In this analysis piece, we look at the rationale behind a growing underlying type in the European structured products market.

Decrement indices have become increasingly popular in the last ten years. They take an existing index, stock or other underlying and create a synthetic version by exchanging an actual dividend stream for a fixed one. They are principally created for use in structured products.

Decrement indices have emerged as an alternative solution in many markets and are particularly popular in France - Tim Mortimer, FVC

Most structured products are “long” the underlying, meaning that if the underlying goes up the structured product will have a higher payoff. Because of this a key part of the hedging strategy will be for the investment bank to hold a delta hedge in the underlying asset. In turn, this delta holding will pay any dividends of the underlying and the bank will receive these.

The value of this will be factored into the original pricing of the structured product. If dividends on the underlying are reduced or cancelled during the product’s lifetime then the bank will suffer a significant shortfall and likely lose money on the transaction.

While the hedging process tends to concentrate on volatility, dividend risk can also be a significant factor. This is particularly true for long dated products where the cumulative effect of receiving reduced dividends will be higher. Dividend risk is also a lot harder to hedge than volatility risk since dividend swaps tend to be much less liquid (if they exist at all) than traded or broker market options.

This situation has been known for many years but came to particular attention during the Covid pandemic when many companies suddenly cut dividends to maintain their own cash reserves in the face of shocked business models, most noticeably in sectors like aviation and tourism.

Decrement indices have emerged as an alternative solution in many markets and are particularly popular in France. The index is created by taking the “base” underlying, first re-investing dividends to produce a total return version and then subtracting a constant pre-defined synthetic dividend, thus giving rise to the name decrement.

There are two flavours of decrement indices – fixed points or fixed yield. For example, a stock with current price €1,000 the fixed points version of a decrement index might be set at €40 per year, and the fixed yield version at four percent. Both would be alternatives to a stock expected to pay around €40 per year. The bank is the no longer exposed to actual dividend payments since they would be reinvested back into the index and therefore contribute to the product payoff rather than forming part of the income of the product hedge.

This certainty of dividend means that the bank does not have to make the choice between running risk or pricing in a lower amount to be conservative and so both bank and investor should benefit. Decrement indices make the most sense for higher dividend underlyings where the uncertainty over dividend amount is greater. Since there may be structured products linked to the conventional version of the underlying or other underlyings with similar yields decrement indices are popular to maintain the optical terms of the product such as yield or barrier level to appear competitive.

Logically one might wonder why there is a need to subtract an arbitrary decrement amount at all when the risk reducing part of the exercise is the re-investment of dividends. One of the principal objections to decrement indices is their complexity as they add an extra layer for the investor to consider. Education and disclosure are key to a successful investor outcome.

Decrement indices started out as alternatives for stock indices such as the Eurostoxx-50. Recently they have become popular for single stocks and for a single stock the dividend risk is more concentrated as there is no diversification as there would be in an index.

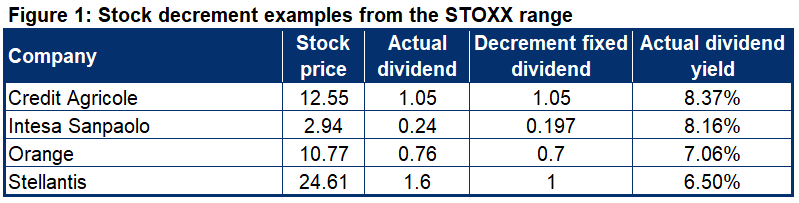

Index provider STOXX is one of the leading developers of this concept and has created the STOXX Single Stock Decrement Indices derived from stocks from European, Swiss and US blue-chip companies. These indices were developed with, and are marketed exclusively by, Citi, an arrangement that gives STOXX a licence fee stream and Citi an advantage in terms of product offering over the period where the exclusivity has been agreed.

Structured product examples can be found on the SRP database. Many ten year auto-calls have been issued in 2023 and 2024 to date. Examples include one linked to the Orange decrement index (dividend fixed at €0.7 per year) and the other to the worst of the Credit Agricole and Orange indices (dividend fixed at €1.05 per year). Another product example is also a ten year auto-call linked to the Stellantis decrement index.

All these stocks have high dividend yields (6.50% or more) have autocall levels at or just below the initial index level. The worst of product pays a contingent coupon of 16.8% per annum if both stock indices are above 70% of the initial level and the other two single name products have a snowball yield of 11% per annum.

The use of high dividend stocks and a long maturity plays to the strength of the decrement index concept.

A final example is a five year autocall linked to Intesa Sanpaolo (ISP). This product has a shorter maturity but given that ISP has the highest dividend yield of the group and is a volatile underlying the terms offered are still attractive, a contingent coupon with memory of 7.2% with a very deep barrier set at 40% of the initial level.

In conclusion we see that decrement indices have a good rationale for single stock linked products and can allow for effective risk management and attractive terms.

Image: Rymden/Adobe Stock.