Bank of Montreal took the lion’s share of the Canadian structured product market in the last quarter of 2019, but National Bank of Canada almost matched the leading manufacturer after a significant increase in its issuance.

Bank of Montreal (BMO) has reported a strong net income of CAD1.59 billion (US$720m) in the first quarter of 2020, a five percent jump from the previous year quarter.

BMO commenced the quarter on a high note as it became the first major Canadian financial institution to offer a structured deposit to retail investors. In December 2019, BMO debuted the first-ever leveraged exchange-traded note (ETN) linked to cannabis in the US.

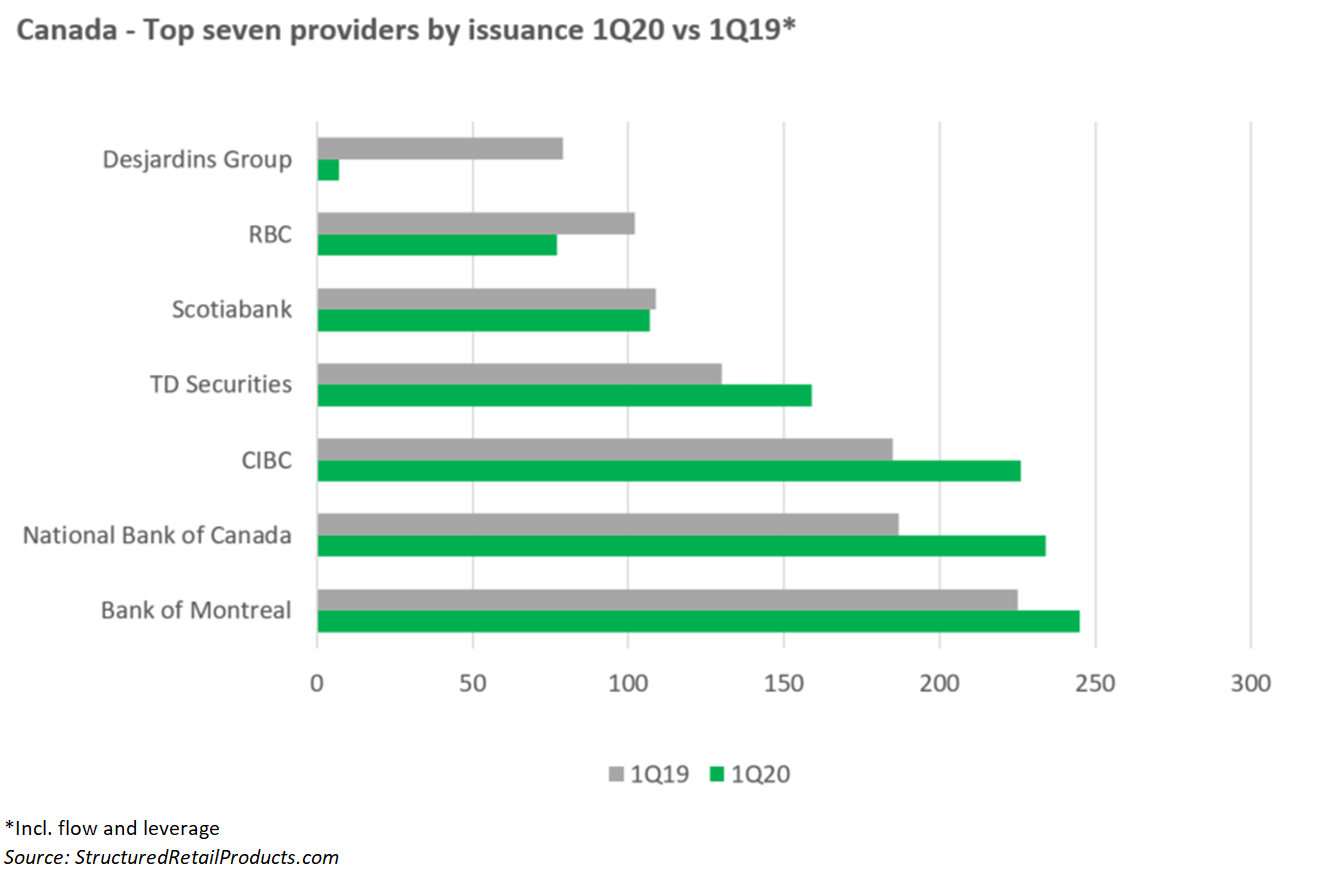

According to SRP data, BMO issued a total of 245 structured products in Q1 2020, taking the lead for the second time in a row as seen in Q1 2019 where the company boasted a figure of 225 products.

Currently, the bank has 3,826 live products listed in both Canada and the US. They are wrapped as PPNs, notes and GICs with a wide range of tenors from less than three years to over six years. Underlyings include VanEck Vectors Gold Miners ETF, SPDR S&P Biotech ETF, Russell 2000 and S&P500. The tranche investments belong to multiple asset classes such as real estate, interest rate, hybrid and commodities.

In terms of over-the-counter derivatives, the bank holds CAD 4.85 trillion in interest rate contracts, CAD 1.12 trillion in foreign exchange contacts, CAD 36.7 billion in commodities contracts, CAD 58.12 billion in equity contacts and CAD 9.05 billion in credit contracts as of 31 January 2020.

BMO’s measured return on their risk-weighted assets (RWAs) stands at 1.94% as of the first quarter.

‘We have significant momentum, with businesses increasing market share,’ said chief executive officer, Darryl White (pictured). ‘Our commitment to growing our business, improving efficiency and building a stronger BMO for our customers, employees and communities will continue to drive our focus on delivering consistently strong relative performance and long-term shareholder value.’

In second place in terms of product issuance is National Bank of Canada (NBC) with a total figure of 234 products in Q1 2020, up from its Q1 2019 value of 187 structured products.

The bank’s first quarter net income soared by 11% to reach CAD 610 million from CAD 552 million in 1Q19 while net interest income (NII) totalled CAD 930m in Q1 2020, an eight percent increase from its Q1 2019 figure of CAD 863.

SRP data shows that the bank has 2,803 live products, all of which are listed domestically. Underlyings include Wells Fargo, Verizon, USD 3M Libor, US Bancorp and HSBC. The tranche investments fall under interest rate, hybrid, FX rate, credit and fund asset classes and are wrapped as GICs, notes and PPNs.

For the past few months, the bank has not been issuing PPNs as opposed to its competitors BMO, Toronto-Dominion Bank and Royal Bank of Canada, SRP data shows.

NBC cites that the Canadian economic environment experienced a slow-down in the fourth quarter of 2019 which provided a cause for concern. The slump is expected to reverse promptly, and the bank has stated that they do not feel the need to slash interest rates barring a Covid-19 pandemic due to a middle-class tax cut which is expected to drive consumer spending and push GDP growth by 1.8%.

Risk-weighted assets stand at CAD 86.21 billion as of 31 January 2020, up from its 4Q19 value of CAD 83 billion while the bank has CAD 6.98 billion in derivative financial instruments, less than its 4Q 2019 value of CAD 8.13 billion.

‘The Bank is maintaining its strategy of balancing volume growth with disciplined cost management and prudent risk management,’ said president and chief executive officer, Louis Vachon.