We look at structured products in the US market linked to underlyings that have exhibited poor performance during 2023.

For the vast majority of product types and payoffs the most important factor in determining structured product returns is the underlying asset and its performance throughout the life of the product.

Moderna and Peloton reached peak levels during the Covid-19 pandemic which had a major positive impact on their respective companies

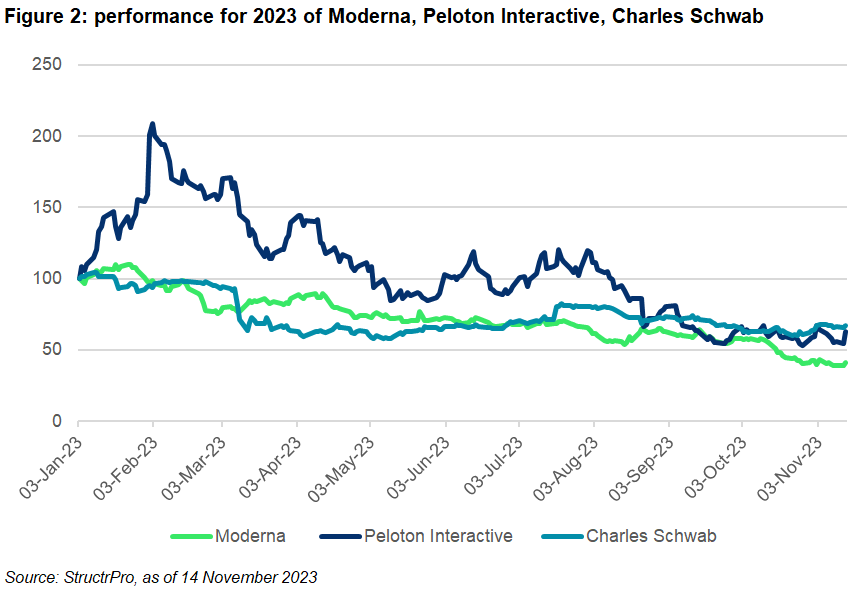

The first of the three companies we will examine is Moderna Inc (a pharmaceutical and biotechnology company) which has seen huge falls since its peak in the third quarter of 2021. It has shown a steady decline from January this year. We will also look at Peloton (Sports equipment) which has fallen by around 70% from its year high (as of 14 November 2023). The third stock is The Charles Schwab Corporation (financial services) which has a significantly longer history than the other stocks.

Moderna and Peloton reached peak levels during the Covid-19 pandemic which had a major positive impact on their respective companies. Charles Schwab peaked at the beginning of 2022 when Moderna and Peloton had fallen back to something close to their pre pandemic levels.

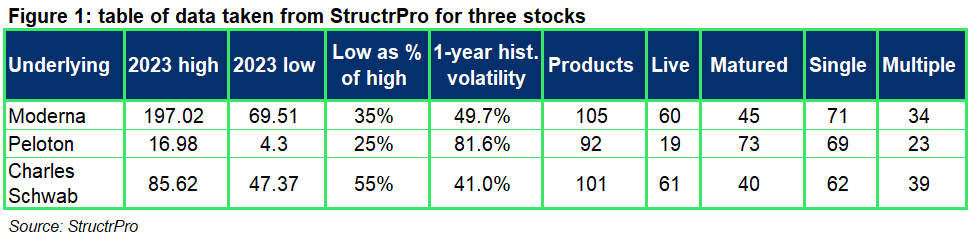

Figure 1 shows metrics on the three stocks and includes data taken from US structured product portfolio and lifecycle tool StructrPro. Most products were linked to the underlyings individually with some linked to a basket including the respective stock. There are a total of 158 products still live linked to one or more of these stocks. Of these 74% are currently reporting a loss. The average structured product payoff (using the latest valuation) is 66.24% and the average underlying level is 56.2% of its starting price.

Figure 2 shows the evolution of each stock in the past year and highlights their downward trajectory.

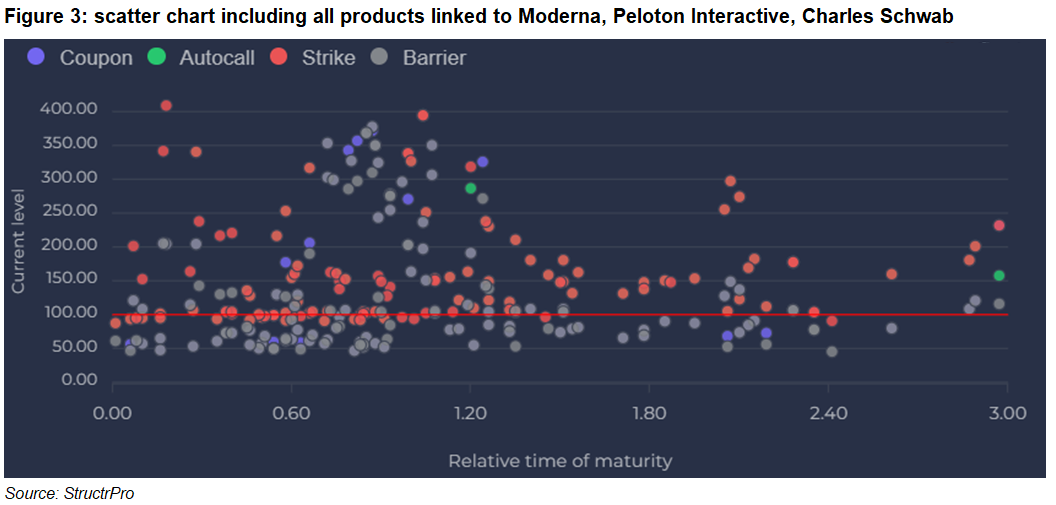

Figure 3 shows the distribution of live products linked to the three featured underlyings. The chart shows various key risk levels: autocall, coupon barrier, capital barrier and strike for each product. Consistent with weak stock performance, this chart shows that as expected for most products linked to these underlyings key levels have been breached and in some cases the products are very far below the required levels.

Of these three stocks, Peloton has had the largest falls over the past year which is reflected in the high stock volatility of over 81%. Of the 19 products that are live and linked to Peloton all have breached their relevant capital at risk barrier level and the average current valuations is only 14% of initial investment.

This is undoubtably a very disappointing outcome for investors who have held these products for an average of over two-years and shows how volatile single stock linked products can be. Two years ago, the one-year implied volatility was around 60%, already at the top end of typical levels therefore any products striking at that time will have offered very attractive headline terms.

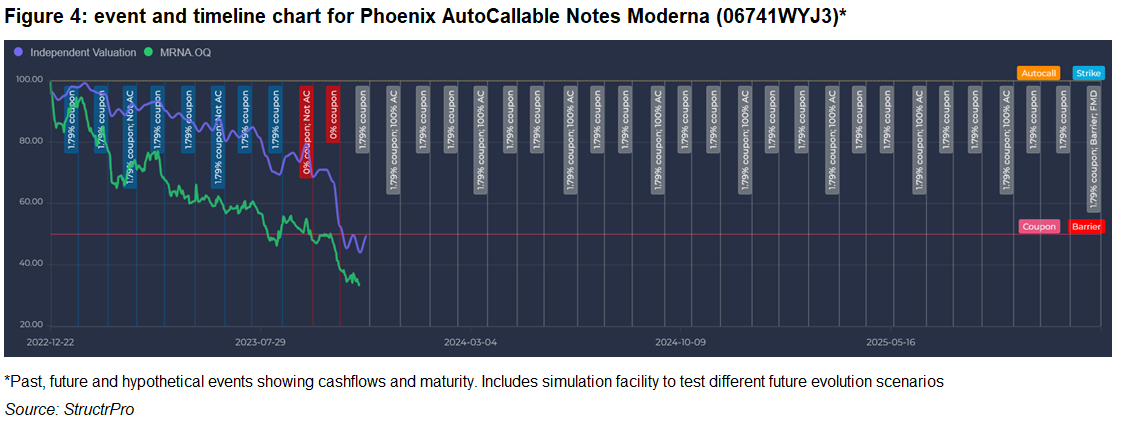

There are 60 products linked to Moderna Inc and although most products are currently pricing well under par there is more time left in some cases than for Peloton linked products. This may give investors some hope of a recovery. Figure 4 shows the StructrPro “Event and Timeline” chart for a single income autocall product linked to Moderna inc. It struck in December 2022, has a coupon barrier of 60% and an autocall barrier of 100% of strike level.

The underlying is currently 34% of the strike level (10 November 2023). The product paid the first eight coupons of 1.79% per month (approximately 21.5% p.a.) but has failed to pay at the last two coupon opportunities as indicated in red. To pay coupons again the underlying needs to increase by 76% to get back above the coupon barrier.

The product has over two years to run and the current implied volatility of almost 60% would suggest that recovery at some point is possible. The coupon barrier and capital at-risk barrier are both set at 60% of the initial level so if coupons are resumed, capital repayment is also a much more likely prospect. This would be a great outcome for investors given the current valuation of the product.

Autocalls and income autocalls will successfully call in growth markets leaving investors able to invest in different opportunities. However, when underlyings are not performing well the products continue until maturity and in the case of very poor outcomes will suffer losses to capital in addition to missing potential income or returns.

It is often easier to highlight products that have performed, outperformed other sectors or have made especially impressive returns for investors. Not all underlyings will show growth in any given period and clearly the risk for highly volatile underlyings cannot be underestimated. Structured products linked to such underlyings provide targeted opportunities with some risk control and yield enhancement.

The StructrPro structured product and lifecycle service provides deep analysis on the US structured products market. It is jointly run by SRP and FVC and covers some 82,000 products issued in recent years. Performance analysis can be seen at an individual product level and on portfolios of multiple products. The application shows results for both matured and live products for any portfolio in the US market.

Main image: VideoFlow/Adobe Stock.