When it comes to investing, most people who want to make money avoid taking too much risk. In response to this, economist Harry Markowitz developed the modern portfolio theory (MPT).

Introduced in 1952, MPT explains how risk-averse investors can construct portfolios to maximise expected returns depending on the level of risk, emphasising the following paradigm: the higher the risk, the higher the return. This theory has one important conclusion: investors can increase their Sharpe ratio using correlation between different asset classes. In other words, investing in different kinds of assets is less risky than owning only one type.

This theory, however, was formed before structured products existed.

Correlation, which is a statistic that measures how a pair of asset prices perform in relation to each other, is used in passive portfolio strategies. In practice, it is illustrated by a number, whose value should fall between -1 and +1.

One of the key reasons academic research has not considered structured products within the MPT is down to two issues: 1) structured products are tailor-made instruments, so there is a lack of information about historical performance as an asset class; 2) because of their different payoff profiles, structured products do not follow a standard distribution pattern.

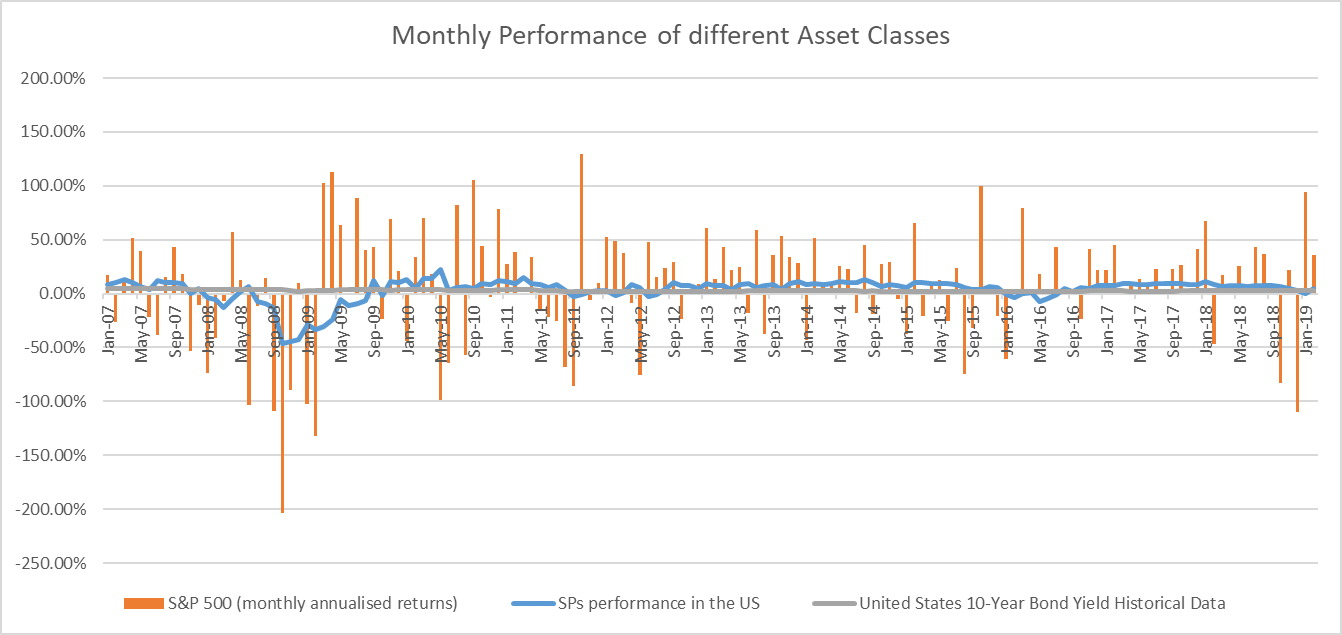

Source: www.StructuredRetailProducts.com, Ycharts and NYU

To understand how structured products can impact MPT, we looked back at our own performance data for the US market, between January 2007 and February 2019. Albeit not a perfect match for performance of the asset class due to the different terms of individual products, by using the average monthly return on structured products (weighted by the volume of each product) we found that, historically, the return distribution of structured products does not vary from other asset classes, such as equity. As shown on the monthly performance chart, this allowed us to continue with our research into how structured products fit in a passive portfolio.

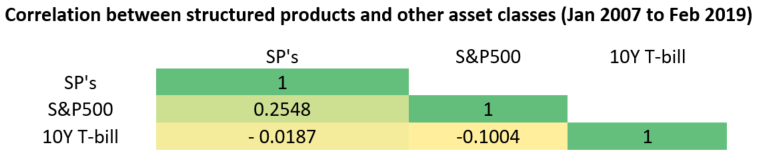

When looking at the correlation of structured products with other asset classes, we reached two conclusions:

- Compared to fixed income (in this particular case, 10-year US Treasury bills), there is a negative (but almost no) correlation between these two asset classes. Although structured products have a fixed income component, their behaviour is much closer to that of equity markets.

- Compared to equity (in this particular case, the S&P 500 index), the performance of structured products is positively correlated, but only on 25%. This means that although they move in the same direction as equity markets, structured products performance is not strongly correlated with them.

Therefore, as an asset class, structured products provide a higher level of diversification due to their different payoff profiles. As most structured products sold in the US market are yield enhancement products, where investors obtain a higher return as long markets are stable or bullish, this means that their usage can provide more diversification even in a passive portfolio.

Source: www.StructuredRetailProducts.com, Ycharts and NYU

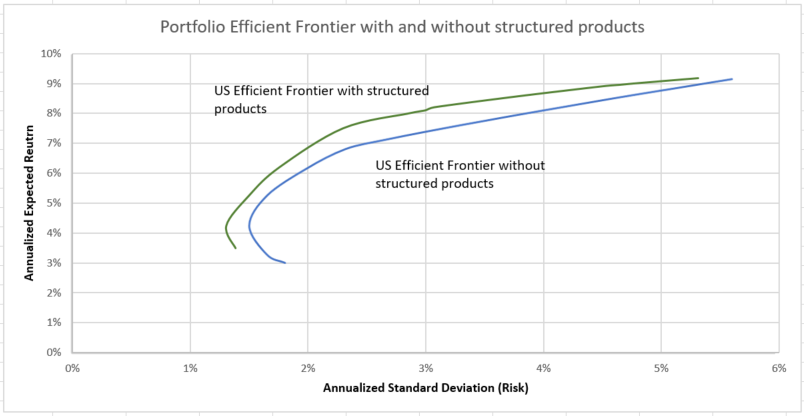

As MPT is used to determine optimal portfolios that offer the highest expected return for a predefined level of risk, we compared an efficient frontier, using historical data between 2007 and 2019, that could invest in equity (10 different assets), fixed income (six different assets), others (two different assets) and structured products (one asset class).

We then created two different scenarios: one without structured products (17 assets) and another with structured products (18 assets). Looking to both efficient frontiers, we found structured products improves the sharpe ratio for US investors.

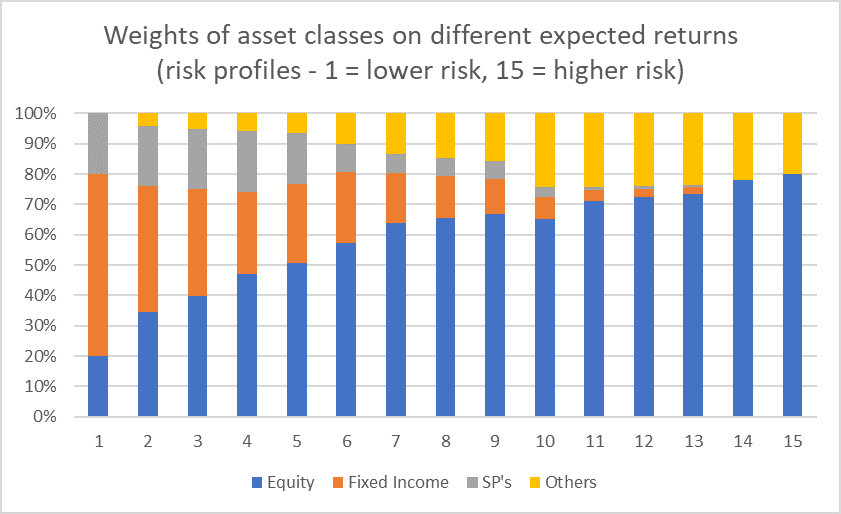

Source: Tiago Fernandes

To demonstrate the practical implications of structured products in a portfolio, we simulated a series of different risk profiles, from risk averse (minimising the risk that investors are willing to take) to appetite for risk. Using the historical performances of the different assets classes, we concluded that risk-averse investors are the ones who should be using structured products as an asset class. Although we are including different types of structured products, applying the MPT tells us that a risk-averse investor should have 20% of their portfolio invested in structured products.

This percentage starts to decrease when investors want to outperform the equity market, in which case structured products are replaced by other asset classes such as commodities. Overall, to maximise the return per unit of risk, investors should allocate between 15% and 20% of their portfolio to structured products.

Source: Tiago Fernandes

This analysis encompassed all types of structured products. We believe that if we had included different asset classes of structured products depending on their payoff profile, the conclusion would likely be the same: structured products are an important tool for US investors.