There is little doubt that fixed indexed annuities (FIAs) provide a risk-return function that investors want – they limit losses and have the ability to shape potential returns. But since interest rates have decreased, indexed annuities linked to risk control indices have become increasingly popular.

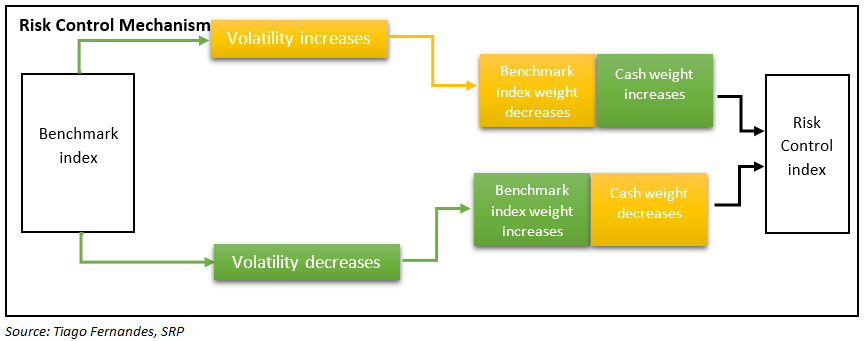

Risk control indices use a dynamic asset allocation strategy based on the index and cash, where they preselect a volatility target. Whenever volatility of the index is above the target, the risk control index disinvests from the index and invests in cash instead.

The reason for their success is linked to the very reason they exist: in bear markets, where volatility is high, the risk control index is not exposed to equity markets, so it outperforms the benchmark. In a sideways market, however, volatility changes rapidly, so it will underperform, as it will have lower participation when markets recover.

The sideways market is the reason why risk control indices have been underperforming their benchmark in the past year. With the ongoing Sino-US trade war, Brexit and so many other unpredictable events, markets have been suffering rapid falls followed by recovery periods.

The truth is that the US retail investor has not saved enough to meet their retirement needs. The only way to achieve required savings levels is for them to find a better-paid job or increase the return on their savings: the second option is, at least in theory, the easier one. This means that FIAs can be part of the solution to the retirement saving problem as they can offer a better risk and reward investment profile.

Bearing in mind the risks of these risk control indices, the only way to increase realised return and keep capital protection is to look for the alpha. This is where smart beta indices enter the equation.

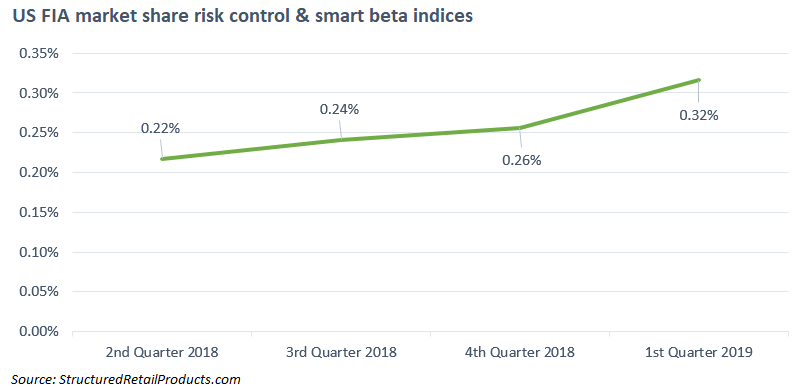

The data presented in the chart above shows that the market share of FIAs linked to risk control and smart beta indices has been growing in the past 12 months. The market share of these strategies has increased at a steady pace during the period, starting at 0.22% in March 2018 and ending at 0.32% in the first reading for 2019. The graph shows a clear upwards trend, which means that the share of strategies linked to risk control and smart beta indices would likely continue growing in the near future.

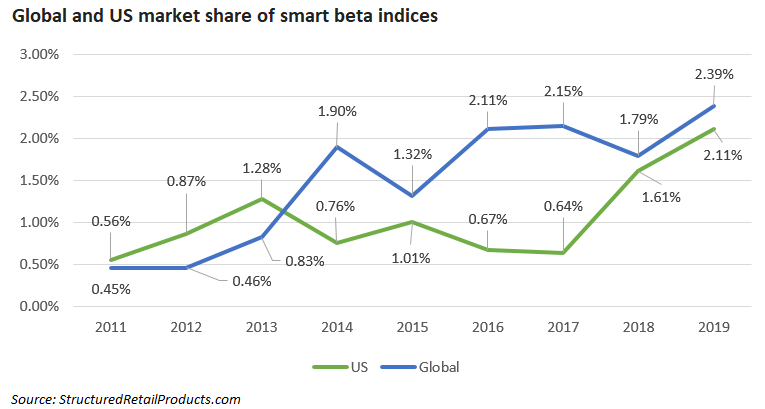

The chart above compares the respective global and US market shares of investment strategies linked to smart beta indices since 2011. Both lines show an upwards trends with significant volatility and highest peaks in 2019. The growth is likely to continue according to the trend. The market share on a global level has grown by more than 530% for the period (from 0.45% in 2011 to 2.39% in 2019), and the market share on a US level has grown by nearly 380% (from 0.56% in 2011 to 2.11% in 2019).

Smart beta strategies seek to enhance returns, improve diversification, and reduce risk by investing in economic factors. Their aim is to provide investors with exposure to market inefficiencies to improve returns.

Looking at the global and US structured product markets, there has been an increase in the market share of these indices as a solution to a low interest rate environment. Ultimately, investors cannot afford simply invest in the S&P 500, bonds and wait for better days. Their retirement certainly cannot.