Structurers and traders at investment banks involved in structured products are constantly assessing pricing and risk management as part of the issuance program they are involved in.

In order to determine which product types, look attractive and the terms that can be achieved the main focus is on the levels of interest rates and volatility as these are the primary drivers of price and risk.

In the last year, CBOE/S&P have developed and brought out two major additions to the VIX family - Tim Mortimer, FVC

Interest rates influence everything about the market and wider economy and their journey over the last couple of years has fundamentally affected every asset class from bonds, equities and structured products.

Volatility is also something talked about in the wider market and can affect confidence and how much money is invested at different times, with high volatility a signal to many investors to stay on the sidelines. Each underlying has its own volatility picture with levels, term structure, skew and smile effects that precisely define how options are priced. Traders follow every underlying on their book in detail, but others prefer a high-level aggregate overview.

It was to provide this market service and subsequent liquidity that the VIX index was created. Making its debut in 1993 brought by the Chicago Board of Exchange (CBOE) and now maintained in conjunction with S&P DJ Indices. It uses liquid exchange traded options on the S&P-500 at (or nearest to) 30-day maturity to calculate a precise value for implied volatility. Over the years the VIX has become an important barometer of market activity. It is sometimes known as the “fear index” since high levels of the VIX demonstrate high market volatility and with the expectation of possible large future moves, with the fear that they could be on the downside. It has established itself as the single most followed indicator of market implied volatility.

With the success that the original VIX established for the S&P-500, similar versions have been created over the years for many other equity indices such as the Nasdaq 100 and Eurostoxx 50.

In the last year, CBOE/S&P have developed and brought out two major additions to the VIX family. The first is the CBOE S&P 500 Dispersion Index. This measures the difference between option volatilities of the stocks in the S&P 500 and volatility of the index itself.

For each stock in the S&P-500 its individual 90-day volatility is calculated with the same methodology as is used by the VIX itself by monitoring traded options. The weighted average of the square of these implied volatilities is then calculated, using the weighting of each stock in the S&P-500. From this the square of the actual VIX level is deducted and the square root is taken. This calculation is then defined as the Dispersion index.

This calculation seems complicated and relies on the precise algorithm to calculate implied volatility based on a set of call and put prices using quantitative techniques developed by well-known academics Emanuel Derman and Bruno Dupire in the 1990s.

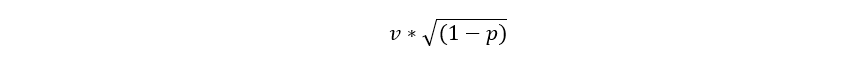

It can be shown that for an index made up of stocks with roughly equal weighting, volatility and constant pairwise correlation the value of the dispersion index should be approximately equal to

Where v is the stock volatility and p is the correlation between the stocks.

Therefore, the dispersion index value increases when volatility increases and when correlation decreases.

The dispersion index concept has no doubt been inspired by “dispersion options” which have been used for many years to get exposure to the correlation between an index or basket and the constituent stocks. The dispersion index therefore gives a measure of volatility and correlation of the stocks within the S&P-500. Correlation is something which is hard to hedge, and the dispersion gives a way to try to do this, although the relationship between correlation and dispersion is subtle, and high correlation implies low dispersion and vice versa.

The highest level of the dispersion index recorded so far is 59% on 18 March 2020 which was during the initial market turmoil caused by the pandemic. The value at the time of writing is around 25%. The dispersion index is defined to never go below zero and on one occasion in February 2018 the calculation broke down caused by a 10% fall in the S&P 500 and the jump in volatility skew. This highlights a weakness in the methodology that can occur in extreme circumstances.

Because of the technical nature of the dispersion index definition, it will be useful as a measure of stock variation within the S&P 500 but it remains to be seen whether much liquidity can be created in any hedging vehicles such as ETFs which would allow this concept to be actually used to manage correlation and volatility risk.

The second innovation brought to market recently is called the Credit VIX. This measures volatility of different tranches of the two main credit indices iTraxx and CDX created and maintained by HIS Markit, now part of the S&P Global group.

This index is calculated by assessing swaptions on credit default swaps and performing a similar theoretical calculation to the VIX to derive a volatility value. CDS and credit indices have been around for decades and have been very important since the Lehman crisis as a barometer of credit risk. The volatility measure quantifies the market expectation of the magnitude of likely CDS moves from the swaption information. Such swaptions are less liquid than S&P 500 options so only time will tell how robust and meaningful the credit indices will be.

These two new volatility indices are interesting developments for traders. They go well beyond the original concept of measuring equity index volatility. By targeting equity stock dispersion and credit volatility CBOE and S&P have created some interesting new metrics.

Disclaimer: the views, information or opinions expressed herein are those of FVC, and do not necessarily reflect the views of SRP.

Image: KanawatTH/Adobe Stock.