FX rates remained the underlying asset most favoured by Chinese retail investors.

Join us on 17 June 2025, at SRP China 2025 and gain exclusive insights from industry leaders on the evolving structured products market in China—register today to secure your place.

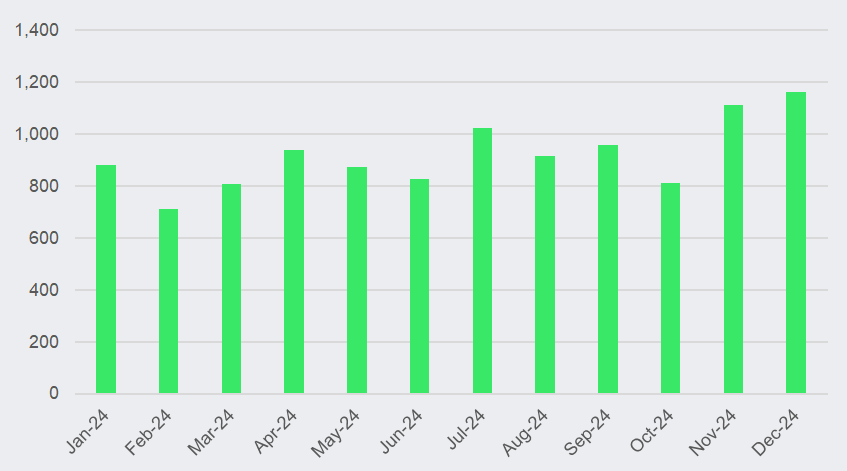

The SRP China database registered 1,162 tranches of retail structured deposits issued in December 2024, almost flat compared to the prior month.

Monthly issuance of structured deposits sold to retail investors in 2024 (unit: tranches)

Source: SRP

Underlyings, payoffs

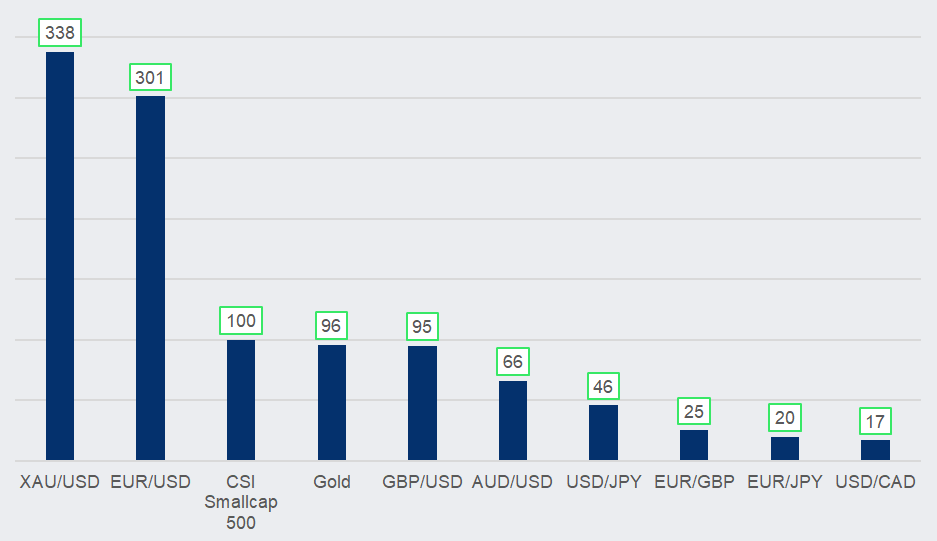

The spot gold price traded against the US dollar (XAU/USD) continued to dominate the retail structured deposits’ underlying league, with 338 newly-issued products tracking the asset in December.

Structured deposits sold to retail investors - most featured underlyings by issuance in December 2024

Source: SRP

The Chinese retail market has been known to favour the use of gold as a safe haven asset for structured deposits in recent years. The growth of this trend coincided with the uptick in the performance of the precious metal over the past year, soaring over 34% to hover around the US$2,700 mark.

‘We are constructive on gold given peaked real yields, elevated geopolitical uncertainties, robust central bank demand, and anticipation of more retail participation,’ J.P. Morgan Private Banking's strategists wrote in a January note.

‘For long term investors, gold merits a position in a diversified portfolio, potentially serving as short-term protection against risk events, a reliable longer-term store of value, and most importantly as a portfolio risk diversifier,’ the strategists wrote.

There were also 96 product issuances directly tracking gold from four local issuing banks, consisting of Hua Xia Bank, China Merchants Bank, Ping An Bank, and Bank of China, similar to the prior month’s trend.

Other frequently used underlyings included the euro against the US dollar (301), the British pound against the US dollar (95) and the Australian dollar against the US dollar (66). The digital and digital range were the most comment payoff structures for these FX rates-linked products.

Around 30% of the total issuance in December has matured, dominated by short-tenor FX rates products. Of these, a 25-day EUR/USD-linked structured deposit issued by Bank of China first traded on 6 December was the best-performing retail product of the month, recording a 100.24% in capital return (3.56% pa).

For equity index underlyings, CSI Smallcap 500 index led the pack with some 100 related products launching in the retail market, followed by CSI 1000 (14) and CSI 300 (9). All these products were mostly commonly structured as full-principal-protected autocallables.

The top-pick foreign underlying for structured deposits came in the shape of iShares 20+ Year Treasury Bond ETF, recording four product issuances which were all issued by HSBC Bank. The British bank also issued three products tracking the Nasdaq-100 Volatility Control 10% NC Index that were debuted to the market in November. The latter was commonly seen in capital protection products with a knock-out and puttable payoff structure.

Issuers

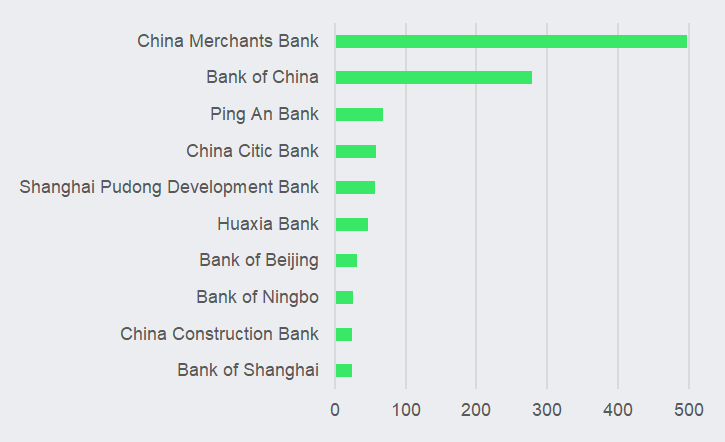

China Merchants Bank continued to lead as the largest retail product manufacture in China by issuance, with 497 structured deposits launching in December, up from 440 tranches in November.

Retail structured deposits - top 10 issuers by issuance in December 2024 (unit: tranches)

Source: SRP

The Shenzhen-based bank also issued some 2,294 tranches of structured deposits targeting institutional investors last month, slightly down from 2,441 tranches seen from the prior month. Almost all of which were tracking FX pairs, in addition to three gold-linked products.

Among retail products, Bank of China continued to be the runner-up with 278 tranches. This is followed by Ping An Bank which issued 68 structured deposit in December.

Other large domestic issuers included China Citic Bank (59), Shanghai Pudong Development Bank (57) and Hua Xia Bank (47).

Looking ahead

The new year kicked off with Standard Chartered Bank China rolling out its first individual client-facing tranche of US bond-linked structured deposits as US bond exposure gained traction among investors in the rate-cutting cycle.

While navigating the shift in the interest rate environment, investors are also paying close attention to the latest economic data of China, US President Donald Trump’s policy on tariffs in his second term, and the National People's Congress's upcoming annual meeting in March, following the announcement of a flurry of stimulus measures since last September. The blue-chip CSI 300 index edged down 3.8% year-to-date to 3,855 points.

‘In light of the changing dynamics in US tariff hikes, geopolitical tensions and China’s policy response, we maintain a barbell strategy focusing on defensive yield stocks, especially during the periods of escalation of tariff disputes and rotate to growth and high beta stocks during period of trade truce and when negotiation and deals settled,’ Singapore’s Oversea-Chinese Banking Corporation investment researchers wrote in a note at the beginning of the month.

Main image: Aboodi Vesakaran/Unsplash

Do you have a confidential story, tip or comment you’d like to share? Contact Us | SRP (structuredretailproducts.com)

Disclaimer: While SRP's aim is to provide accurate and up-to-date information, the data provided is gathered from third parties. SRP does not take responsibility for the accuracy of the data and will not be held liable for any errors or omissions contained in the information provided. The information and data included on SRP's market reports uses sources believed to be reliable. SRP assumes no liability or responsibility for the quality, content, accuracy or completeness of the information, text, graphics, links and any other items contained on this report.