Dutch bank is re-opening Groenbank, a former issuer of structured products, ‘to make a serious contribution to a sustainable society’.

ABN Amro has reported a net profit of €725m for the third quarter of 2018, an increase of 8% on the same period last year. Net interest income was up 4% year-on-year on the back of a strong Dutch economy, according to the bank.

On October 1, 2018, ABN Amro reopened Groenbank, which finances sustainable projects based on the green scheme as established by the Netherlands Enterprise Agency (Rijksdienst voor Ondernemend Nederland – RVO). The decision to reopen Groenbank is in line with strategy of facilitating the transition to a sustainable society, according to the bank.

Between September 2005 and May 2008, ABN Amro Groenbank issued eight structured products targeted at retail investors in the Netherlands. The structures included three capital protected Groenbank Groen Discovery Notes which were each linked to a basket of 20 stocks from the FTSE4Good Index. The remaining five products were Rente Vast Notes, also linked to 20 stocks from the FTSE4Good Index, which featured the fixed upside payoff.

Groenbank, which was gradually phased out between 2010 and 2018 following a set of tax changes, reopened to support companies transitioning to a sustainable business model with new modes of financing, and savers – who will receive tax advantages through the green scheme – can initiate their green savings at the bank with a green deposit.

In the third quarter of 2018 the number of sustainable client assets increased to €13 billion and by 2020 the bank aims to finance €1 billion worth of circular company assets, across all sectors and through a minimum of 100 separate deals, ‘resulting in carbon emissions reduction of at least one million tonnes’.

3Q2018 included a €27m restructuring provision relating to the refocus of the corporate & institutional banking strategy while private banking’s operating income included €12m in tax-exempt sale proceeds following the divestment of the activities in Luxembourg.

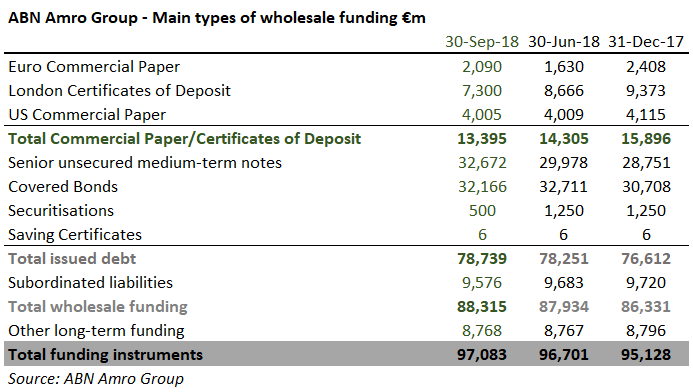

Issued debt securities went up by €0.5 billion, totalling €78.7 billion due to increased long-term funding. Total wholesale funding (issued debt plus subordinated liabilities) increased to €88.3 billion at September 30, 2018 (June 30, 2018: €87.9 billion), mainly reflecting an increase in long-term unsecured debt.

Long-term funding raised in the third quarter of 2018 amounted to €3.1 billion with a weighted average maturity of 4.6 years and consisted primarily of €2.9 billion in unsecured medium-term notes. This funding was issued mainly to replace maturing funding, according to the bank.

‘In the past years, we have invested in our client businesses, grown the loan book, addressed the cost base and prepared for Basel IV, while increasing the dividend pay-out to shareholders,’ said Kees van Dijkhuizen (pictured), CEO, ABN Amro Group, commenting on the 3Q2018 results. ‘More recently, we took further steps to improve the profitability of corporate & institutional banking and the international activities of private banking, and this has resulted in a good third quarter.’

The SRP database lists 12 live structured products issued or distributed via ABN Amro. Ten of these are available in France including NOC Juillet 2026, an eight-year autocallable linked to the Eurostoxx 50 which struck on July 13, 2018 and was issued in collaboration with Goldman Sachs. Just two tranche products are still available in the Netherlands, one of which, the Capped and Floored Note on 10-year Euro Swap Rates, was distributed via Mees Pierson with Morgan Stanley acting as the bond provider.

Click the link to view the full third quarter 2018 results for ABN Amro.