The French banking group issued €20.5 billion of structured notes in 2024 as its equities business recorded the second best Q3 ever.

Société Générale has posted revenues of €6.8 billion (US$7.3 billion) for Q3 2024, up 10.5% year-on-year (YoY). Revenues for the first nine months of 2024, at €20.2 billion, increased by 5.3% (9M 2023: €19.1 billion).

This is the second best Q3 [for the equities business] ever - Claire Dumas, CFO

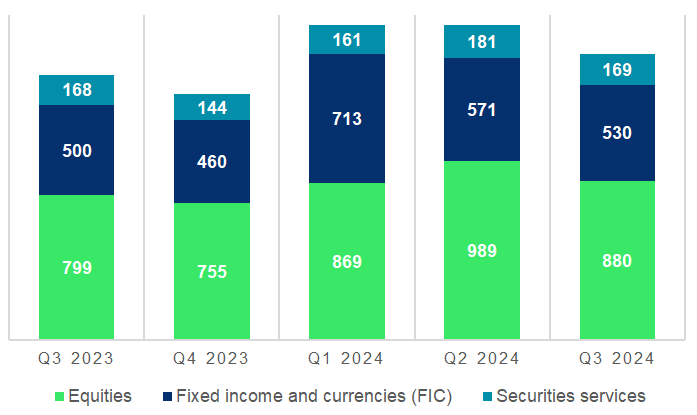

Global markets and investor services rose to €1.6 billion during the quarter, up 7.6% YoY; over 9M 2024, revenues totalled €5.1 billion (+3.1% versus 9M 2023). Growth was mainly driven by global markets which recorded revenues of €1.4 billion in Q3 24, up 8.6% YoY amid a positive environment that was particularly conducive to equities.

Over 9M 2024, global markets revenues totalled €4.6 billion, up 4.5% YoY.

The equities business recorded revenues of €880m in Q3 2024, up 10.1% compared to the prior year quarter, notably on the back of growing client activity in listed products and financing combined with strong performance in derivatives throughout the summer volatility peaks.

‘This is the second best Q3 [for the equities business] ever,’ said Claire Dumas (pictured), group chief financial officer (CFO), speaking during the earnings webcast on 31 October. Dumas will step down as CFO at the end of January 2025 to pursue professional opportunities outside the group. She will be succeeded by Leopoldo Alvear who will also become a member of the group executive committee. Alvear currently is the group CFO and general manager at Banco Sabadel.

Revenues for the first nine months of 2024 revenues for equities increased by 12.9% to €2.8 billion.

Fixed income and currencies (FIC) registered a 6.1% increase in revenues to €530m during the quarter, driven by robust demand for rates and forex flow activities, particularly from US clients. Over 9M 2024, revenues decreased by 6.0% to €1.8 billion.

Securities services’ revenues, at €169m, were up 0.6% YoY as the business continued to reap the benefit of a positive fee generation trend and robust momentum in private market and fund distribution. Over 9M 2024, revenues were down by 8.2%.

Société Générale: Global Markets and Investor Services revenues (EURm)

Source: Source: Société Générale Q3 2024 presentation

SRP data

In Q3 2024, Société Générale issued around 4,050 publicly offered structured products worth an estimated US$4.5 billion – an increase of more than 70% by issuance but down 22% by sales volume from the 2,364 products that gathered US$5.7 billion in Q3 2023, according to SRP data.

During 9M 2024, the bank collected an estimated US$18.2 billion from 12,938 products (H1 2023: US$14.8 billion from 6,220 products).

Products for Q3 were sold across 15 different jurisdictions (Q3 2023: 16), with the highest issuance, by some distance, seen in Switzerland where the bank issued 3,043 products that were mostly autocall, (barrier) reverse convertibles while the highest sales, at an estimated US$1.5 billion from 162 products, came in SG’s home market France.

Other European markets where the bank was active on the primary market during the quarter included, among others, Germany, Sweden, Finland and the UK.

Outside of Europe, SG was the manufacturing company behind 379 products that were distributed in Hong Kong SAR via HSBC and Hang Seng Bank that were mostly capital protection products with knockout (166 products) and range/accruals (109).

A further 333 products were issued in Taiwan to private banking clients of BNP Paribas, Cathway Securities, CTBC, E.Sun Commercial Bank, Standard Chartered, and more while in the US it sold 22 unregistered notes for a combined US$37m.

On the secondary market, Société Générale issued more than 134,000 leverage products targeted at investors in Germany (Q3 2023: 144,098), where it was the number four issuer of turbo certificates by issuance – behind J.P. Morgan (142,295), Morgan Stanley (137,295) and BNP Paribas (134,777).

The most popular underlying asset for the bank’s turbos, which were issued via the Société Générale Effekten vehicle, were single equity indices such as the DAX Index (8,698) followed by Nasdaq 100 (7,047) and DAX/XDAX (4,697). Gold was the preferred commodity of the German investor (6,473) while the shares of Tesla (3,988) and Nvidia (3,169) were also in demand.

During Q3 2024, SRP also registered 909 callable bull bear certificates (CBBC) and 99 warrants issued by the bank in Hong Kong SAR (Q3 2023: 639 CBBCs and 114 warrants). Of these, the majority were linked to the Hang Seng Index (642 products) while popular shares included those of Tencent (36), Meituan Dianping (27) and Hong Kong Exchanges and Clearing (22).

Funding

As of 11 October 2024, the group had issued a total of €38 billion in medium/long-term debt, of which €17.5 billion in vanilla notes. The 2024 long-term vanilla funding programme is completed.

In addition, €20.5 billion of structured notes has been issued in 2024.

End-September 2024, the group’s consolidated balance sheet included €163 billion worth of debt securities issued (31 Dec 2023: €160.5 billion) and an outstanding for hedging derivatives of €14.6 billion (€18.7 billion).

On 30 September 2024, the group’s common equity tier 1 ratio stood at 13.2%, around 300 basis points above the regulatory requirement.

Click the link to read the full Société Générale results and the presentation.

Do you have a confidential story, tip or comment you’d like to share? Contact Us | SRP (structuredretailproducts.com)