ‘autocall, barrier reverse convertible’ and payoff style ‘snowball’ raised EUR2.4 billion, representing 9.29% of the total sales volume in 2021 in France.

All products in France in 2021 with the payoff style ‘snowball’ raised in total EUR2.5 billion, representing a market share of 9.6%.

5.3 Standard report & individual component view

Standard report is the traditional report providing data for each unique combination of components.

For example, the ‘underlying’ report shows products linked to the single underlying - Eurostoxx 50 (two products raised the total of EUR13.69m) or to multi underlyings - Eurostoxx 50 and S&P 500 (three products linked to a basket comprising of Eurostoxx 50 and S&P 500 raised the total of EUR2.4m).

Individual component view is a second layer analysis providing results per component, included in the standard report, which can occur in various combinations or as a standalone.

Below example of the underlying component view shows the total number of products linked to the Eurostoxx 50 index as single component and as combination with other underlyings. In total, 10 products are linked to the Eurostoxx 50 index, either as a single index or as part of a multi-underlying basket with a total sales volume of EUR 22.94m.

Individual component view is available for the following reports:

- Asset class report

- Payoff type report

- Underlying report

- Underlying Sector report

- Wrapper report

- Wrapper group report

5.4. Product term reports vs tenor reports

The new product term report, when accompanied with the old tenor report, provides life-cycle sensitive analysis of market development. The first of the below reports shows the breakdown of product maturities, as stated in their term sheets, while the second report shows the actual realised investment terms. As per the example, a large number of the products with initial longer maturities have expired at their first or second anniversary.

6. Professional Investor and Non-public market

6.1. Professional Investor

Professional Investor is a new category filter for accessing data for private banking, institutional and offshore products.

6.2. Non-public market

If no information is available about the offer jurisdiction of a product, this product will be added to the newly created ‘non-public’ database. Its default currency is USD.

We hope you find these new features to be useful. If you have any questions, check our data model guide for further details or feel free to contact us.