The German trade body is including risk information for the outstanding market volume in its quarterly statistics.

The German association for structured securities (Bundesverband für Strukturierte Wertpapiere or BSW) has started publishing risk indicators for the entire structured securities market in its quarterly market volume statistics, as well as detailed information for all product categories.

We want to contribute to a stronger securities culture in Germany through transparency and facts - Christian Vollmuth, BSW

This marks the first time that a financial industry association has created transparency regarding how much capital investors have invested and at what risk, according to Christian Vollmuth (pictured), managing director and member of the BSW board.

“We want to contribute to a stronger securities culture in Germany through transparency and facts,” he said.

The data is based on the legally binding summary risk indicator (SRI) for securities which is part of the mandatory information provided by the key information document (KID) required by the PRIIPs regulation.

The SRI, which ranges from 1 (lowest risk) to 7 (highest risk), takes into account both the market risk (based on the historical volatility of the financial instrument) and the issuer's credit risk.

Germany: market volume by product class as of 31 March 2025

| Product category | Market volume (€m) | Market share (%) | Risk classification (SRI) |

| Investment products with 100% capital protection | 52,518 | 54.4 | 1.18 |

| Investment products without capital protection | 44,094 | 45.6 | 3.83 |

| Investment products total | 96,613 | 96.5 | 2.39 |

| Leverage products total | 3,470 | 3.5 | 6.91 |

| Structured products total | 100,083 | 100 | 2.55 |

Source: BSW

As of 31 March 2025, a total of €100.1 billion was invested in structured securities in Germany (SRI 2.55).

Investment products made up 96.5% of the total market volume and included €52.5 billion invested in products with 100% capital protection and €44.1 billion invested in capital-at-risk products with an SRI of 1.18 and 3.83, respectively.

The remaining 3.5% of market volumes, or €3.5 billion, was linked to leverage products which had an SRI of 6.91

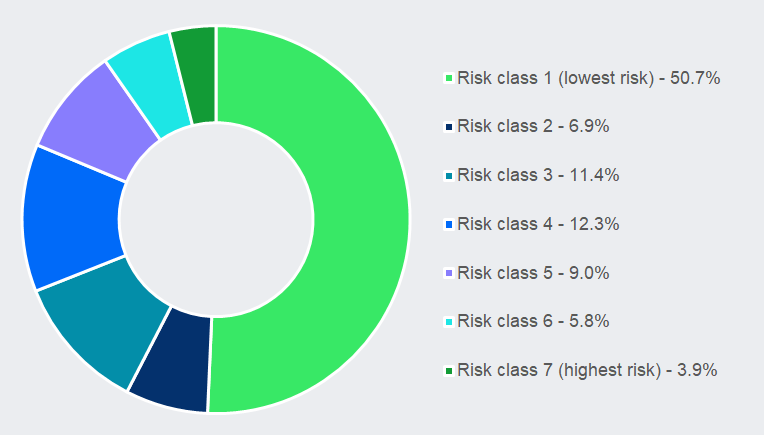

Germany: market volume by risk class (SRI) as of 31 March 2025

Source: BSW

At 50.7%, more than half of the market volume fell into the lowest risk class 1, which typically also includes euro money market ETFs and euro money market funds. Shares of large European companies mostly belong to risk classes 5 and 6, while equity funds and equity ETFs that are based on broadly diversified international, regional or national equity indices such as MSCI World, Eurostoxx 50 or DAX are mostly assigned to risk classes 4 and 5.

“Just as every investor should be aware of the risks associated with their securities, we want to educate the public about the risks that all investors in structured securities have assumed with their investments,” said Vollmuth.

“These risks are lower than many assume: the volume-weighted average risk of all structured securities – from fixed-interest bonds with 100% capital protection to knock-out warrants – corresponds to an SRI of 2.55,” he added.

Click the link to read the BSW market volumes and risk classification for March 2025 (German).

Do you have a confidential story, tip or comment you’d like to share? Contact Us | SRP (structuredretailproducts.com)