In this article, we look at the market dynamics in the US around growth and income products over the last three years.

The last three years have seen big shifts in global economies and markets. The main story worldwide has been the big rise in interest rates, this has been accompanied by broadly positive equity markets and decreasing volatility levels.

High level analysis of a structured product market is possible with a service like StructrPro and helps provide guidance to the continuous issuance program and task of providing investors with a wide range of optimal solutions

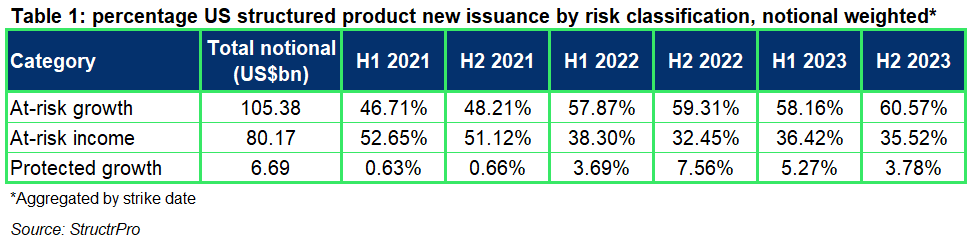

The US structured product market has remained buoyant during this time with steady issuance coupled with strong performance. There have been significant changes in the composition of products over this time. Table 1 below shows the evolution by overall classification of share by notional.

At-risk growth products have steadily increased in popularity in the last three years, at the expense of at-risk income products. Protected growth products have increased their share from less than 1% in 2021 to nearly 8% in the second half of 2022.

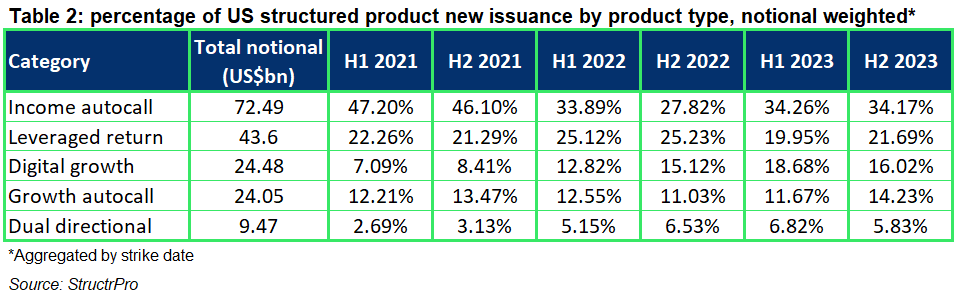

Further insight can be obtained by studying Table 2. Income autocalls have declined in popularity significantly, although they retain the largest share at 34%. While leveraged return products have consistently maintained their position, digitals have more than doubled their share over three years. Steady gains have also been achieved by the growth autocall and dual directional payoffs.

These movements in market share make complete sense in the context of interest rates and volatility changes. The VIX 1 year index which measures 12-month S&P-500 volatility has dropped from around 27% during 2021-2022 to 20% in 2023. Meanwhile USD 5-year rates rose from 0.5% in 2021 to nearly 4% in 2023, peaking in the middle of last year.

The prevailing level of interest rates is probably the most important overall benchmark for investors. It dictates the balance between risk free opportunities such as cash and the demand and attractiveness of higher yields investments or equity returns.

Income autocalls have shown a significant fall in popularity over the last three years. As interest rates have risen and volatility has fallen, they have become less attractive propositions. More viable risk free or very low risk solutions are now available at levels around 5% yield and the pickup that autocalls can provide has been reduced because of the lower premiums that can be generated.

Given that structured products inevitably have some associated costs, income autocalls are struggling to demonstrate sufficient yield advantage over risk-free investments. A contributing factor may also be that autocalls are often stock based worst-of products and inevitably some stocks have had bumpy rides and the associated products sustained losses or failed to provide a positive return.

Changes in market parameters have benefitted the digital relative to other payoff types such as income autocalls

Leveraged return products have stayed very consistently in second position, the classic geared upside with buffer or barrier protection has always been popular to provide high returns in a moderate rising market with significant downside protection. Because this payoff is the closest to direct equity exposure of any structured product type its pricing is relatively invariant to changes in interest rates and volatility levels and therefore is viable in almost all market environments. Its investor base is moderate risk equity investors who prefer to quick returns and downside protection at the expense of capped returns.

The dramatic increase in digital products is interesting. The typical product in this category is 2-5 years long with a fixed maximum payoff often around 10-15% per year of maturity length. This return is paid if the underlying is above a given level which is usually either 90% or 100% of the initial level, with downside risk from the barrier or buffer level.

Changes in market parameters have benefitted the digital relative to other payoff types such as income autocalls. Since the payment is made at maturity there is a higher discounting effect than for a product with a regular income stream. Secondly, digital payoffs are relatively invariant to volatility levels so given that volatility has fallen they start to look more attractive by comparison.

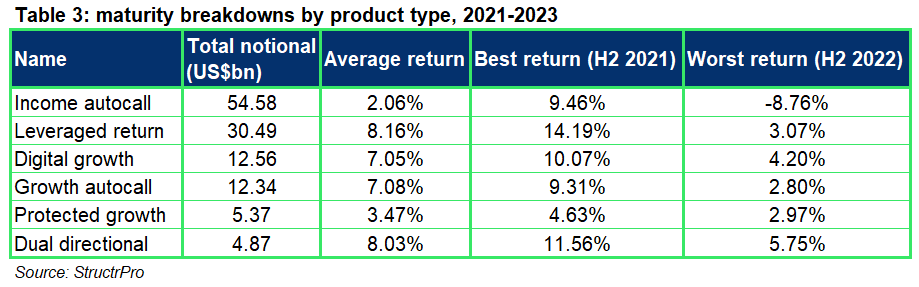

Analysing maturities shows how different product types have performed over the last three years. Volumes of maturities reflect previous issuance patterns and in the case of autocalls positive market performance to generate early maturities.

The order of product types by maturing notional volume in the last three years differs slightly from new issuance over the same period. One standout statistic is that the income autocall product type has the worst average return of the six main types and is the only one to show a loss over an entire six-month period - that of the second half of 2022.

Perhaps these poor performances over several years have accelerated its decline in popularity for re-investment opportunities. Another interesting point is that all six product types shared the best and worst half year (second half of 2021 and 2022 respectively) during the last three years, showing that different product types have rather closer correlated returns than might have been imagined.

High level analysis of a structured product market is possible with a service like StructrPro and helps provide guidance to the continuous issuance program and task of providing investors with a wide range of optimal solutions.

Image: Kasto/Adobe Stock