Credit Suisse has announced the implementation of several ‘key initiatives’ and ‘structural improvements’.

The changes, which came into effect on 1 August, include the creation of a global investment bank to build a client-centric global platform with scale for corporate, institutional and entrepreneurial clients, and the creation of a global trading solutions unit and a globally integrated equities platform.

The Swiss bank led by chief executive officer Thomas Gottstein (pictured) will also launch a new sustainability, research & investment solutions (SRI) function, to centralise and combine its Investment Solutions & Products (IS&P) division – which houses the bank’s structured products business - and research capabilities.

The bank will provide at least CHF300 billion of sustainable financing over the next 10 years; enhance consideration of biodiversity; and transition its corporate oil & gas business by reducing exposure to traditional business.

The new unit will be led by Lydie Hudson who takes on the newly-created role of head of sustainability, research & investment solutions. Hudson has been charged with appointing ‘sustainability leaders’ in each division, with a mandate to articulate business-specific strategy.

Credit Suisse’s new strategy also includes the development of ‘sustainability client offering’ for wealth management clients by integrating sustainability across the investment and advisory product suite; for institutional investors by creating a sustainable institutional product offerings across asset management and other institutional client organisations, including sustainable capital markets and structured products, funds and investment research integrating Credit Suisse's proprietary ESG framework; and for corporate clients by supporting its corporate clients globally to deliver on their transition strategies with sustainable, green, renewable and transition lending, capital markets underwriting & advisory services driving the United Nations Sustainable Development Goals (UN SDGs).

The Swiss bank will also invest in growth initiatives across its Swiss Universal Bank, International Wealth Management (IWM) and Asia Pacific businesses, and will also combine chief risk and compliance officer function to create alignment across its control functions.

The changes are aimed at generating run-rate savings of approximately CHF400m per annum, from 2022 onwards.

H1 results

The announcement comes on the heels of the bank’s half-year results which delivered the highest first half net income in a decade (CHF2.5 billion). Credit Suisse reported Q2 20 pre-tax income of CHF1.6 billion, up 19% year-on-year; net income attributable to shareholders of CHF1.2 billion, up 24% year-on-year; and net revenues of CHF6.2 billion, up 11% on the first six months of 2019.

Return on tangible equity (RoTE) in H1 20 stood at 12%; whilst H1 20 pre-tax income stood at CHF2.8 billion, up 16% year-on-year with net income attributable to shareholders of CHF2.5 billion, up 47% year on year; and net revenues at CHF12 billion, up 9% year-on-year.

By business division, IWM’s Q2 results continued to be ‘supported by higher levels of client activity, which was offset by certain adverse market impacts and higher credit provisions’.

Pre-tax income in Q2 20 decreased 22% on 2019 to CHF348m, with net revenues down seven percent and higher credit provisions, partially offset by lower operating expenses. IWM recorded a return on regulatory capital of 21% and solid net new assets of CHF5.9 billion for the second quarter.

Private Banking recorded pre-tax income of CHF268m, down 21% on H1 2019, affected by higher credit provisions and lower net revenues of CHF919 million, down seven percent year-on-year. Net revenues benefitted from higher client activity, which was more than offset by lower net interest income and recurring commissions and fees.

Within transaction and performance-based revenues, the Swiss bank reported significantly higher brokerage and structured product issuance fees, and benefited from higher industry-wide transaction volumes and proactive client engagement. Recurring commissions and fees declined in line with AuM, which were negatively impacted by FX movements. Net new assets stood at CHF1.8 billion with solid contributions from emerging markets and Europe, bringing the half year 2020 total to CHF 5.5 billion at an annualised growth rate of three percent.

In addition, asset management’s pre-tax income in Q2 20 decreased 23% year-on-year to CHF80m, with a decline in net revenues and stable operating expenses.

Structured products

Credit Suisse remains a global force in the structured products market and ranks fifth in the issuer ranking year-to-date with more than 6,000 products issued worth an estimated US$8.4 billion (2.9% market share), according to SRP data.

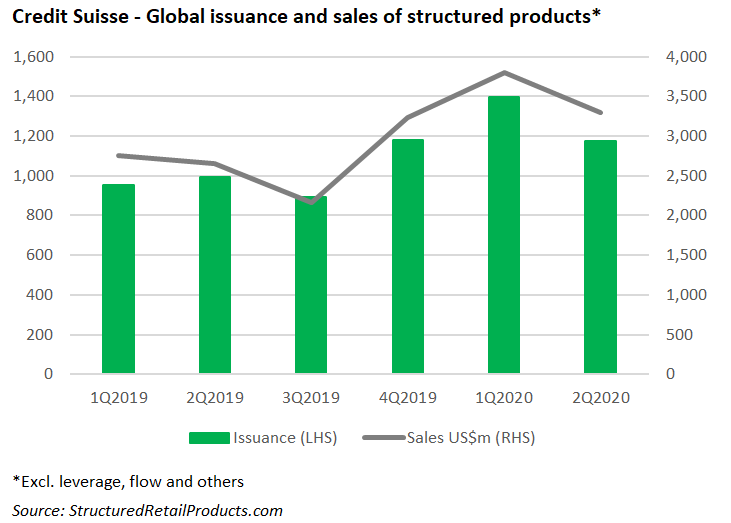

The bank collected an estimated US$3.2 billion from 1,134 products (excluding flow and leverage) in Q2 20, a 15% fall by sales volume compared to the previous quarter (1,397 structured products/US$3.8 billion).

The products were distributed across 17 different jurisdictions, of which Taiwan was the most active market for the bank, recording 539 products worth an estimated US$1.8 billion in Q2 20. Taiwan took over the US market were the bank issued 276 products worth US$1.02 billion – recording a decrease in issuance and sales quarter on quarter (616 products / US$1.9 billion in Q1 20).

Most products issued during Q2 20 were sold packaged as structured notes (822 structures/US$2.9 billion) and with a knockout structure (757 / US$2.3 billion). The most featured underlying during the second quarter was the share basket (537 products/US$1.8 billion) followed by the S&P 500 index (172 products/US$444m); and the Eurostoxx 50 index (80 products/US$144m).

Click in the links to access Credit Suisse second quarter results and the new strategy report.