The first quarter of 2020 wraps up just as the Brazilian Central Bank slashes interest rates.. The move is an emergency measure that has already been made in other countries such as the US and UK in a response to the outbreak of the Covid-19 virus that has rattled financial markets across the world.

Structured product issuance in the Brazilian market crowned a new leader at the end of the first quarter of 2020, as Morgan Stanley surpassed Santander Brasil, the most prolific provider during the same quarter the previous year.

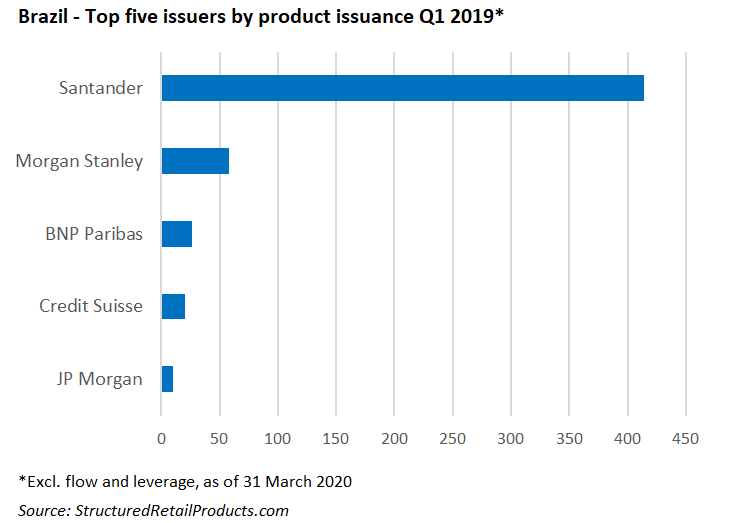

Santander Brasil dominated the Brazilian structured products market in Q1 19 with 414 products at BRL 338.45m (US$65.2m) but did not make any issuances in Q1 20.

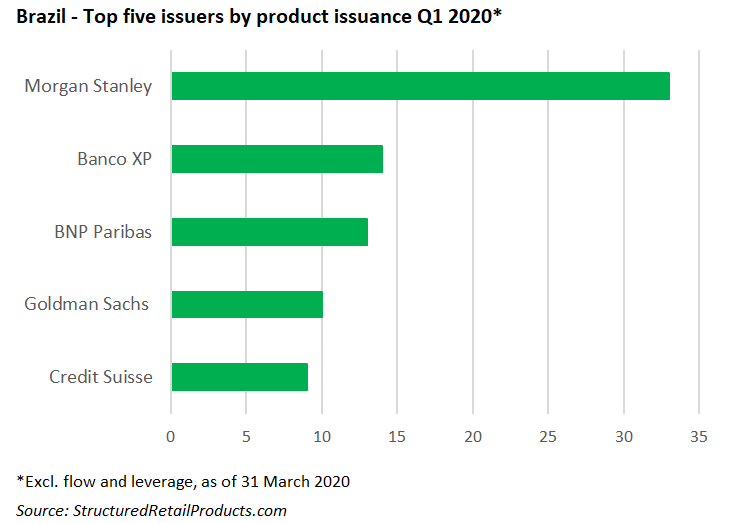

Despite having issued a lower number of products in Q1 2020, Morgan Stanley sped ahead with a total figure of 33 products and a sales volume of BRL 481.13m.

Nevertheless, the US financial institution maintained its first-place position in terms of market share with a Q1 20 figure of 37.48% up from 27.44% in the same quarter in 2019.

A total of 90 products were issued in Q1 20 overall with the top five providers being Morgan Stanley, Banco XP, BNP Paribas, Goldman Sachs and Credit Suisse. In Q1 19, 547 products were issued in which the five key players were Santander Brasil, Morgan Stanley, BNP Paribas, Credit Suisse and JPMorgan Chase.

According to SRP data, Santander Brasil has 1,372 live tranche products that domestically listed and are wrapped as structured operations certificates (known as certificados de operações estruturadas, or COEs). Underlyings include USD/BRL, S&P 500, interest rate (unspecified), Ibovespa Brasil Index and Brazil Consumer Price Index. The investments range from short to long-term and fall under the interest rate, inflation, FX rates and equity (single index) asset classes.

Morgan Stanley has a total of 609 live tranche investment products listed in Brazil with underlyings that include Vale, Usiminas, Amazon, Gerdau, Eurostoxx 50 and Morgan Stanley Investment Funds-Global Opportunity Fund. The products are also wrapped as structured operations certificates and fall under the real estate, hybrid, equity, credit and commodity asset classes.

SRP data shows that monthly volumes for Q1 20 progressively declined from 40 products in January, 34 in February to 16 in March at sales volumes of BRL 568.24m, BRL 498.99m and BRL 216.37m, respectively.

The first quarter of 2019 followed a similar trend, though in higher volumes. January boasted a figure of 272 products at BRL 1.23 billion, February had 243 products and March had 32 products at sales volumes of BRL 872.22m and BRL 779.99m, respectively.

From an asset class perspective hybrid structures were most popular of which 26 out of a total of 90 were issued at a sales volume of BRL 368.81m. However, in the same quarter of 2019, the equity (single index) ranked first with 203 products with a total sales volume of BRL 774.15m.

A spokeswoman from Santander Brasil declined to comment on the bank’s issuance drop.