Investor demand for products offering a balance of protection and growth dominate in 2021.

Increased market volatility and growing inflation drove total US annuity sales to the highest levels since 2008, and the third highest recorded in history, according to results from the Secure Retirement Institute (SRI) US Individual Annuity Sales Survey.

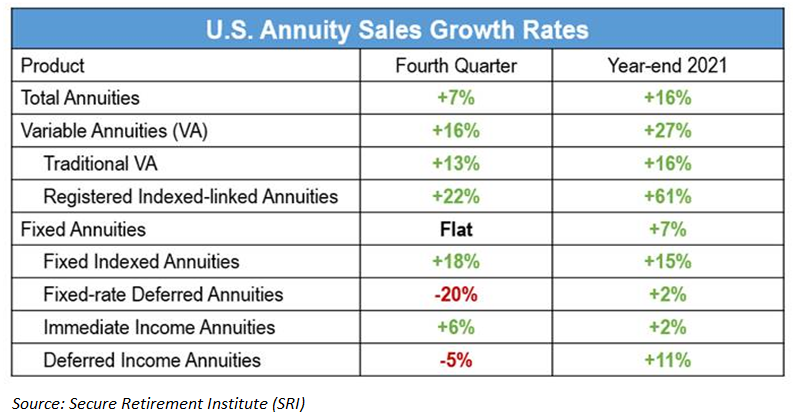

Total annuity sales were US$254.6 billion in 2021, up 16% from 2020. In the fourth quarter, annuity sales were US$62.8 billion, seven percent higher than in Q4 2020.

The expected interest rate increases, and continued product innovation will make FIAs more attractive in 2022 - Tod Giesing, SRI

‘After 2020, there was significant pent-up demand for investment options that offered a balance of protection and growth,’ said Todd Giesing (pictured), assistant vice president, SRI Annuity Research.

The fourth quarter registered index-linked annuity (Rila) sales, at US$10.3 billion, 22% higher than prior year. In 2021, Rila sales were US$38.7 billion, 61% higher than in 2020.

‘Rila sales benefited from current economic conditions […] and broader market offerings as new carriers enter the market,” said Giesing, adding that SRI is forecasting Rila’s sales growth to continue in 2022.

Fixed indexed annuity (FIA) sales in Q4 2021 were US$16.6 billion, an increase of 18% year-on-year. Fee-based FIA sales jumped 55% in the fourth quarter to US$74.5 million. Total FIA sales rose 15% in 2021, to US$63.7 billion, representing the highest FIA sales growth in three years.

‘Accumulation-focused FIAs drove sales growth in 2021 as investors look for principal protection with greater investment growth to offset rising inflation,’ noted Giesing. ‘The expected interest rate increases, and continued product innovation will make FIAs more attractive in 2022.’

Together, sales of Rila and FIA products represented 40% of total annuity sales in 2021.

Annexus partners with State Street to develop TDF

Retirement income solution provider Annexus Retirement Solutions has joined forces with State Street Global Advisors to help develop a target date fund (TDF) with an embedded income solution for the defined contribution (DC) plan marketplace.

The solution embeds Lifetime Income Builder – a product that employs group FIAs with a guaranteed lifetime withdrawal benefit – within the structure of a TDF. It provides participants with additional growth opportunity and six percent income in retirement.

The TDF design anticipates using three of the US top-tier insurance providers to deliver lifetime income. This multi-carrier model allows the insurance providers to bid on pricing each month, which can help lower participant costs and deliver higher income benefits and better outcomes.

‘Until Lifetime Income Builder, industry attempts to deliver in-plan lifetime income largely relied on existing individual-based products that weren't optimized to meet participants' needs in the DC plan space,’ said Dave Paulsen, chief distribution officer for Annexus Retirement Solutions.

Guardian unveils FIA

The Guardian Life Insurance Company of America has launched the Guardian Secure Index Annuity. The fixed indexed annuity offers guaranteed retirement income clients cannot outlive, with additional growth potential. It is available for sale through registered representatives of Park Avenue Securities.

Investors can take advantage of potential gains during index upswings based on the index they select such as the S&P 500 or two proprietary indices: AB Global Allocator Index and the Pimco Balanced Allocation Plus Index. Clients are insulated from index downturns as they will never lose premium due to a dip in the index value, and they have the flexibility to modify their index selection annually.

The product has an optional guaranteed living benefit rider that provides an income base of between three to six percent per year for life, depending on the clients age at the time of the first guaranteed annual withdrawal, and whether one of two people are covered.

Volatility Shares introduces ETFs on VIX futures

Volatility Shares announced the launch of the 2x Long VIX Futures ETF and the -1x Short VIX Futures ETF. The former is designed to track twice the Long VIX Futures Index, which expresses the daily performance of a theoretical portfolio of first and second month VIX futures contracts that are rolled daily. The index determines its daily settlement price from the time weighted average price of its theoretical portfolio over the last 15 minutes of the regular equity trading session.

The -1x Short VIX Futures ETF is designed to track the Short VIX Futures Index, an index that has been designed to deliver the full daily inverse performance of a portfolio of short-term VIX futures contracts.

The funds continuously offer and redeem shares in blocks of at least 10,000 shares at an initial price per share of US$15.

“We’re excited to bring back the VIX futures exposure that investors have been missing since 2018,” said Stuart Barton (right), co-founder of Volatility Shares.

Milliman Financial Risk Management will serve as commodity sub-adviser and US Bank will serve as the custodian.

FTSE Russell adds to FTSE ADX series

FTSE Russell has introduced the FTSE ADX 15 Index, which represents the top 15 eligible companies listed on Abu Dhabi Securities Exchange (ADX), selected by a combination of free float adjusted market capitalisation and median daily trading value.

The index has been designed to support the creation of new investment products including derivatives, ETFs, index funds, and structured products.

The FTSE Russell and ADX partnership aims to create a suite of complementary indices that meet the needs of both retail and institutional investors, locally and globally.

The FTSE ADX Index series consists of the FTSE ADX General Index and FTSE ADX Sector Indices: 10 sector-specific indexes that include telecommunications, healthcare, financials, real estate, consumer discretionary, consumer staples, industrials, utilities, basic materials and energy.

Solactive launches future trends report

Solactive has released the Future Trends Report. The report, which is developed and written by the company’s research team, provides an outlook into current and future investment themes. It anticipates megatrends that could significantly impact the world and fuel business growth for current and future corporations.

In the report, Solactive concentrates on identifying major beneficiaries of specific themes and opportunities, clustered into three categories: future technology, environmental change, and the future of health & living.

In the Future Trends, the index provider highlights 35 thematic investment ideas.

‘For each theme, the team has provided some background and rationale and we look forward to engaging with market participants to discuss those ideas further and ultimately turn them into investable indices,’ said Konrad Sippel (right), head of research at Solactive.

Click the link to read the full Solactive Future Trends report.