SSEK law firm investigates investor losses involving J.P. Morgan Chase autocallable contingent interest notes linked to S&P GSCI Crude Oil Index Excess.

Law firm Shepherd Smith Edwards and Kantas (SSEK) is looking into claims of losses involving JPMorgan Chase Auto Callable Contingent Interest Notes linked to the performance of the S&P GSCI Crude Oil Index Excess (SPGCCLP).

This kind of investment is not suitable for most retail investors - SSEK

‘Financial firms, such as JPMorgan Chase, have been creating auto-callable notes and selling them to retail customers who lack the investing experience or risk tolerance level to handle the losses that can result,’ stated the law firm. ‘However, this kind of investment is not suitable for most retail investors.’

According to SSEK, J.P. Morgan Brokers may have misrepresented all the risks to investors as many of them were not expecting to sustain significant losses when Covid-19 and the other adverse events that followed heavily impacted oil prices and their investments.

‘If an investment product and its risks are difficult to explain to an investor, let alone for the latter to comprehend, then the more a financial advisor should do to make sure that they explain this product in a way that a customer can understand,’ added SSEK.

The law firm noted that under Financial Industry Regulatory Authority (Finra) guidelines, broker-dealers have ‘a duty to make sure that its registered representatives conduct the necessary due diligence to both fully understand any financial instrument they recommend to a customer as well as ensure that it is suitable for the latter according to their specific investing goals and risk tolerance level.’

Losses resulting because of brokerage firm negligence can be grounds for a Finra arbitration claim to pursue damages.

Vestr deploys ESG reporting capabilities

Clarity AI and actively managed certificates (AMC) platform Vestr have launched a partnership to enable ESG reporting capabilities for asset managers.

Clarity AI’s data has been integrated on Vestr’s Delta platform and will be made available to all Vestr clients and their users. This will include ‘comprehensive product reporting’, including individual and joint ESG impact ratings, and will be offered alongside the platform’s portfolio management tool.

New York-based Clarity AI offers ESG and sustainability capabilities by using advanced technology to gather, assess, organise, clean and quality-check raw data, which is then used to align to industry consensus ESG risk analysis. The company covers more than 50’000 public companies, 280’000+ funds from 198 countries and 188 governments.

‘Investors are increasingly applying these non-financial factors as part of their analysis process to identify material risks and growth opportunities,’ said Rico Blaser (above-right), co-founder and CEO of Vestr.

‘While ESG metrics are not part of the mandatory financial reporting, companies are increasingly making disclosures in their annual reports or in a standalone sustainability report. And we want to support this development,’ said Blaser.

Swiss-based Vestr offers a cloud-based solution for AMCs targeted at structured products issuing houses.

US annuity provider adds SG prop play, offers 7% upfront

US annuity provider Legacy Marketing Group has launched a 7% upfront premium bonus product on its newest fixed indexed annuity (FIA) series, LibertyMark Freedom.

Issued by Americo Financial Life and Annuity Insurance Company, the new LibertyMark Freedom 10 Plus and 10 LT Plus annuities will pay the 7% premium bonus (6% in California) at contract issue with no vesting schedule or risk of recapture.

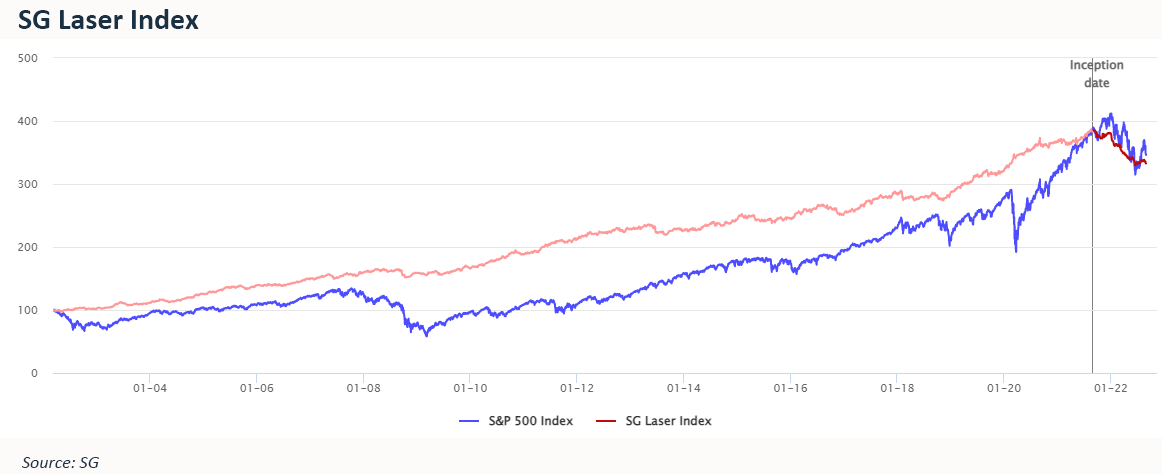

In addition, LibertyMark Freedom 10 Plus and 10 LT Plus provide investors a selection of 14 index options, some with uncapped participation rate options. The most recent addition to the index pool includes the SG Lead Asset Select Exposure Rotation (Laser) Index, an index offering systematic adaptative risk allocation.

The index begins with a basket of Société Générale proprietary indices that cover exposure to US equities, US government debt, and commodities within the agriculture, metals, and energy sectors.

The index uses the SG Market Sentiment Indicator to assess whether the market is in a growth phase, intermediate phase, or shrinking phase, and aims at stabilising itself during periods of high market volatility by reducing its exposure in chaotic markets, through a volatility control mechanism.

Other proprietary indices deployed by Legacy Marketing in its indexed annuities include the Barclays Trailblazer Sectors 5 Index, BNP Paribas Momentum Multi Asset 5 Index, Morgan Stanley Target Equity Balanced Index as well as the SG Columbia Adaptive Risk Allocation Index.

Click in the link to access LibertyMark Freedom product information.

Registered index-linked annuity (Rila) sales reach all-time record

Total USannuity sales increased 16% to US$79.4 billion in the second quarter, according to Limra’s US Individual Annuity Sales Survey.

Fixed-rate deferred (FRD) and registered index-linked annuity (Rila) sales reached an all-time record for the quarter, while fixed index annuity sales fell just short of a record quarter.

Rila sales saw the highest quarter ever in the second quarter, up 8% to US$10.8 billion. In the first half of 2022, Rila sales were US$20.4 billion, 6% higher than the previous year. Rila sales now make up 40% of overall variable annuity sales.

Fixed indexed annuities (FIA) sales also had a strong quarter, with US$19.7 billion in the second quarter, up 19% from second quarter 2021 and 20% year to date (YTD).

Traditional variable annuity (VA) sales fell in the second quarter. VA sales dropped 27% to US$16.5 billion in the second quarter, the lowest quarterly results since the fourth quarter of 1995. YTD sales are down 20%.

‘When you look at the carriers that fared well in the quarter and in the first half of 2022, those with a diversified suite of annuity product offerings were most successful,’ said Todd Giesing (above-right), assistant vice president, Limra Annuity Research.

Fixed annuity products also showed positive growth as consumers looked for safety from volatile equity markets.

‘With average yields at or above 3% for fixed-rate deferred annuities, it’s a rate environment we haven’t seen in a long time,’ said Giesing.

FRD sales led the way with a total of $28.7 billion in the second quarter, 79% higher than second quarter 2021 sales. In the first six months of 2022, fixed-rate deferred annuities totalled US$44.6 billion, a 46% increase compared with the same period last year.

Mirae Asset rolls out new HSTech 2x leveraged tracker

Hang Seng Indexes Company has licensed the HSTech 2x Leveraged Index to Mirae Asset Global Investments to serve as the underlying index of the new Mirae Asset Tiger Synth-China HSTech Leverage ETF(H).

The HSTech 2x Leveraged Index is the leveraged version of the Hang Seng Tech Index (HSTech) with a leverage ratio of 2x. The HSTech represents the 30 largest technology companies listed in Hong Kong that have high business exposure to technology themes and pass the index's screening criteria.

The new ETF brings the number of exchange-traded products linked to indexes in the Hang Seng family of indexes to 116 – with listings on 16 different stock exchanges across the world.

As of 31 July 2022, AUM in products passively tracking indexes in the Hang Seng Family of Indexes had reached a total of about US$52.4 billion.

The ETF was listed on the Korea Exchange on 23 August 2022.

Main image: zhengzaishanchu/Adobe Stock Free