Shanghai Commercial Bank (SHCB), a Hong Kong bank with a presence in the UK, US and mainland China, has adopted Bloomberg’s Multi-Asset Risk System (MARS) collateral management solution to support its preparation for regulatory requirements pertaining to uncleared margin rules (UMR).

SHCB began their search in 2019 for a solution to fully manage their collateral and margin calculation to better comply with upcoming UMR requirements from local and global regulatory regimes.

‘MARS collateral management was the ideal global risk management solution to support our fast-growing global structured products business and Bloomberg’s coverage of multi asset derivatives, including structured products, was key to why we selected them,’ said Edmund Lai (pictured), chief of treasury at Shanghai Commercial Bank.

In addition to selecting MARS collateral management for its collateral management and margin calculation needs, SHCB has integrated Bloomberg’s SIMM methodology licensed from Isda, with its existing third-party trading workflow, for calculating initial margin requirements for non-centrally cleared derivatives.

MARS provides risk analytics, integrated data and automated workflows to help reduce operational and credit risk - its suite of products incorporate risk-based solutions for margin, valuation and collateral management to monitor initial margin requirements for pre-trade and back-testing needs and has built-in portfolio reconciliation tools to communicate and resolve disputes.

Retail investors escape from British equities and the pound

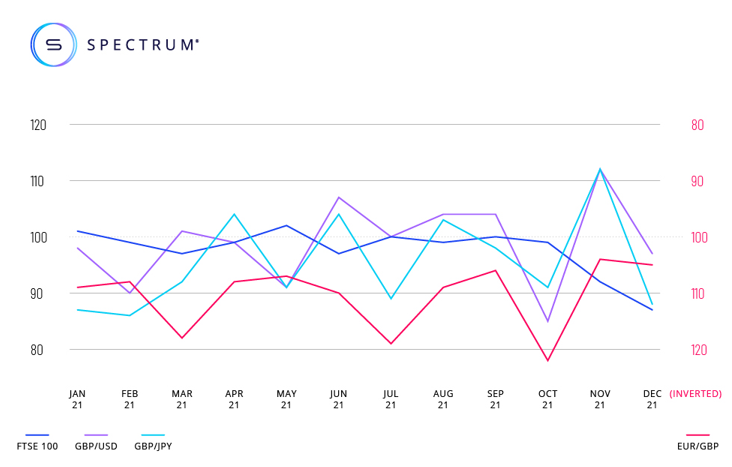

Spectrum Markets, the pan-European trading venue for securitised derivatives, has published its SERIX sentiment data for European retail investors for December which shows that of all investible equity indices the UK’s FTSE 100 experienced the most long-selling and short-buying activity.

Since the SERIX value on the FTSE 100 stood at 100 in September 2021, representing an equal balance of buying and selling, the curve sloped sharply into bearish territory in the following months, finally reaching a value of 87 in December, the lowest monthly value for the index since the SERIX was introduced as a benchmark.

In contrast, positive investor sentiment can be observed in the Italian MIB 40 index (101), the Spanish IBEX 35 (104) or America’s Nasdaq 100 (103).

At the same time, investors lost confidence on the British pound - the SERIX value for the GBP/USD currency pair fell from 112 in November to 97 in December, indicating a bearish investor sentiment. A similar trend was seen for sentiment around the GBP/JPY and GBP/EUR currency pairs.

‘Overall, it seems retail investors simply did not see much in the way of encouraging signs in the UK market at the end of the year and - on the contrary - even see it as overvalued, which is illustrated by the numerous bearish positions on the FTSE 100 index,’ said Michael Hall, head of distribution at Spectrum Markets. ‘Investors also do not seem to consider the slight recovery of the FTSE to be sustainable in the long-term or sufficient cause for optimism. Alternatives such as the Spanish IBEX or the Italian MIB currently seem to be more convincing to Index investors.’

During December, 72.5 million securitised derivatives were traded on Spectrum Markets, with 37.2% of trades taking place outside of traditional hours. More than 83% of the traded derivatives were on indices, 9.8% on currency pairs, 5.4% on commodities, and 1.6% on equities, with the top three traded underlying markets being DAX 40 (24.1%), Nasdaq 100 (17.8%), and S&P 500 (14.6%).

Leverage Shares dispatches 42 new ETPs, adds 5x leverage structures

Leverage Shares has listed 42 new exchange-traded products (ETPs) across European markets.

The new products include a range of tracker ETPs offering 1:1 exposure to ARK Invest’s thematic ETFs and Berkshire Hathaway stock.

In addition, the company adds leveraged ETPs covering major sectors such as healthcare, airlines and other single stocks such as Moderna, Coinbase and NIO, as well as two 5x leverage ETPs tracking the Invesco QQQ Trust Series 1 ETF and SPDR S&P 500 ETF.

The tracker ETPs offering 1:1 exposure to Ark’s strategies will come with a management fee of 0.35%, with the same being 0.75% for the leveraged and inverse leveraged versions.

The new ETPs physically own the underlying stock, so no swaps or derivatives are used to gain exposure. All the ETPs will trade in USD, GBx and EUR and are listed on the London Stock Exchange, Euronext Amsterdam and Euronext Paris.

Leverage Shares now has 145 ETPs, offering access to big names such as Moderna, Airbus, Tesla, Microsoft, Meta, and Apple. According to FE Analytics, four of Leverage Shares’ ETPs appeared in the top 10 best-performing ETFs of 2020.

Marcuard Heritage eyes AMCs

Zurich-based wealth manager Marcuard Heritage has partnered with securitisation specialist GenTwo to make more alternative assets investable via actively managed certificates which will be added to its product range.

Marcuard Heritage was looking for a bespoke off-balance sheet issuing solution to complement its investment fund offering which can be ‘a complicated and expensive process’. The issuance vehicle will enable Marcuard to bring to market actively managed certificates (AMC) with Swiss ISIN codes - without the usual involvement of a bank issuer.

‘I have always felt that it is very important not only to offer clients tailor-made investment instruments, but also to facilitate their access to new assets and thus ensure that they have more opportunities for returns,’ said Hakan Sesle, head of investment solutions at Marcuard Heritage. ‘This capability is going to enrich our investment solutions and processes.’

The firm is looking to launch tailor-made AMCs offering access to alternative investment areas such as digital assets or real estate to respond to client demand for new and previously portfolio-incompatible assets that can generate returns and improve portfolio diversification.

ISP Group targets Latam buy-side

Swiss independent financial services firm ISP Group has expanded into the Latin American market with the opening of an office in Panama.

The Zurich-based group offers a range of private market products, paying and placement agents, custody as well as wealth and asset management services. The firm’s offer to Latin American asset managers, brokers, banks, fund managers and financial institutions includes placement agent services for private markets, private equity, private debt and club deals, securitisation, structured products, derivatives, bond trading and crypto, and fund distribution.

The new office will ensure dedicated, localised customer service and acts as our hub for the entire Latin-American continent, according to Marco Bartolucci, CEO of ISP Group. ‘Our local team of highly qualified, seasoned experts ensures that local customers get unconstrained, direct access to ISP Group's global specialty services,’ he said.

The Panama office is co-headed by Michael Zollinger, partner and CEO ISP Panama, and Marcos Montero, partner ISP Panama. The launch of the new office is in line with firm’s growth strategy which includes office openings in Geneva, Lugano and Hong Kong this year.

Along with Michael Zollinger and Marcos Montero, the team in Panama also includes Sabina de Jaramillo and Donald Lee in the business development team, Ana Lorena Urriola, compliance officer, and Lidia Sanchez, business support.