Belgian trade body Belsipa reports 69% increase in sales volumes as life wrapped products prosper.

Sales of structured products in the primary market amounted to €1.56 billion in the first quarter of 2019, an increase of 69% year-on-year and up 12% compared to the previous quarter, according to the Belgian Structured Investment Products Association (Belsipa).

The turnover of structured life-insurance products (Branch 23) in particular, increased significantly, by 221% compared to last year, followed by structured bonds, which were up 60% on an annual basis. At €863 million, the turnover on the secondary market was at its lowest point over the past 12 months.

At the end of March 2019, the outstanding volume in ‘live’ structured products stood at €31.2 billion, up three percent compared to the end of the last quarter of 2018 (€30.3 billion), signifying almost a billion euro more assets invested. This is the first quarter-on quarter increase for more than two years, according to the trade body.

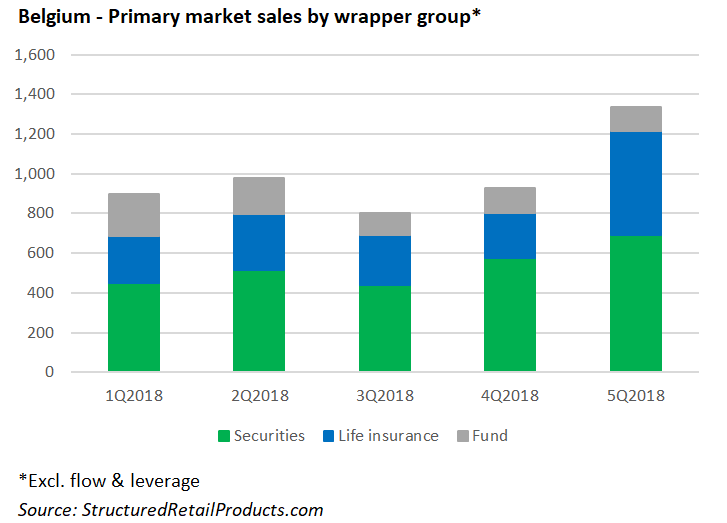

Belsipa’s figures are backed up by SRP’s own data, which saw 72 structured products worth €1.34 billion (excluding flow and leverage products) striking during the quarter, up from 62 products with sales of €921m in the period January – March 2018.

The best-selling product in Q1 2019 was indeed a Branch 23 product and came in the shape of Belfius Invest Accelerator 03 2027 which is linked to the iStoxx Europe Demography 50 and sold €145.7m during its subscription period. In total, there were 17 life wrapped products in the first quarter, which were distributed via AG Insurance, Belfius, BNP Paribas Fortis, BPost Bank and KBC, respectively.

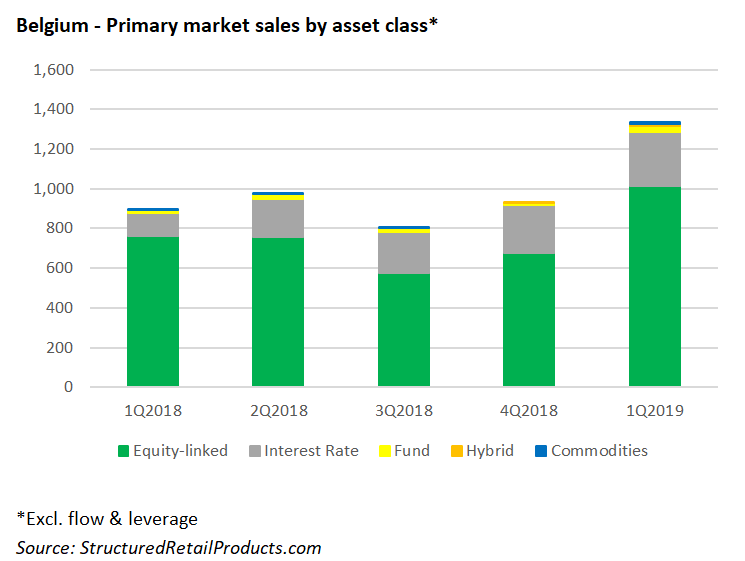

The majority of products in Q1 2019 were linked to equities, either to a single index (38 products worth €737m) or a basket of stocks (12 products worth €269m), while products linked to the interest rate were also in demand (16 products worth €270m) were also in demand, according to SRP data.

The best performing product in the quarter was KBC EquiPlus 90 US Buyback USD 2. The structured fund, which sold €28.7m at inception, was tied to a basket of 30 US companies and returned 157.96% after 5.5-years, or 8.69% per annum.

Structured products have played out their strong position as an alternative with interesting return opportunities at the beginning of the year, ‘especially in times of zero interest rates’, according to Florence Devleeschauwer, chair, Belsipa, commenting on the results.

Filip Gils, vice-chair, Belsipa, added: ‘More and more investors are realising that due to inflation, a cash-only approach would hollow the investment portfolio. That is why structured products with capital protection are used, [these products] have a strong tradition in Belgium and allow investors to build up capital while minimising risk.’

Belsipa was founded in 2013 and has Belfius, BNP Paribas Fortis, ING Belgium, KBC, Société Générale, Commerzbank and Natixis as full members. Next to them, also Axa Group, Crelan, Bank Nagelmackers, AG Insurance and Deutsche Bank provided data to the report, which covers approximately 95% of the Belgian market.

Click the link to view the full Belsipa market report on retail structured products for Q1 2019.