Almost 70% of live products featuring the Hang Seng China Enterprises Index (HSCEI) are in safe territory and far from breaching their defensive barriers.

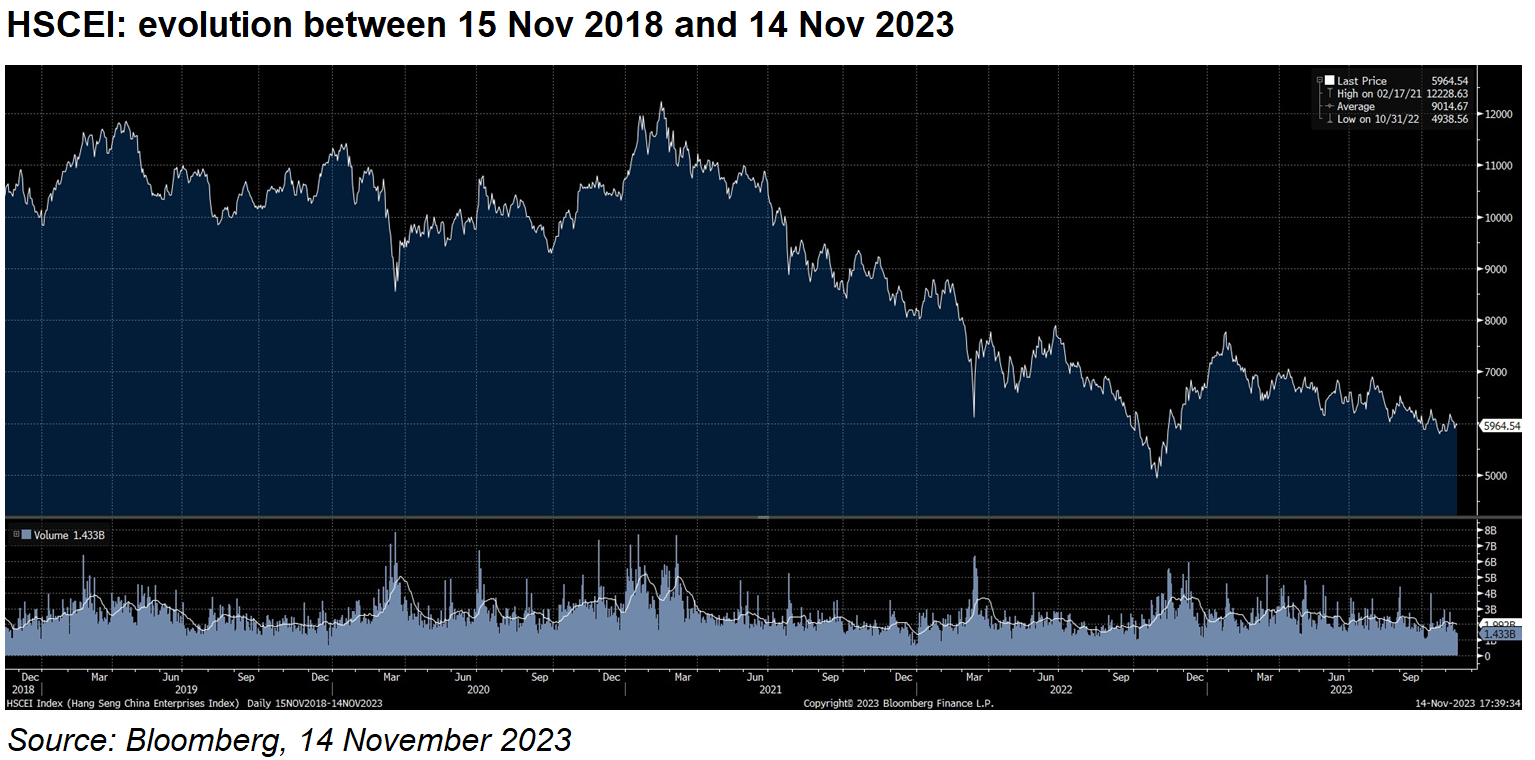

The persistent weakness in the performance of the Hang Seng China Enterprises Index (HSCEI) which is down nearly 50% from its 2021 peak has brought out red flags given the South Korean market exposure to worst of structures featuring the troubled gauge.

The environment has been relatively slow-paced which tends to give dealers time to hedge their books

The disappointing performance of the Hang Seng China Enterprises Index (HSCEI) in 2023 could leave issuers in South Korea facing potential losses as a further sharp fall in the Hong Kong’s listed index spot price could trigger hedging losses resulting from breaches of downside defensive barriers on autocallable structures.

Hedging dynamics, however, have been “relatively orderly when we look at how the market has been responding to the spot move lower from the start of the year,” according to a senior equity derivatives research banker.

“The environment has been relatively slow-paced which tends to give dealers time to hedge their books,” said the source. “You wouldn't necessarily get large stresses in the book like you might for violent spot moves, which we've had certain instances of in the past, but not necessarily this year. When we look at the impact on parameters, certainly they are not as big as it would have been in previous years.”

According to the banker, the duration of the books is also lower than before as recent issuance levels have been quite low and a significant number of the outstanding exposures come from legacy products.

“That means that there isn't the same level of outstanding Vega as there used to be in the market. That's always going to make it easier for dealers in general to manage their books,” he said.

A trader at a South Korean securities house added that there are not many concerns from a hedging perspective as the total Vega has decreased because the “total balance of autocalls in the market has decreased, some of the products have knocked in and a big portion of products issued in 2021 are losing Vega as they near expiration”.

“Additionally, the Vega from new issuances is not expected to be substantial, as there hasn't been a significant volume of new issuances since 2022 compared to before 2020,” said the trader.

The Chinese market has been sluggish for a long time, largely because of the political situation, which appears unlikely to change in the near future. Events such as a significant improvement in the U.S. and China relations could potentially transform the situation, but we don't have much time remaining before the expiration.

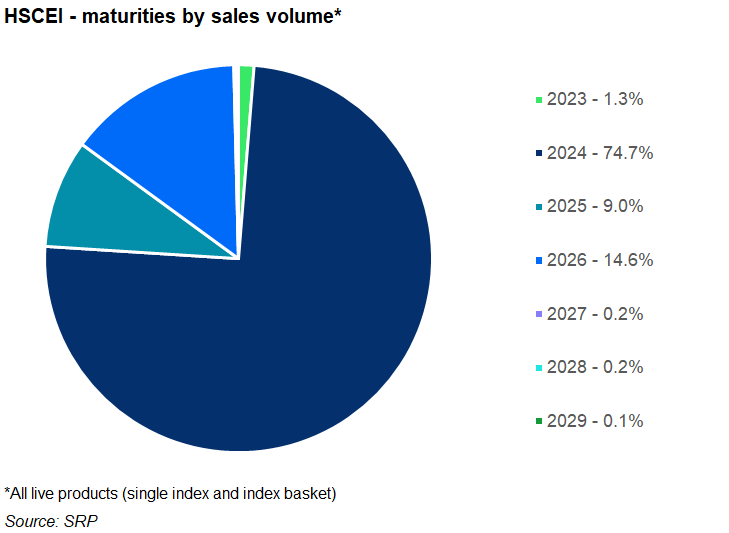

SRP data shows that there are 7,169 live structured products worth an estimated US$19.3 billion, featuring the HSCEI index of which 26% (1,874 products worth US$2.5 billion) have struck YTD and 87 products/US$198.5 million are set to mature in 2023.

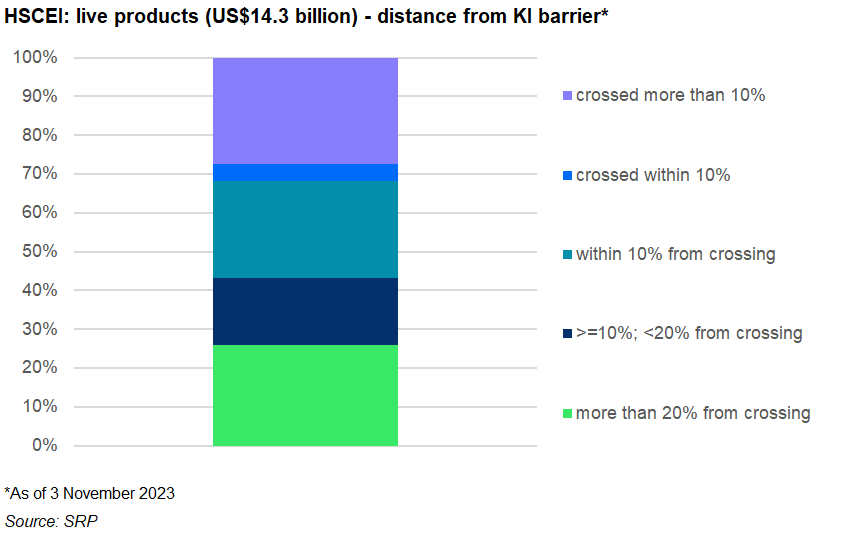

Looking at all the live autocall structures featuring the HSCEI index as part of a worst of basket, 26% of the live worst of structures linked to the HSCEI (3,694 products) are at more than 20% distance of breaching their barriers with 17% (2,461 products) within 20% distance and 25% (3,608 products) of autocalls are within 10% of breaching their barriers being the most sensitive to future decline in the underlying.

As of 3 November, SRP data shows that of the 4,316 products (worth US$14.3 billion) featuring a Knock-In barrier protection only four percent (619 products) of worst of structures featuring the HSCEI index have breached their defensive barriers by less than 10% and 27% (3,918 products) have breached their barrier by more than 10%.

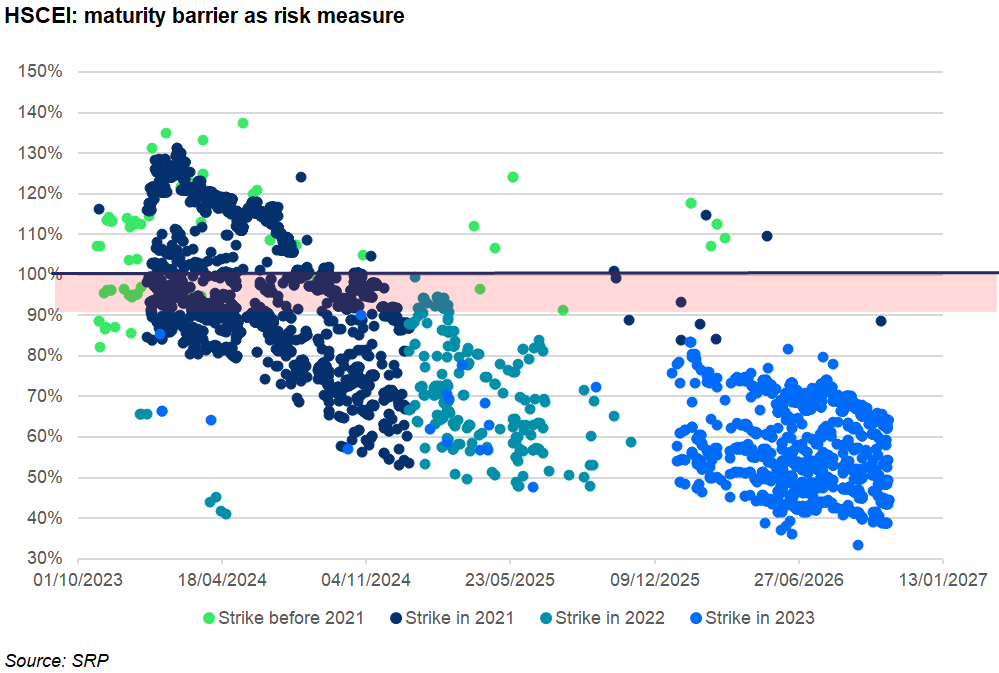

The graphic below shows the current barrier levels for individual products and maturities for Knock-In products as of 3 November 2023.

The knock-in barriers, which normally would force investors to participate 1:1 in the worst-performing underlying asset if they are breached during the product term or at maturity, range from 85% to 35% of the initial index level, absorbing a 43% decline in the underlying, SRP data shows. The average knock-in barrier of 5136.75 is 13% below the close of the index price as of last Friday 10 November 2023.

Most of the products breaching their downside barriers struck in 2021 with a handful of worst of structures that struck in 2020 also breaching their protection barriers. Autocall structures linked to the HSCEI striking in 2022 and 2023 are all at a safe distance from their barriers.

With the spot already below the peak Vega on HSCEI “dealers have already switched from being long skew to short skew”, said a derivatives trader from a European investment bank.

“That happened a while ago and dealers in general would have had quite a bit of time to hedge their books,” he said. “For that reason, if you have a gradual spot move lower, it's usually easier to manage because you will have time to adjust your books to that move.

“If the spot keeps going down, you've got the same stresses [and] the same parameter changes as you would have before your short skew. So, if you're hedged that then you're going to be relatively covered on the spot moving lower.”

The HSCEI remains the most featured underlying in autocallables sold in the Korean market and by large the worst-performing of all the benchmarks used in the market including the Eurostoxx50, Kospi100, S&P500, and Nikkei 225.

SRP data also shows that the HSCEI represents a lower proportion of products issued more recently as issuance has been more concentrated on the S&P500, Kospi 100 and Nikkei 225 which have performed better in terms of spot.

According to the equity derivatives research banker, Korean products tend to have very low autocall levels – starting at 90% or even 85% which can involve five percent step-downs over their life after the first six months.

“The final autocall level can be as low as 60%, sometimes 50%,” he said. “You have a lot of buffers before the product starts incurring losses.

“If we don't see reissuance into HSCEI, then the expectation would be less Vega selling on the index compared to what you would otherwise expect leading to an upward bias in implied vols. [However,] issuance has been very low for a while which means that the supply of Vega has been relatively muted. For that reason, over the next few months, even if we don't see a significant amount of reissuance, I don't think it means that we will see a big shift higher in implied vols."

The trader at the SK securities house also pointed at the lower volume of new issuances which has been limited “as older products have not reached their knock-out level for nearly two years”.

“Consequently, investors' funds have remained tied up in these products. It's uncertain whether these investors would be willing to reinvest in these products if a significant loss were to occur next year,” he said.

The current situation in South Korea – and in the Swiss market with the Roche stock – although reminiscent of recent ‘peak Vega’ events in the market is far from distorting the market. In Q3 2022, the South Korean regulator sounded the alarm on worst of structures featuring the HSCEI but this was after the sharp fall in the value of the HSCEI triggered a loss of US$800m worth of investor money as the barrier levels of hundreds of products were breached.

This year, back in June, Korea’s Financial Supervisory Service (FSS) released a circular noting that equity-linked securities (ELS), worth KRW7 trillion won (US$5.3 billion) – mostly tied to the Hang Seng China Enterprises Index – were at risk of capital losses.

With about KRW6 trillion of these on track to mature in the first half of 2024, the Korean regulator is monitoring the threat from HSCEI-tied structured products.

SRP data shows that a total of 2,596 ELS tracking the HSCEI index have been issued year to date with a combined notional of US$3.8 billion equivalent. These products are also tied to a group of 11 underliers including the S&P 500, Eurostoxx 50, Nikkei 225, and Kospi 200.

Additional reporting from Jocelyn Yang, Suzanna Moni, Nikolay Nikolov and Marc Wolterink.

Main image: Blue Planet Studio/Adobe Stock