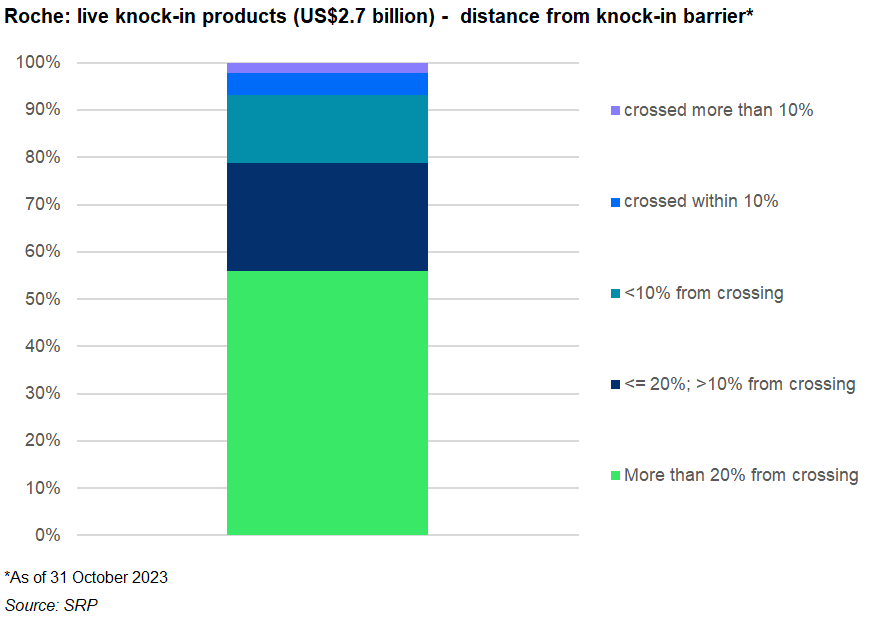

More than 75% of live products featuring the Swiss share are more than 10% away from crossing their Knock-In barriers; 55% at more than 20% from breaching them.

The performance of the Roche stock throughout 2023 has raised concern in some parts of the market as the disappointing performance of the pharmaceutical company has put a number of structured products at risk in the Swiss market – mostly worst of barrier reverse convertible structures (7,149 products), often also featuring Nestle and Novartis, as well as autocalls (1,383).

We haven't seen a significant impact in the market from the Roche performance. The spot move is relatively orderly, and so far it's not producing significant market distortions

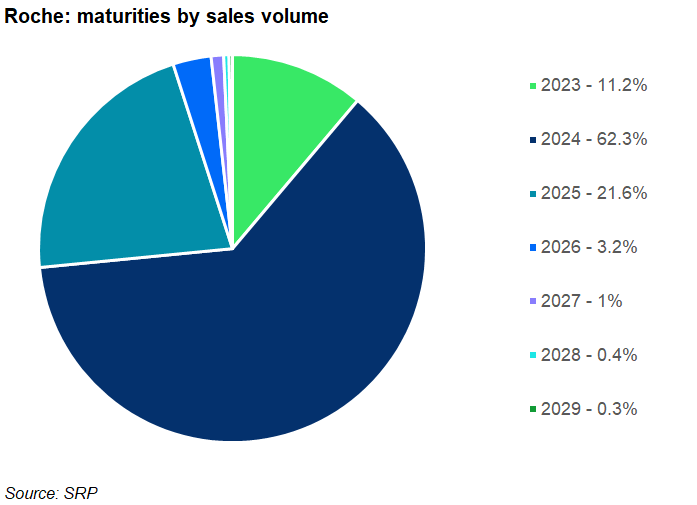

According to SRP, there are 8,932 products (worth US$2.7bn) linked to Roche which feature a knock-in Put. Of those, 11% of the products are set to mature in 2023 with most maturities concentrated in 2024 (62%) and 2024 (22%).

Despite claims from market commentators claiming that ‘Swiss autocalls are 10% away from disaster’, SRP data shows that only two percent of worst of structures featuring the Roche share have breached their barriers in 2023 by more than 10% and 4.8% have breached their barrier by less than 10%.

In addition, 14.3% of the live worst of structures linked to Roche are within 10% distance of breaching their barriers, 22.6% of the products are within 20% distance from breaching the barrier and 56% of the products are at a more than 20% distance of breaching their barriers.

“We haven't seen a significant impact in the market from the Roche performance. The spot move is relatively orderly, and so far it's not producing significant market distortions,” a senior trader at a Swiss bank told SRP.

The banker noted, however, that there are some aspects of the autocallable levels in general which can sometimes require more focused management of the book.

“When an underlying is getting close to expiry and you're below the autocall level, then from the dealer's perspective, they're going to have a long digital from that. If you're above that, they're not going to have that digital because you're above the autocall level and get autocalled and the put is not activated. That type of barrier can involve more management,” he said.

“The others can often be long gamma if you're above the barrier and short gamma if you're below it, and you'll need to manage either the decay if you're above it, or the short if you're below it.”

“In general, with interest rates moving up, there has been a shift towards capital-guaranteed products across different markets,” said the trader. “That means that the books that previously had many structured products being predominantly about selling puts have been balanced with structured products that are buying calls and at-the-money calls. We have seen that shift.”

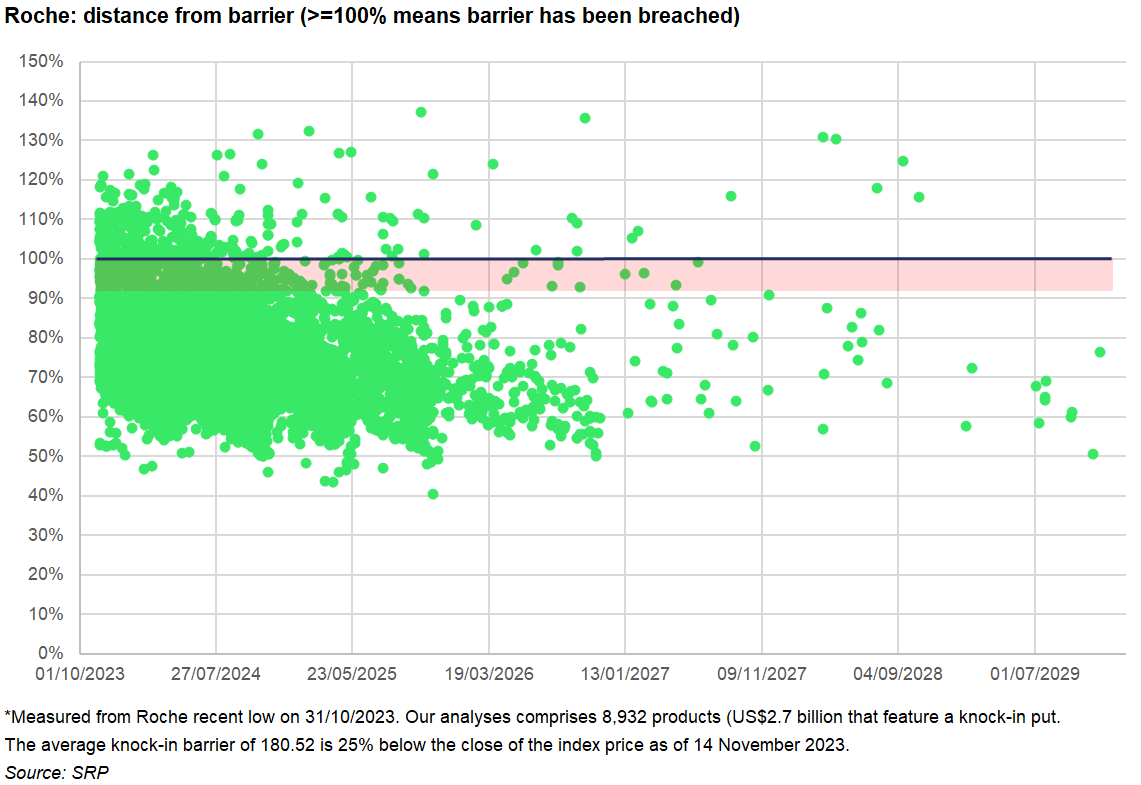

The graphic below shows the current barrier levels for individual products and maturities for knock-in products as of 31 October 2023 - the average knock-in barrier of 180.52 is 25% below the close of the index price as of yesterday 14 November 2023.

The knock-in barriers, which normally would force investors to participate 1:1 in the worst-performing underlying asset if they are breached during the product term or at maturity, ranges from -90% to -35% of the initial level with a -62% average, SRP data shows.

The main providers of Roche-linked autocalls and reverse convertible structures include most Swiss banks - Vontobel, UBS, Zuercher Kantonalbank, Raffeissen Switzerland and Leonteq – as well as several other issuers such as Société Générale, Goldman Sachs, Barclays, BNP Paribas and Citi.

The current situation with the Roche stock is reminiscent of recent ‘peak Vega’ events in the market and follows the recent circular from the Korean Financial Supervisory Service (FSS) raising the alarm again as the balance of structured products reaching their knock-in level in South Korea involved KRW7 trillion (US$5.3 billion) in the first half of the year.

As reported, however, SRP data shows that almost 70% of live products featuring the Hang Seng China Enterprises Index (HSCEI) are in safe territory and far from breaching their defensive barriers.

Additional reporting Nikolay Nikolov, Suzanna Moni and Marc Wolterink.

Image: Usman/Adobe Stock.