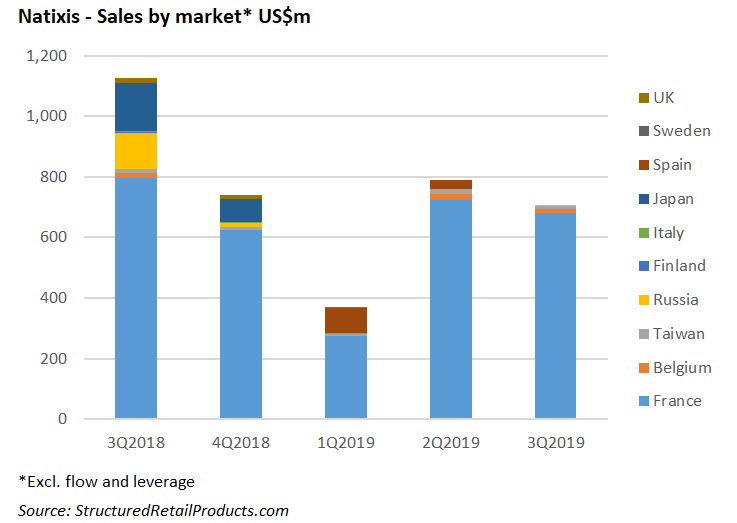

The French bank saw its revenues increase in the third quarter of 2019 with growth in investment banking, insurance and payments. Issuance and sales of structured products, however, were down 46% and 40%, respectively, despite a number of successful ‘green’ campaigns in Belgium and France.

Natixis has reported a net income of €415m in the third quarter of 2019, up 16% from €358m in the prior year quarter.

Underlying net revenues in corporate and investment banking (CIB), at €784m, were up three percent yearonyear, primarily driven by global finance, with the bank also reporting growth of global markets activities (+3% y-o-y) and of its green & sustainable hub.

The hub, whose purpose is to develop CIB’s green and sustainable finance activities in Europe, but also in the Asia Pacific and Americas platforms, has been at the centre of a number of campaigns by the bank in recent months, especially in Belgium and France, where structured products were launched that not only provided green funding, but for which the performance equity underlying was a green index too.

One of the ‘green & sustainable’ products issued by the bank in the third quarter was Porphyre Climat Septembre 2019, an eight-year medium-term note linked to the Euronext Climate Objective 50 Euro EW Decrement 5 % Index, which was distributed in France via Groupama and listed on the Luxembourg Stock Exchange for an issued amount of €180m.

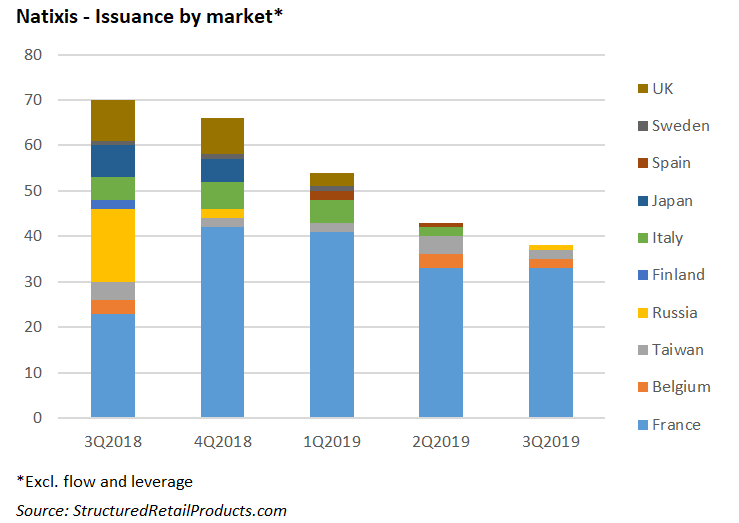

Natixis issued 38 structured products worth an estimated €702m between July 1 and September 30 2019, significantly down from the 70 products with combined sales of €1.1 billion launched by the bank in the same quarter last year.

The products were distributed across just four markets. France was the busiest market with 33 products which were available via a number of private banks, brokers and financial advisers, including, among others, Cyrus Conseil, DS Investment Solutions, Equitim, Oddo & Cie, and Swiss Life Banque Privée.

Natixis sold also products in Belgium, via Deutsche Bank and Nagelmackers, and in Russia via Sberbank, while outside of Europe the bank was the manufacturing company behind two private banking products that were distributed via Jih Sun Bank and Mega International Commercial Bank, respectively.

Asset management’s AUM reached €921 billion as at September 30, 2019, up three percent quarter-on-quarter and 14% year to date, while wealth management’s AUM reached €30.3 billion, with €900m positive net inflows in the quarter. Liabilities and equity on the bank’s balance sheet included debt securities worth €49.1 billion, up from €48.5 billion end-June.

‘In the third quarter of 2019 our revenues grew in line with or faster than our costs in each of our businesses demonstrating our agility and the flexibility of our cost base as well as the relevance of our business model,’ said François Riahi (pictured), chief executive officer, commenting on the results.

Click the link to view the full Natixis 3Q 2019 results and the presentation.