In this article, SRP analysed the current status of French products - redeemed versus live - per year of issuance for the period 2013 to 2023 in France.

For the last 10 years France has been a market of autocallable structures, with high annual rates of early redemption and rapid rollover of the nominal invested. This has been possible due to the ability to adapt the asset class to challenging market conditions and different market contexts.

Most products issued since 2017 adopted more frequent early exit windows rather than the annual observation, which had been prevalent until then

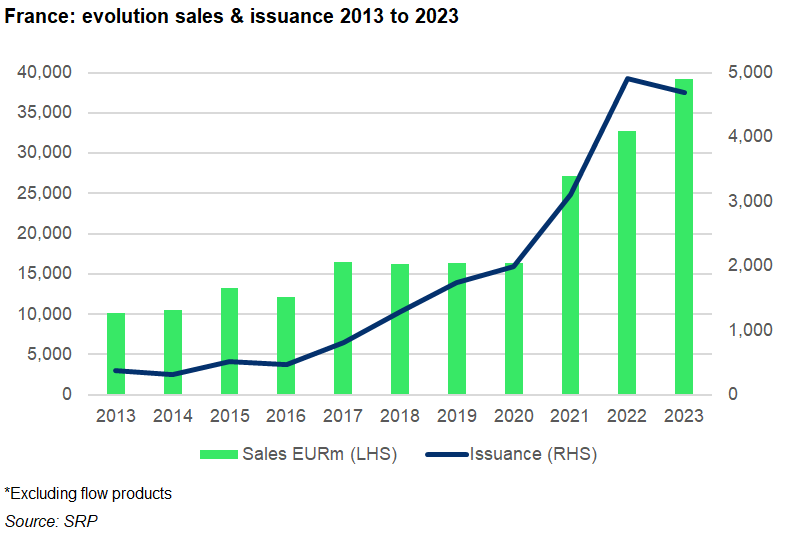

According to SRP data, some 367 structured products worth an estimated €10.1 billion (US$10.9 billion) were issued in France during 2013. Ten years later, the number of issued products registered on the SRP France database reached 4,967, a 13-fold increase, while sales volumes, at €39.2 billion, were up 290%.

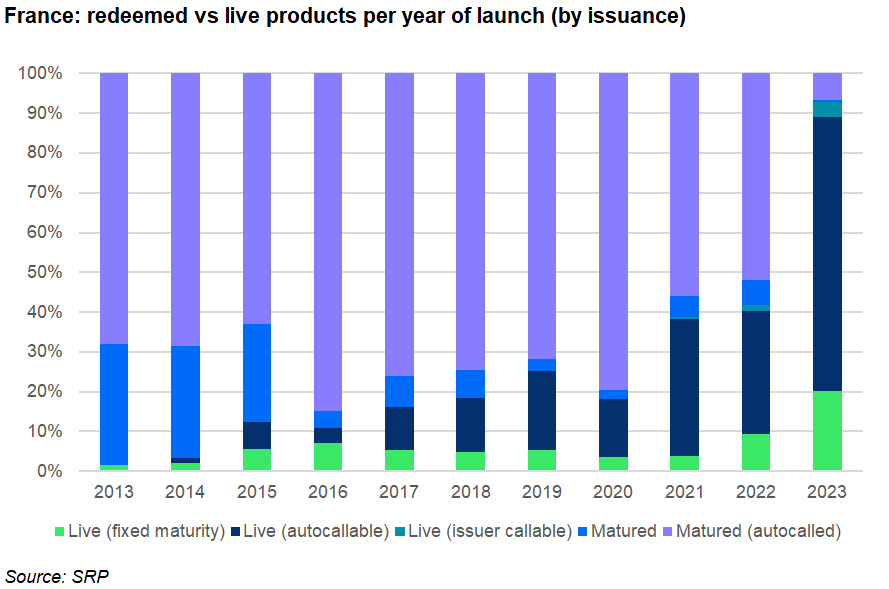

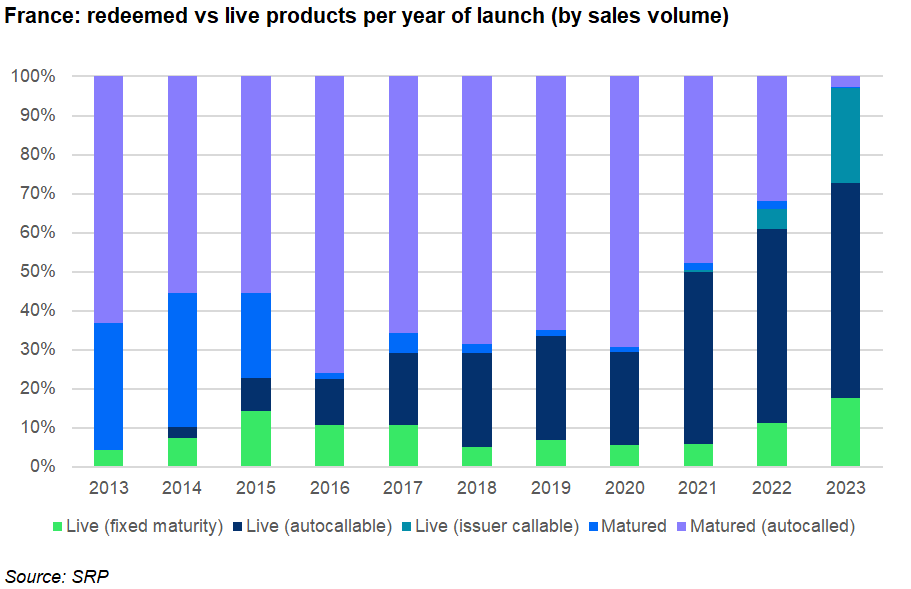

We look at the proportion of live products that are issuer callable (from 2021 onwards), autocallable, and those that have a fixed maturity while the maturing products are divided into those that have autocalled and those that matured organically.

To start with, we focus on how the French market has evolved in the period. The below chart shows that there has been a steady increase in issuance and sales volumes from the start, with a steep increase in both from 2020 onwards.

Looking at the 367 products that were issued in 2013, only three worth a combined €194m are still live. The products in question are capital protection structures from the SG Retraite series that are due to mature in 2025, 2028, and 2033, respectively.

Some 68% of the structures on offer in 2013 have since autocalled (250 products worth €6.4 billion) while a further 30% (114 products/€3.3 billion) have matured.

For 2014 and 2015, the picture is fairly similar, with the percentage for products that have autocalled at 69% and 63%, respectively, although for 2015 there is still a relatively high percentage of autocallable products that is still live (seven percent).

In 2016, 85% of products issued that year has since autocalled – the highest for the whole observation period. They include 171 products on the Eurostoxx 50, 88 products on the Euro iStoxx Equal Weight Constant 50, 36 products on the Cac 40, and 34 products on the Cac Large 60 Ewer index – one of the first decrement indices used in the French market.

The largely positive market performance in 2019 allowed the early redemption of many products issued in the previous years. Additionally, most products issued since 2017 adopted more frequent early exit windows rather than the annual observation, which had been prevalent until then. This significantly increased the successful call rate of products during the following years, which remained high until 2020 (between 72 and 80%). However, in 2021 that figure fell significantly (56%) at the expense of live autocallable products which reached 35%, an increase of 20 percentage points YoY.

In many cases, this was not a miss, but a deliberate choice of the providers to adapt the issuance of 2021 (and after) in the context of the rebounding markets after the Covid-19 crisis.

Given the high valuations of stocks and indices, it was assumed that new products would potentially have a longer duration then for products launched in previous years. For that reason, rather than mechanically focusing on the objective of early exit, structures have been adapted to pay a coupon –even in the event of a fall in the markets. Further to that, many products were designed with a first autocall observation date in two- to three years (and no longer in the first year), but the autocall barrier would be defined at -10%, -15% fall on the indices in three-years. This explains the higher proportion of live autocallable products launched in 2021 and 2022.

In 2021 we also started seeing the first issuer callable products in the French market, although their numbers – 17 in total of which nine are still live – were quite low. In 2022 and 2023, however, these products saw a noteworthy uptick in both issuance and sales volume: 84 products worth €1.6 billion were issued in 2022 against 184 products that sold an estimated €9.6 billion in 2023.

Some 2,284 products worth €14.8 billion have autocalled in France during 2023. This represents 15% of the current outstanding volumes in the end of the year.

Main image: Alliance/Adobe Stock.

Do you have a confidential story, tip or comment you’d like to share? Write to info@derivia.com