The US investment bank’s Dutch domiciled issuance vehicle for structured products sees profits increase more than threefold in 1H2019.

JP Morgan Structured Products BV has posted a profit of US$8.7m after tax for the first half of 2019, up from US$2.1m in the same period last year.

Financial liabilities designated at fair value through profit and loss included short-term and long-term structured notes worth US$20.7 billion as of June 30 2019 (December 31 2018: US$17.4 billion). Total financial liabilities stood at US$24.9 billion, according to the company’s interim results.

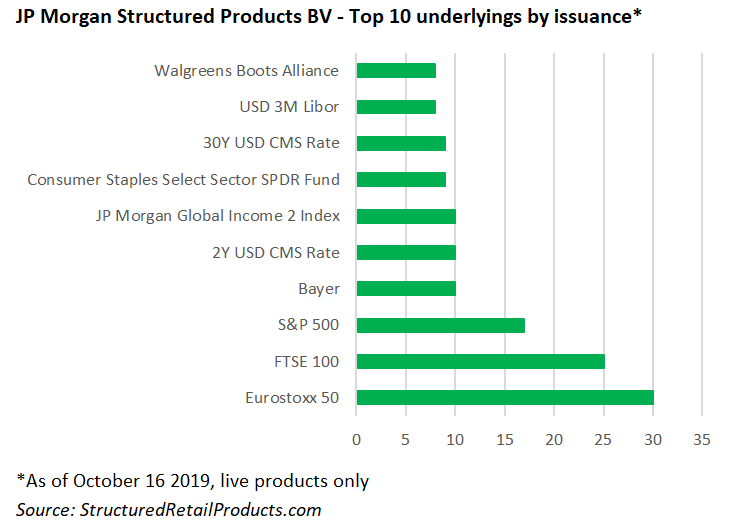

The SRP database registers 378 structured products issued via JP Morgan Structured Products BV. Of these, 188 products, with strike dates between November 2014 and September 2019, are still live. The products sold approximately US$680m and are denominated in – among others – US dollars, sterling, euro, Russian roubles, and South African rand.

The Eurostoxx 50 is the most popular underlying by issuance, seen in 30 structures, followed by the FTSE 100 (25) and S&P 500 (17), while the most used payoff is the reverse convertible (88 products).

The best-selling live structure is the Buffered Return Enhanced Note, which is targeted at institutional investors and sold US$105m during its subscription period. The one-year product first struck on November 26 2018 and participates 100% in the upside performance of the MSCI World Index, capped at an overall maximum return of 114.75%.

A further 189 products have matured of which JB Novo 2020, distributed in Denmark by Jyske Bank, was the best performer. The three-year note, which was tied to the share of Novo-Nordisk and sold DKK13.5m (US$2m) at inception, knocked out at the first time of asking, returning 105.5% of the nominal invested, or 11.27% per annum.

JP Morgan Structured Products BV was incorporated on November 6 2006 as a private company with limited liability and is incorporated and domiciled in The Netherlands. Its main activity is the issuance of structured products comprising certificates, warrants and market participation notes. Its activities comprise only corporate and investment banking (CIB) services.

The company’s structured products are offered and sold to retail, ‘high-net-worth’ and institutional investors and are linked to a range of underlying reference assets including equity, credit, interest rates, commodities and alternatives such as funds and hedge funds.

During half-year 2019, the company issued structured products in the Asia Pacific region, Europe, the Middle East, Africa, Latin America and the United States of America, issued to private investors or listed on exchanges.

The proceeds of the sale of structured products were used by the company to fund the activities of other JPMorgan Chase undertakings.

Click the link to view the full JP Morgan Structured Products BV interim report 2019.