The US structured product market has grown very strongly over the last few years. Sales volumes, number of products and the universe of active market participants have all increased significantly.

Despite the fondness of the typical American investor for direct equity, index or ETF investment structured products continue to gain traction. Their properties of risk control and targeted returns are being appreciated by a wider pool of brokers and advisors and in turn their investor base.

The first reason for this is undoubtedly the market volatility that has been seen since the start of 2020. In March of that year there was a big market sell-off due to the fears caused by the first part of the Covid pandemic and there have been significant shocks ever since. During 2022 sentiment has been dominated by market fears due to the Russian invasion of Ukraine so that ideas of portfolio protection remain uppermost in many investor’s minds.

US structured product market professionals rely on technology platforms to help them execute business - Tim Mortimer, FVC

While the use of platforms and robo-advisers continues to grow and evolve, the human approach is appreciated by many investors and successful firms continue to use best of breed solutions, involving the advisor looking after the investor while placing business in a low-cost, convenient and compliant way whenever possible.

Structured products fit well into that environment because their features provide clear risk reduction for nervous clients. In addition, it is easy for an advisor to explain the market scenarios that will provide good returns and so the investor can decide if that aligns with their views of future market developments. Therefore, structured products can play an important role in any portfolio alongside more traditional investments.

Importantly, structured products work in many more environments than bull markets that direct equity investors essentially rely on and fit a wider range of investor use cases. These include long-term saving, generating high income at known risk levels and achieving attractive returns even in sideways or range bound markets.

US structured product market professionals rely on technology platforms to help them execute business but also to receive comprehensive data to keep abreast of the market both in terms of the thousands of individual CUSIPs and to measure current and future trends.

Increased insights

SRP has been at the forefront of data delivery for many years for US structured products serving the market with timely information of thousands of new product Cusips every year, supported with news and market commentary.

SRP and FVC are now bringing a new service branded StructrPro to market which will be launched fully by the end of April 2022 in the US.

Data now available from this new service highlights the successes of maturing structured products.

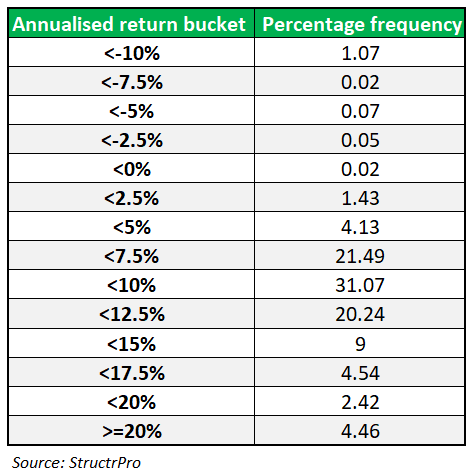

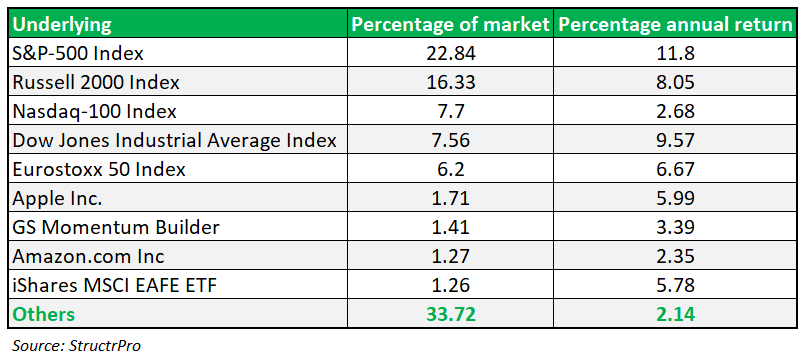

This survey represents over 12,000 individual US structured product Cusips maturing in the last five years. Despite the fact that markets have been extremely volatile and uncertain in recent years performance has been strong and consistent.

Only a tiny proportion of these products have lost money for investors and over 40% have posted gains in excess of 10% pa. These are the sort of returns on the upside that you would expect from direct equity investment in a bull market yet the fact that only a handful of products have suffered losses shows the strength of the capital protection features that are common in the structured product market.

One of the features of StructrPro is the ability to combine live and matured products to create portfolios and track real-world performances.

Image: AdobeStock.