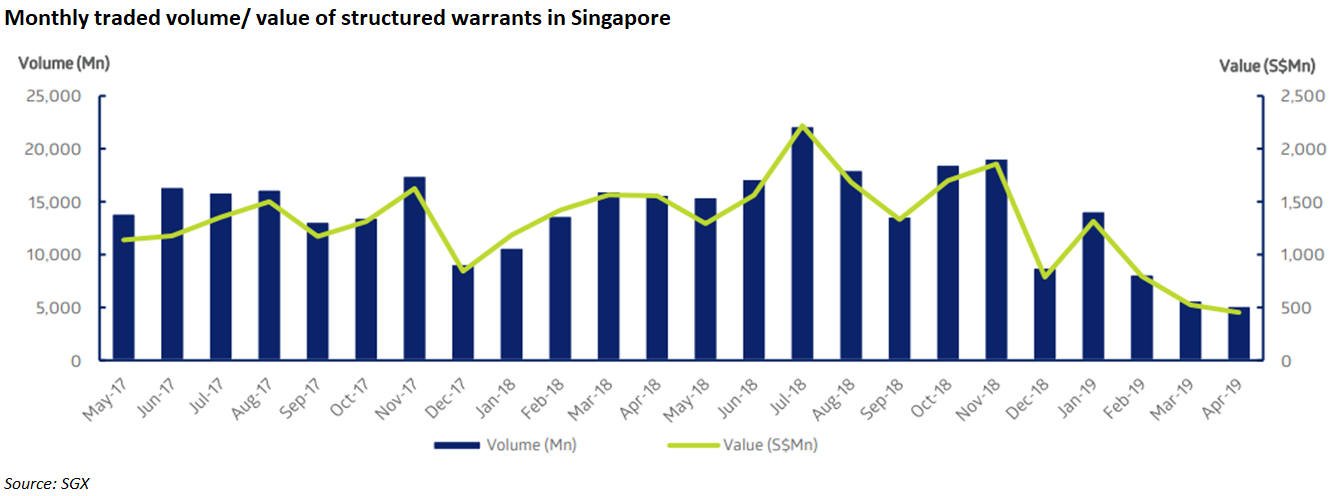

Both the traded value and the volume of structured warrants in Singapore decreased for the third consecutive month in April in the face of calm markets.

The traded value of structured warrants in Singapore in April came in at S$452 million (US$327 million), down almost 14% from a month ago, according to SGX data. From a year earlier, it dropped around 70%.

The figure also marks less than half of that posted in January this year when market activity picked up pace after a sluggish year-end when traders take their Christmas holidays. The traded volume of structured warrants is also on a downward trend, dropping almost 10% last month from March.

“The activities in the warrants market came off on the back of lower investor appetite,” said Keri Neo (pictured), head of products at SGX.

The dampened appetite comes as the market volatility in the first quarter remained subdued, repelling short-term trading. Listed structured products, such as warrants, Daily Leverage Certificates (DLCs) and Callable Bull/Bear Contracts (CBBCs), are generally considered as a short-term trading tool rather than an investment product.

The HSI Volatility Index, for example, came down to below 20 points since mid-January, even dropping to 14 points level in March and April. The Hang Seng Index is the most active underlying benchmark for both the call and put warrants in Singapore, with traded value as well as volume accounting for about half of the total. The volatility index was close to 30 points in October when traded value of structured warrants also surged to S$1.7 billion.

Hong Kong’s volatility index, however, recently shot up to over 20 points level after US President Donald Trump threatened to raise tariffs on billions of dollars of imports from China.

Meanwhile, the traded value of DLCs in Singapore also dropped 35% in April from the previous month to S$71 million. For DLCs, stock linked products are more widely traded than those linked to indices such as HSI or HSCEI. Some of the popular stock names include Geely, Venture and Tencent.

Click the link to view the SGX structured warrants trading summary.